The Department of Administration (DOA) prepares the Annual Comprehensive Financial Report (ACFR), which contains the financial statements of the State of Wisconsin prepared in accordance with generally accepted accounting principles (GAAP) prescribed by the Governmental Accounting Standards Board (GASB). The ACFR includes financial information on state funds, including the State’s General Fund, the Transportation Fund, the University of Wisconsin (UW) System, the Wisconsin Retirement System, and the Unemployment Reserve Fund.

We provided unmodified opinions on the financial statements and related notes of the State of Wisconsin as of and for the year ended June 30, 2022. We provide an unmodified opinion when audit evidence supports the conclusion that the financial statements provide a fair view of an entity’s financial activity in accordance with GAAP. Our unmodified opinions are included in the State’s ACFR, which may be found on DOA’s website. We conducted the financial audit by auditing the State’s financial statements in accordance with applicable government auditing standards, issuing our auditor’s opinions, reviewing internal controls, and issuing our auditor’s report on internal control and compliance.

We also reviewed certain aspects of the federal funding the State received for the public health emergency, and we include in our report certain other matters of interest related to the State’s fiscal year (FY) 2021-22 activities.

Total revenue increased by $4.8 billion and was $39.3 billion in FY 2021-22. This increase was largely the result of an increase of $1.9 billion in income tax revenues and an increase of $663.2 million in sales and excise tax revenues. In addition, federal revenues increased by $2.0 billion largely due to the federal revenue the State received as a result of the public health emergency. Total expenditures increased by $2.2 billion and were $33.6 billion in FY 2021-22. This increase was largely the result of grants and aid to individuals and organizations related, in part, to the public health emergency, increases in Medical Assistance (MA) Program expenditures, and increases in aids to schools.

The fund balance of the General Fund is made up of several components, and the largest is the unassigned fund balance. The unassigned fund balance, which are amounts that are not restricted or committed for a specific purpose, totaled $2.2 billion. The unassigned fund balance represents that, as of June 30, 2022, more resources were available than were spent or obligated in the short term.

The committed fund balance of $1.7 billion includes the amounts held in the statutory Budget Stabilization Fund, also known as the State’s rainy day fund. The balance in this fund increased by $3.8 million in FY 2021-22, primarily from interest income.

The State repaid long-term debt in excess of new debt issuances during FY 2021-22, resulting in a decrease in overall debt. The $1.0 billion in new general obligation bonds and notes issued during FY 2021-22 included $378.2 million for UW System academic facilities and $315.1 million for transportation projects.

