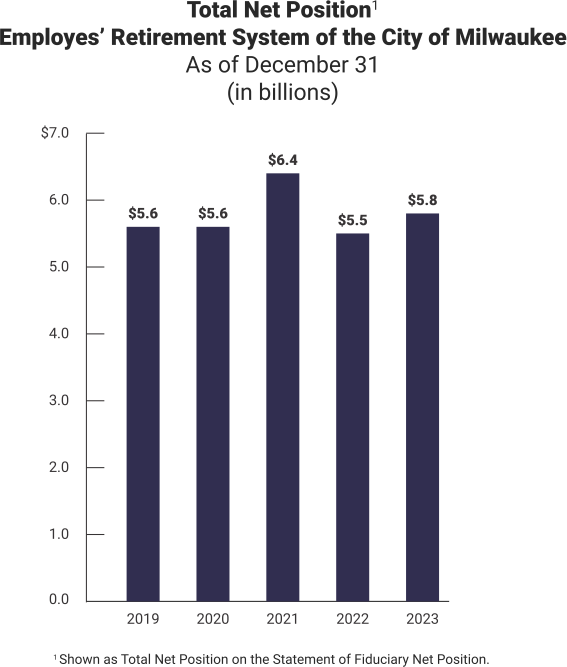

The Employes’ Retirement System of the City of Milwaukee (Retirement System) was created in 1937 and is a cost-sharing, multiple-employer, defined-benefit pension plan with 30,111 members and a fiduciary net position of $5.8 billion as of December 31, 2023. The Retirement System is administered by a staff of 51 full-time equivalent positions.

We provided an unmodified opinion on the Retirement System’s financial statements as of and for the year ended December 31, 2023. Our unmodified opinion is included in the Retirement System’s Annual Comprehensive Financial Report, which can be found on the Retirement System’s website. These financial statements account for the financial position and activity of the Retirement System. We also issued Employes’ Retirement System of the City of Milwaukee (report 24-19).

Employers, including the City of Milwaukee, Milwaukee Public Schools, the Milwaukee Metropolitan Sewerage District, and the Wisconsin Center District, that participate in the Retirement System must meet specific financial reporting requirements in preparing their own financial statements using generally accepted accounting principles. To assist employers, Retirement System staff prepared employer schedules and related notes on which we provided an unmodified opinion and issued Employes’ Retirement System of the City of Milwaukee Reporting for Participating Employers (report 24-20).

We conducted this financial audit by auditing the Retirement System’s financial statements and its employer schedules in accordance with applicable government auditing standards, issuing our auditor’s opinions, reviewing internal controls, and issuing our auditor’s reports on internal control and compliance. This is the first such audit we completed under the requirements of 2023 Wisconsin Act 12.