Report 22-7 | June 2022

The Wisconsin Lottery sells instant tickets and lotto tickets, and participates in the multijurisdictional Powerball and Mega Millions lotto games. The Wisconsin Constitution and Wisconsin Statutes impose certain limitations on lottery expenses. The Wisconsin Constitution also requires that net proceeds from the Wisconsin Lottery be used exclusively for property tax relief for Wisconsin residents. Net proceeds from the Wisconsin Lottery are largely distributed to owners of primary residences in Wisconsin through the Lottery and Gaming Tax Credit.

We provided an unmodified opinion on the Wisconsin Lottery’s financial statements as of and for the years ended June 30, 2021, and June 30, 2020. These financial statements account for the financial position and activity of the Wisconsin Lottery, which is administered by the Department of Revenue. We conducted this financial audit by auditing the Wisconsin Lottery’s financial statements in accordance with applicable government auditing standards, issuing our auditor’s opinion, reviewing internal controls, and issuing our auditor’s report on internal control and compliance. We also assessed the Wisconsin Lottery’s compliance with certain statutory requirements.

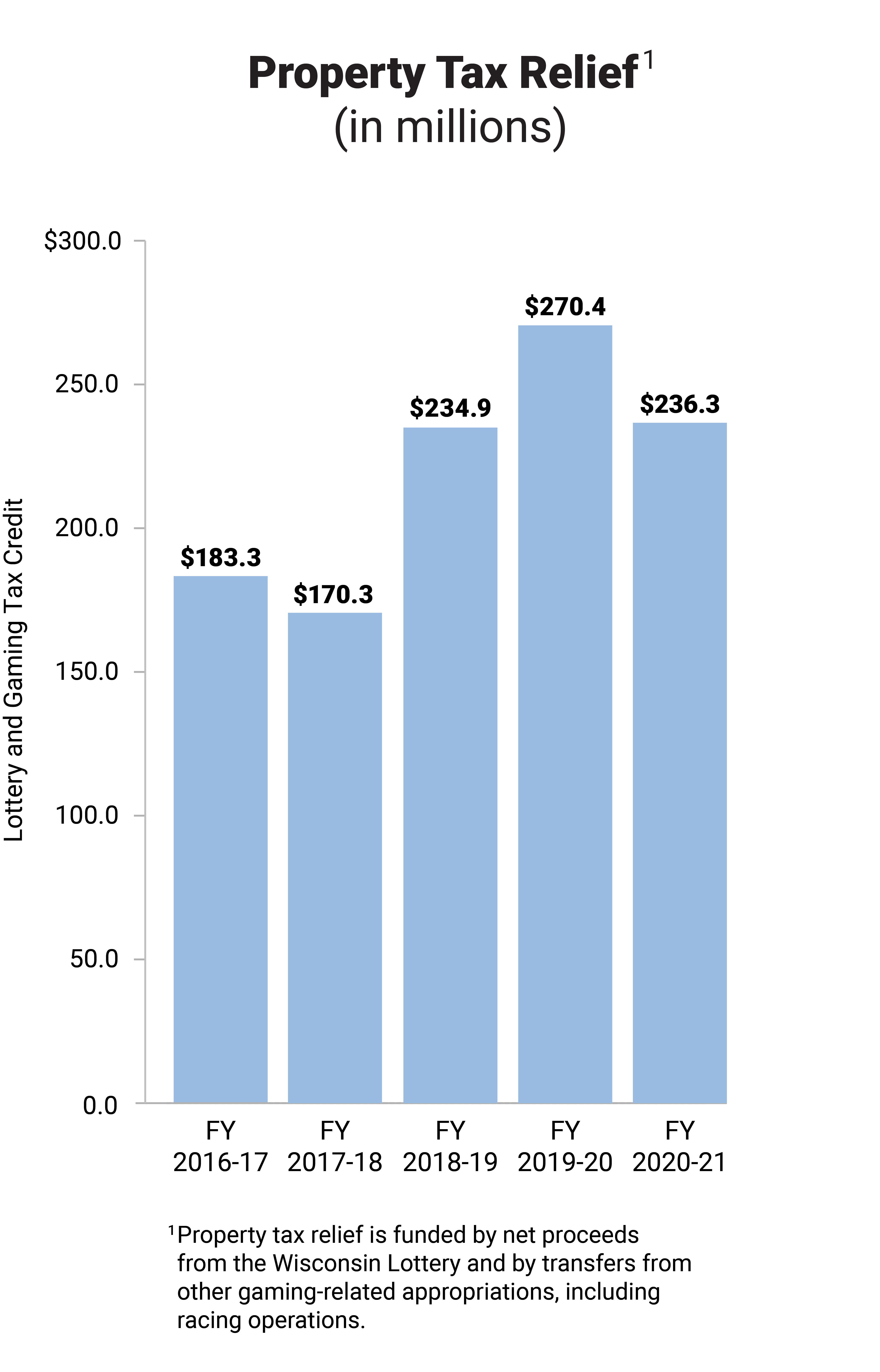

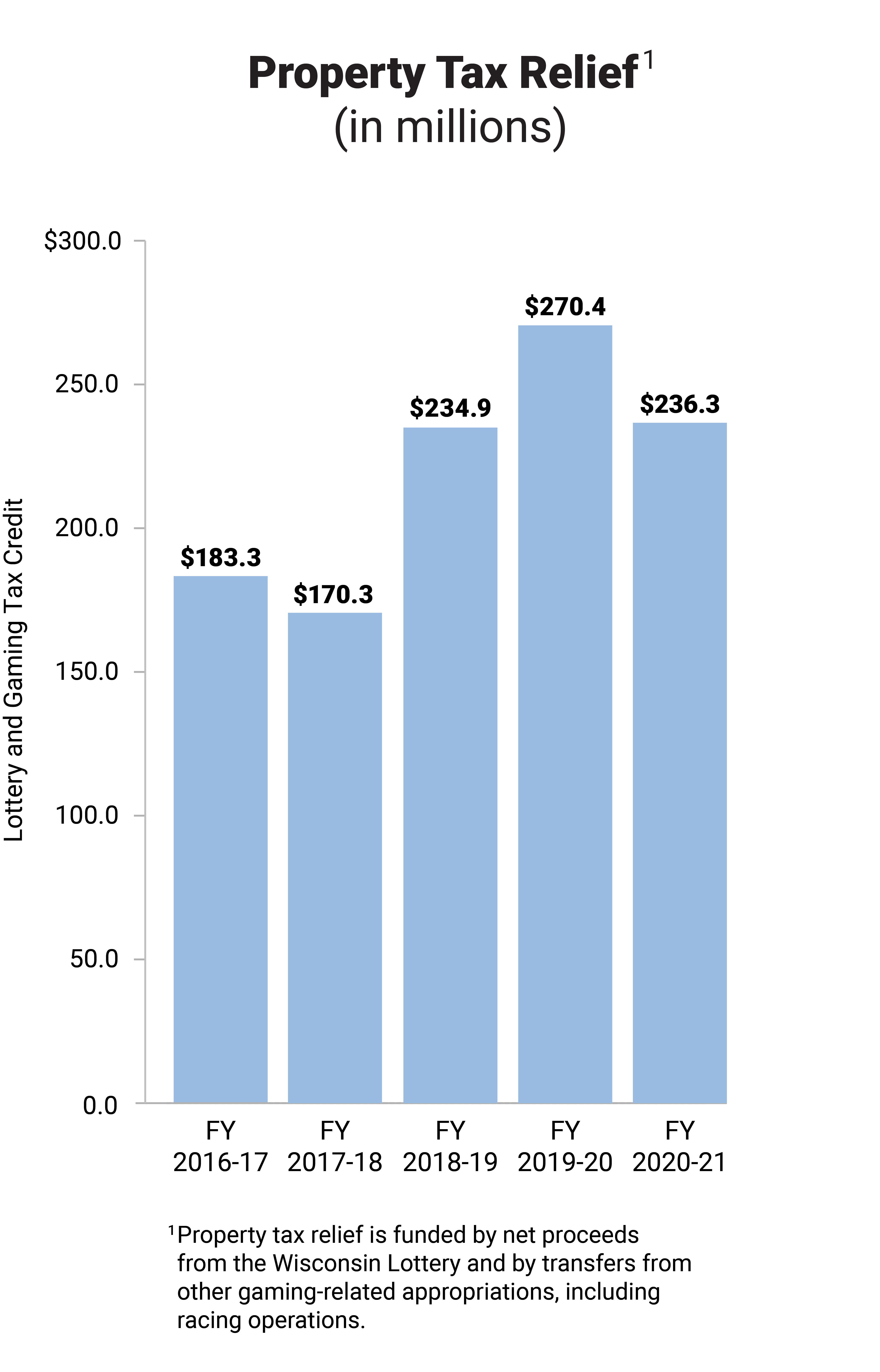

The Wisconsin Lottery was provided with general purpose revenue (GPR) of $71.7 million in fiscal year (FY) 2019-20 and $73.1 million in FY 2020-21 for retailer compensation expenses, vendor fees, and certain general program operation expenses. The provision of GPR funding increased net lottery proceeds available for the Lottery and Gaming Tax Credit. However, the actual amount distributed for the Lottery and Gaming Tax Credit decreased from $270.4 million in FY 2019-20 to $236.3 million in FY 2020-21, or by 12.6 percent, because the estimate of ticket sales used to determine the amount of the credit was less than actual ticket sales.

In October 2021, the Department of Administration and the Legislature’s Joint Committee on Finance authorized the use of $343.6 million in net lottery proceeds for the FY 2021-22 Lottery and Gaming Tax Credit.

