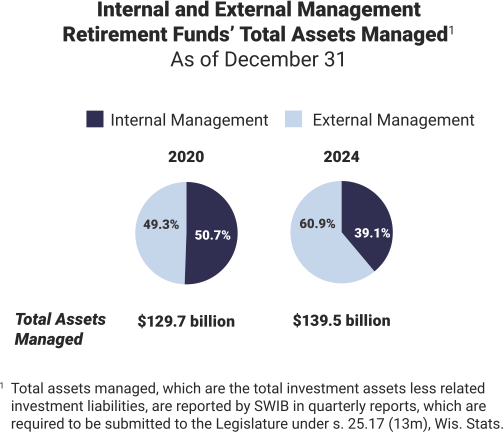

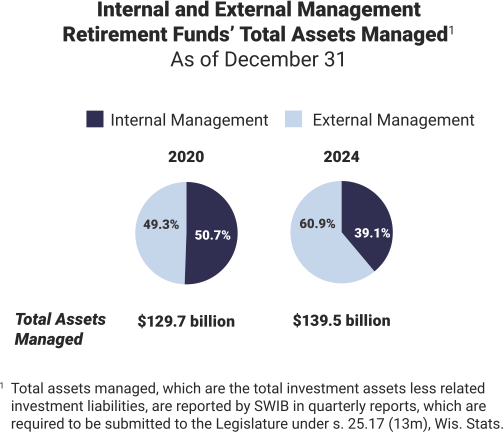

Historically, SWIB’s goal had been to increase the percentage of assets managed internally because external management is more expensive. The percentage of assets managed internally has decreased from 50.7 percent in 2020 to 39.1 percent in 2024. SWIB staff attribute decreases in internal management of assets over this time frame to a number of factors, including an increase in the overall allocation to private fund investments, such as private equity limited partnerships, which are managed externally. SWIB indicated increases in private fund investments are intended to help meet the long-term expected rate of return of 6.8 percent. SWIB also noted decreases in allocations to public equity investments, which are largely managed internally, contributed to the decline in assets managed internally.

Management fees are charged by external investment managers. Management fees typically include a base fee and a performance fee, which is typically calculated based on investment returns. The performance fees fluctuate each year based on the performance of the underlying investment. External investment management fees increased from $827.4 million in 2023 to $1.2 billion in 2024. In comparison, external investment management fees reported by SWIB totaled $1.8 billion in 2021 and $1.1 billion in 2022.