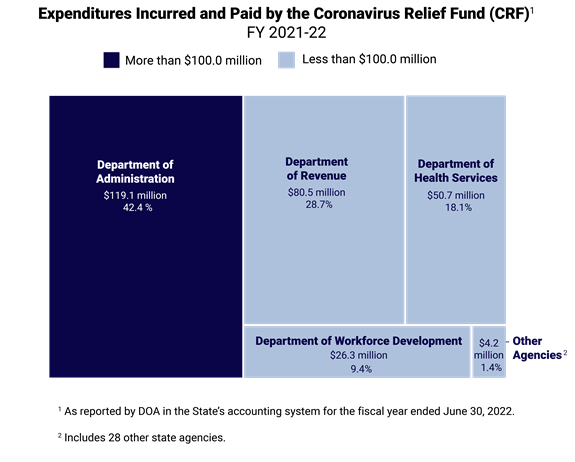

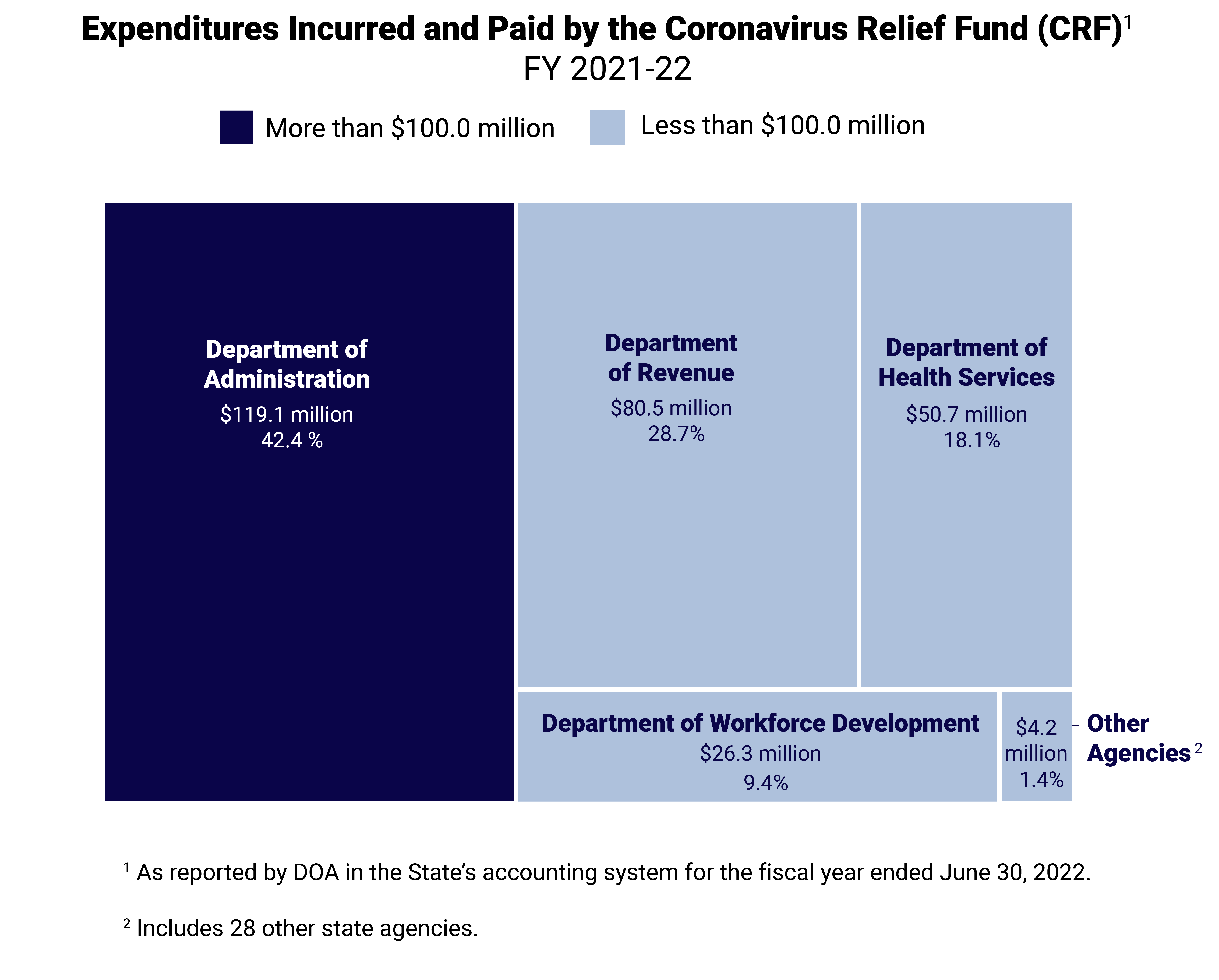

In FY 2021-22, $280.8 million in expenditures at 32 state agencies were incurred and paid by the Coronavirus Relief Fund (CRF). According to amounts reported by DOA, the largest total expenditures were incurred by DOA, which expended $119.1 million in CRF funds, including $110.0 million that was paid to local school districts as school aids. According to amounts reported by DOA, the full amount of CRF funds was expended by September 30, 2022.