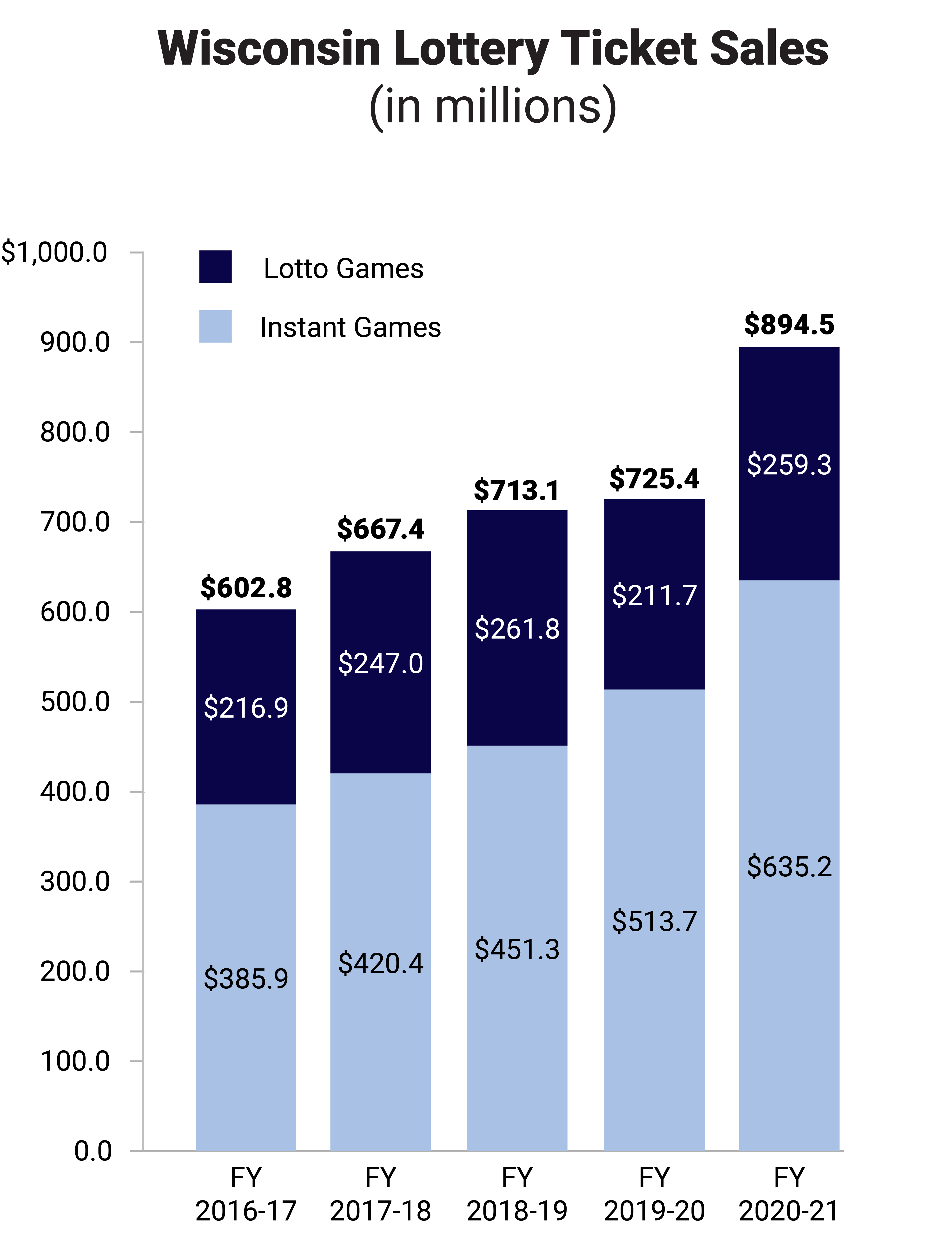

Sales of instant tickets, which are scratch-off and pull-tab tickets, increased by $121.5 million, or by 23.7 percent from FY 2019-20 to FY 2020-21. This increase is primarily the result of increased sales of scratch-off tickets that sold for $10 or more. Lotto ticket sales increased $47.6 million, or by 22.5 percent, due to increased Powerball and Mega Millions ticket sales resulting from the jackpots being higher in FY 2020-21 than those in FY 2019-20.

