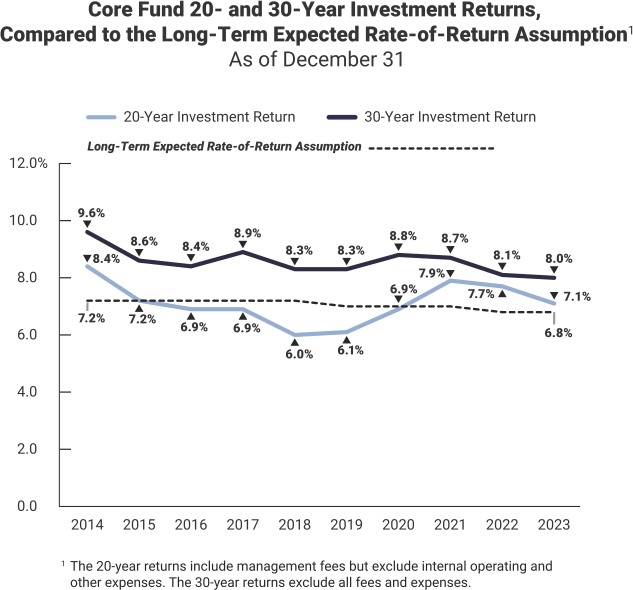

SWIB manages WRS assets in two funds. The Core Fund is a diversified fund that typically is invested for the long term, and the Variable Fund is a public equities fund. SWIB uses market-based benchmarks to measure the performance of WRS assets.

For the five-year period ending in December 2023:

- the Core Fund exceeded its benchmark, which was 8.7 percent, and had an average annual investment return of 9.3 percent, which ranked fourth among a peer group of nine other large public pension plans; and

- the Variable Fund did not exceed its benchmark, which was 12.9 percent, and had an average annual investment return of 12.7 percent.