|

Does it ever feel like the government is out to get you? Does it ever seem as though you can hear the gears turning in the brains of politicians as they dream up new ways to nickel-and-dime you out of more and more taxes? Let's face it: you wake up in the morning and pay taxes on the coffee you drink; you pay taxes on the car you drive to work and the gas you put in it; goodness knows you pay taxes on the wages you earn once you get to work; then you pay taxes on the house you come home to... the examples are endless!

This week was different. This week, your Republican-led state legislature voted to get rid of an entire tax. Some states (ahem... Illinois) manage to invent new taxes practically every year. But Wisconsin's Joint Finance Committee, following Governor Scott Walker's proposal, voted yesterday to completely eliminate the state's portion of your property tax bill. That action is going to save state taxpayers about $180 million over two years, reducing the typical homeowner's property tax bill by about $26 every year. Repeal of an entire tax is a historic step and another example of bold reform that has already saved Wisconsin taxpayers nearly $5 billion in the past six years. This is real progress that is helping real families, and I'm excited to keep working on new reforms to make our state an even better place to live and work.

As always, I encourage you to follow my updates on social media or contact my office directly with your questions. Best wishes on your weekend!

Now THAT Doesn't Happen Every Day

As mentioned above, the Joint Finance Committee voted yesterday to repeal the Forestry Mill Tax, the only state portion remaining on folks' property taxes. The forestry account will be funded instead with general purpose revenues; in fact, $5 million is being placed in a forestry emergency account, to be saved for wildfire, disease and natural disaster relief, and additional funds will be available for forest fire prevention efforts. Even so, this step will help bring the combined total property tax savings for a typical Wisconsin family to more than $1,500 over the eight fiscal years 2011-2018; the trend we had been on previously was a trend of big increases every year. Regrettably, repeal of the Forestry Mill Tax was voted along party lines; no Democrats voted in support of repeal.

In other news, the committee also voted to support the Governor's proposed reorganization of the Department of Natural Resources (DNR). Overall funding and positions at the DNR will not be reduced, but the streamlining will reduce the number of divisions from six to five to improve workload management among existing staff. Separately, funding for county-level conservation staffing and soil and water resource management will be increased, and a $400,000 study will be conducted on the impact of water use on central waterways. These measures improve government efficiency and effectiveness but also provide for new scientific studies to better inform our protection of Wisconsin's natural resources. Unfortunately, all of these measures also were opposed by committee Democrats and passed the committee strictly along party lines.

The Joint Finance Committee is expected to meet again next week to take up several more of the remaining 2017-19 state budget debates that remain.

Way to Go, Wisconsin!

There is plenty of good news to go around in our beautiful and vibrant state this summer! Here are a few highlights that we ought to be proud of. On, Wisconsin!

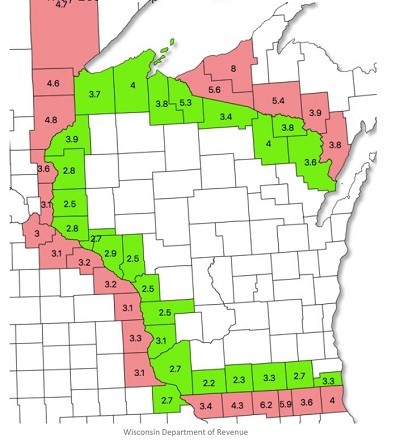

Cross-border comparison. Did you know that every single Wisconsin county that borders another state has an equal or better unemployment rate than its cross-border counterpart? (See the graphic at left.) Data is from May 2017; only Iowa and Indiana join Wisconsin in the national Top 10 best unemployment rates.

Access to quality health care. This week, the federal Agency for Healthcare Research and Quality named Wisconsin #1 in the country for health care quality! The agency has ranked the 50 states since 2006; only twice in the past decade has Wisconsin failed to be ranked in the top three. The rankings account for all different health care contexts and settings (i.e., preventive vs. acute vs. chronic care; hospitals vs. nursing homes vs. home health; etc.). This news comes on the heels of last month's news, when Wisconsin's rural hospitals were also ranked as the best in the nation by the Medicare Beneficiary Quality Improvement Project. These are significant achievements that validate the continuous improvements underway across our state's health systems.

Coolest Thing Made in Wisconsin. It's not too late to nominate a Wisconsin-made product to be named the second annual Coolest Thing Made in Wisconsin. We make combat vehicles and ships for the U.S. military; we make Harley-Davidson motorcycles; we make world-class cheese and dairy products; we make great beer; we're going to start making iPhones (thanks to Foxconn's imminent $10 billion investment in Wisconsin); and we make so much more as well. The winning product will be announced during October Manufacturing Month, which recognizes our state's biggest economic sector (more than 20 percent of our gross production) and the 470,000 employees who make it all happen.

|