|

Thanks for the excellent turnout at the community listening sessions I held last weekend! Along with Sen. Devin LeMahieu (R-Oostburg) and Rep. Tyler Vorpagel (R-Plymouth), I visited with folks from across Sheboygan County at several public meetings. I always appreciate opportunities to help real people solve real problems, and it's always useful to me to hear directly from you about your priorities and the challenges you face. Thank you!

During several days next week, the legislature's Joint Finance Committee will be publicly interviewing leaders from all Wisconsin state agencies about their requests in the 2017-19 state budget. Each day's agenda is available online, and the hearings themselves are broadcast by WisconsinEye live online and on television in many communities. I'd encourage you to follow these proceedings; they're always educational!

As always, I encourage you to follow my updates on social media or contact my office directly with your questions. Best wishes on your weekend!

Protecting Property Owners' Rights

This week, I agreed to coauthor a proposal from Rep. Rob Brooks (R-Saukville) and Sen. Dave Craig (R-Town of Vernon) that would more clearly define homeowners' rights during the process of property tax assessment.

Every so often, your local government's property assessor recalculates the taxable value of your home based on a variety of factors. As a part of this job, the assessor often asks the property owner for permission to inspect the interior of the home. Although many homeowners don't know it, current law allows homeowners to refuse the assessor entry into the home. However, if a homeowner exercises this right, current law actually forbids the property owner from participating in any kind of appeal. There are many real-world examples of property assessors in Wisconsin taking unfair advantage of this power: too often, if a person denies entry to the assessor, the assessor automatically "punishes" the homeowner with an increase in assessed property value (and, therefore, a steep increase in property taxes as well). If this happens, there is no recourse for the property owner; the assessor's decision is final.

On several levels, that isn't right. The bill that I am coauthoring provides that, if a property assessor wants to enter your home to inspect it for tax purposes, the property assessor must provide you with a written notice that you have the right to refuse entry. The assessor would no longer be allowed to increase your property's valuation based on your refusal to allow entry, and the written notice would state this. And the law would be changed to expressly allow you the right to appeal your new tax assessment even if you refused entry or refused to provide your income information to the assessor.

A related court case is currently awaiting a ruling by the Wisconsin Supreme Court. But this bill, if passed into law, would address the problem proactively so that property owners will know their rights and be enabled to exercise them without penalty.

Working for Wisconsin's Middle Class

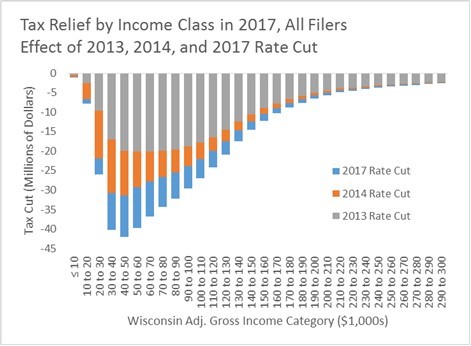

Wisconsin legislators have implemented big income tax cuts over the past several years, as rates have been reduced for all tax brackets and the number of brackets has been reduced from five to four. We sometimes get criticized for favoring only the wealthy in our reforms, but the numbers prove that this accusation rings hollow. As this chart from the Department of Revenue demonstrates, the lion's share of state income tax cuts over the past few years have clearly had the greatest impact on middle-income families, not the wealthy.

The Governor's 2017-19 budget proposal includes additional income tax cuts (also illustrated in the chart) that would benefit all taxpayers but would again have the biggest impact on the middle class. The bottom bracket would see the tax rate reduced from 4.00 percent to 3.90 percent, and the second-lowest bracket would see the tax rate reduced from 5.84 percent to 5.74 percent for all filers. The Governor's budget also proposes getting rid of an entire tax; if passed into law, there would be no state-level tax charged on property tax bills any longer, and property taxes overall would continue to be no higher than they were in 2010. Year by year, we are continuing our work to reduce Wisconsin's historically high tax burden on our citizens, keep spending under control and still make our state a great place to live and work.

|