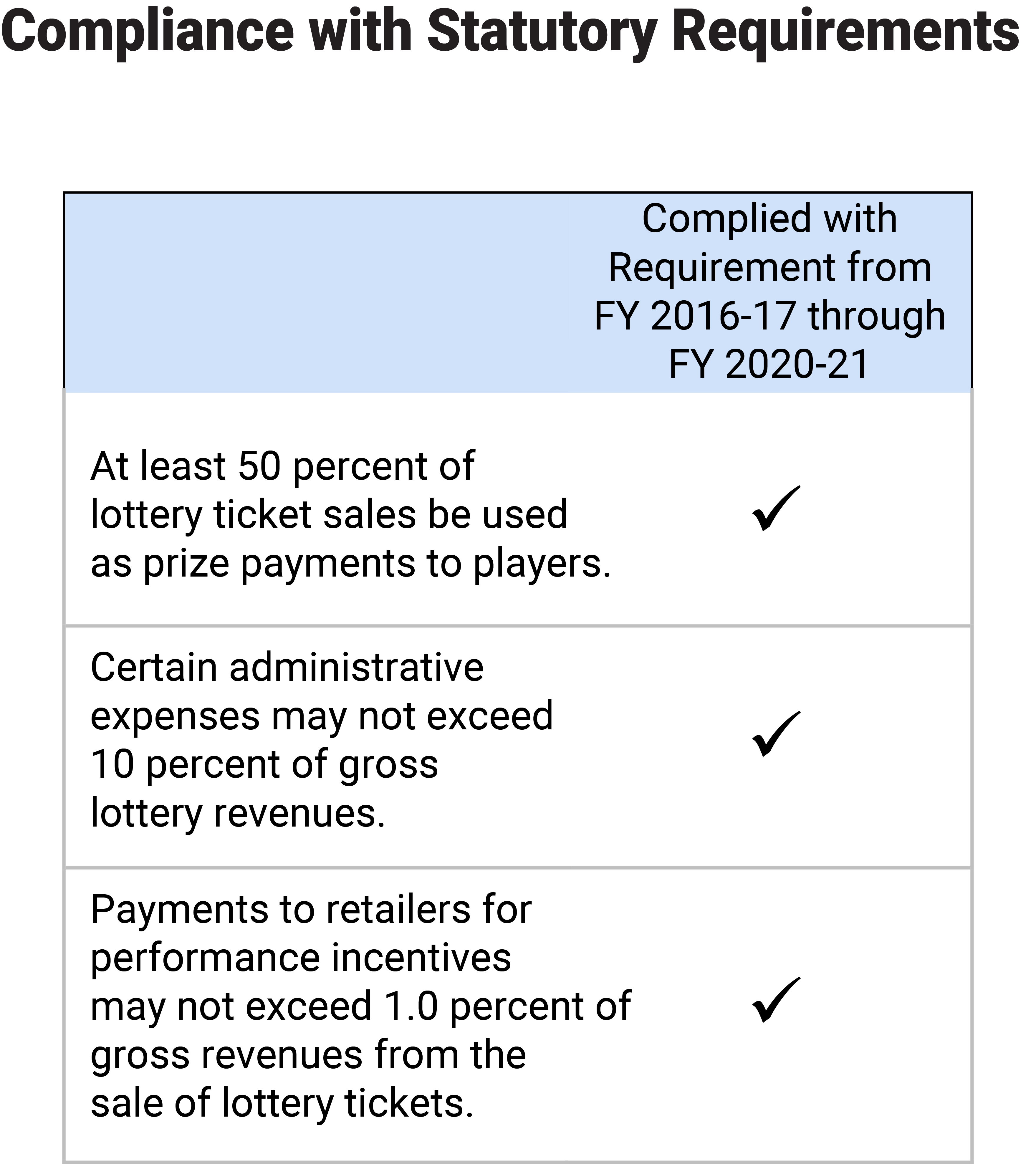

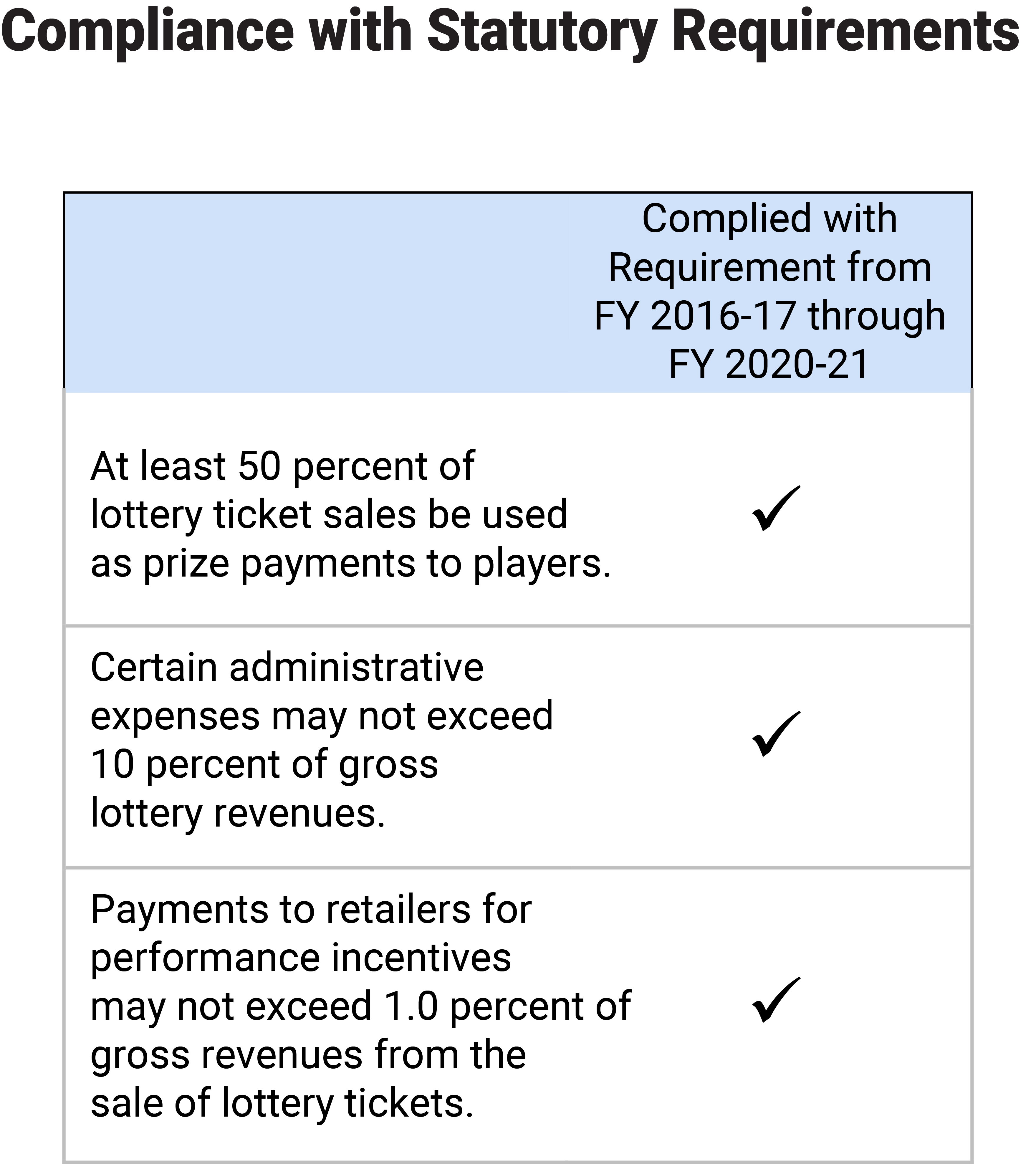

Wisconsin Statutes impose limitations on certain types of lottery expenses, including requirements that:

- at least 50 percent of lottery ticket sales be used as prize payments to players;

- certain administrative expenses may not exceed 10 percent of gross lottery revenues; and

- payments to retailers for performance incentives not exceed 1.0 percent of gross revenues from the sale of lottery tickets.

Through this and other annual audits of the Wisconsin Lottery, we found the Wisconsin Lottery to be in compliance with the statutory requirements during the five-year period from FY 2016-17 through FY 2020-21.

Statutes establish maximum compensation rates for basic commissions and performance program payments to retailers who sell lottery tickets. Basic commission rates, established in Wisconsin Statutes, are currently 5.5 percent of the retail price for lotto tickets and 6.25 percent for instant tickets.

The Retailer Performance Program includes sales incentives for retailers that increase ticket sales, a bonus for retailers that sell winning tickets, and short term incentives for retailers that increase ticket sales of certain games for specific time periods. During FY 2020-21, performance payments for the sales incentives for increasing ticket sales accounted for 77.0 percent of the total incentive payments, winning ticket bonuses accounted for 16.1 percent, and short-term incentives accounted for 6.9 percent.

There were five short-term incentives during FY 2020-21. Total payments for each of the five short-term incentives ranged from $59,800 to $185,305, and the number of retailers who participated in each of these short term incentives ranged from 3,196 retailers to all retailers, which was 3,645 retailers as of June 30, 2021.