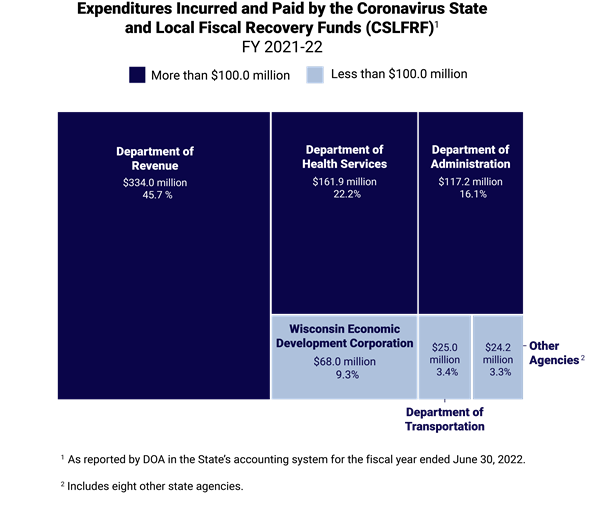

Separate from the CRF, the Coronavirus State and Local Fiscal Recovery Funds (CSLFRF) distributed money directly to state, local, tribal, and territorial governments. The State was allocated $3.0 billion in funding and was advanced $1.5 billion in May 2021, including $205.8 million to be distributed to local governments. In May 2022, the State was advanced $1.5 billion, including $207.7 million to be distributed to local governments. Federal regulations stipulate that eligible expenditures must be incurred between March 3, 2021, and December 31, 2024, and spent through December 31, 2026. DOA reported that $730.3 million in expenditures at 13 state agencies was incurred and paid by the CSLFRF in FY 2021-22. The largest total expenditures were incurred by the Department of Revenue, the Department of Health Services (DHS), and DOA.

Wisconsin’s federal medical assistance percentage (FMAP) is the percentage of medical assistance expenditures the federal government will fund for the State. The FMAP increased by 6.2 percent in March 2020. DHS reported the State received $641.3 million in additional funding in FY 2021-22 as a result of the increased FMAP. In addition, DHS also claimed and received an additional $329.2 million in federal funds in FY 2021-22 under the MA Program, as allowed under the American Rescue Plan Act (ARPA).

Three of these significant deficiencies related to information technology (IT) security at DOA. We note that DOA continued to be in statutory noncompliance by providing insufficient oversight and monitoring of executive branch agency IT operations. Given that these concerns have continued for several years, we recommend that DOA report to the Joint Legislative Audit Committee by March 31, 2023, on its efforts to take corrective actions and implement our recommendations. In addition, we reported a significant deficiency related to internal controls over a new computer application at UW System, which was also included in report 22-25.

We reported two significant deficiencies related to the MA Program, including one related to certain rules programmed into the Medicaid Management Information System and one related to financial reporting for additional funds derived from the increased FMAP.

We also reported a significant deficiency related to the assessment of internal controls at a custodian bank the Board of Commissioners of Public Lands relies upon for certain investment transaction processing and safekeeping.

We make 24 recommendations to these agencies, including 11 recommendations to DOA, 6 recommendations to DHS, 4 recommendations to UW System Administration, and 3 recommendations to the Board of Commissioners of Public Lands.

During our work, we identified four issues that did not meet the requirements for reporting under Government Auditing Standards but that are matters of interest related to the State’s FY 2021-22 activities. We communicated with the responsible state agencies on these matters, which include:

- a remaining balance as of June 30, 2022, in a clearing appropriation at DOA and a transfer of a balance of a Wisconsin Department of Justice (DOJ) clearing appropriation by DOJ to three other DOJ appropriations;

- the re-opening by DOA of the FY 2021-22 accounting records to process a statutorily required transfer that was not made in a timely manner by the Office of the Commissioner of Insurance;

- a deficit balance as of June 30, 2022, in the Unemployment interest and penalty account in the General Fund; and

- a continued increase in the balance of the health insurance fringe benefit variance account, which DOA is responsible for resolving.