Calendar Year 2021

Report 22-12 | September 2022

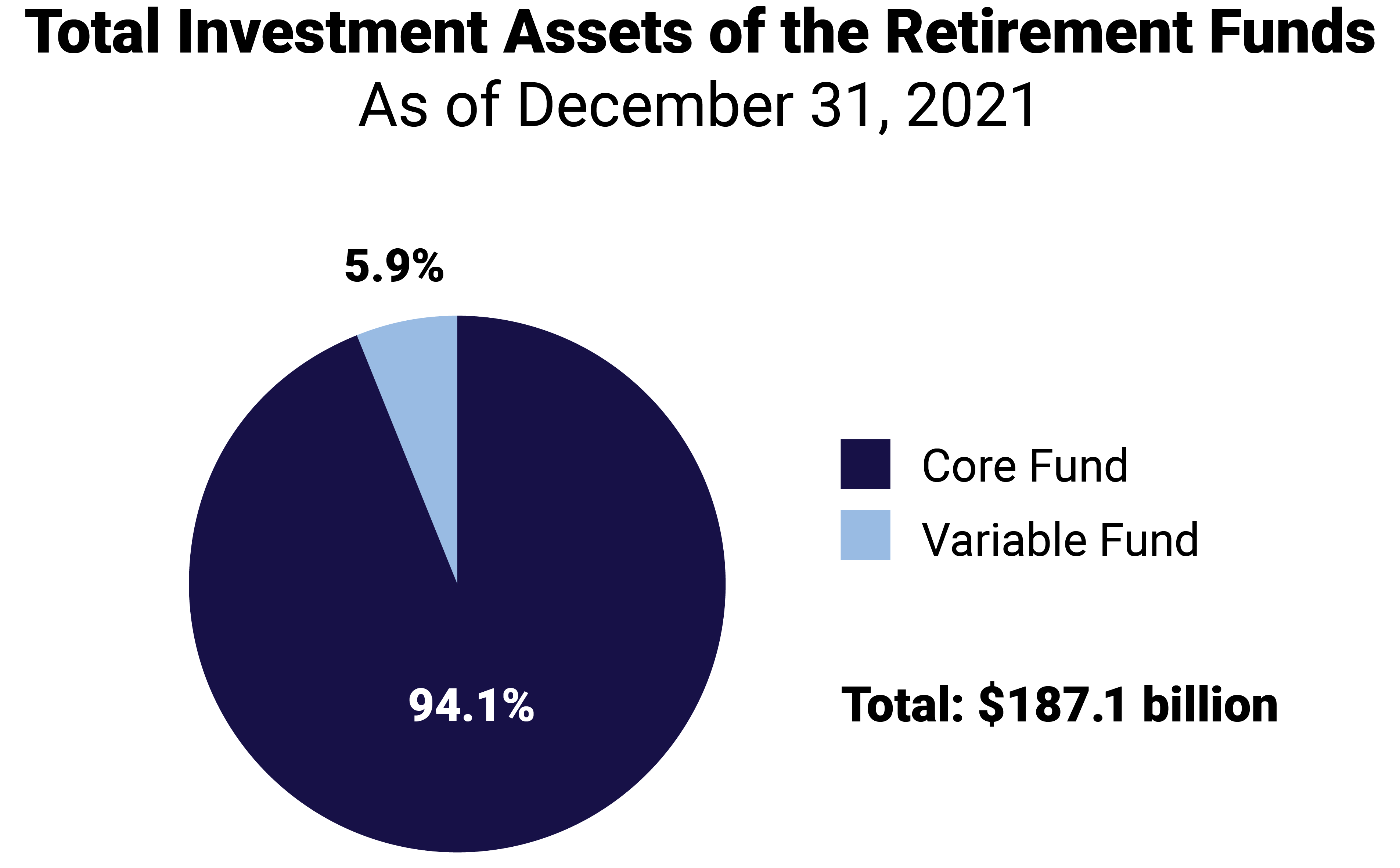

The State of Wisconsin Investment Board (SWIB) invests assets for the Wisconsin Retirement System (WRS) that are held in the Core Retirement Investment Trust Fund (Core Fund) and the Variable Retirement Investment Trust Fund (Variable Fund). Together, these funds are known as the Retirement Funds.

We provided unmodified opinions on the financial statements of the Retirement Funds investment activity for the year ended December 31, 2021. These financial statements report the investments and the investment activity of the WRS. Our unmodified opinions are included in SWIB’s 2021 Retirement Funds Annual Report. We conducted the financial audit by auditing SWIB’s financial statements of the Retirement Funds investment activity in accordance with applicable government auditing standards, issuing our auditor’s opinions, reviewing internal controls, and issuing our auditor’s report on internal control and compliance.

Total investment assets of the Retirement Funds were $187.1 billion as of December 31, 2021. Total investment assets in the Core Fund increased from $148.3 billion as of December 31, 2020, to $176.1 billion as of December 31, 2021. The Core Fund investments include a distinct mix of investment types, such as equities, fixed income, and private fund investments. Total investment assets in the Variable Fund increased from $9.6 billion as of December 31, 2020, to $11.0 billion as of December 31, 2021. The Variable Fund assets in 2021 are primarily made up of public equities.

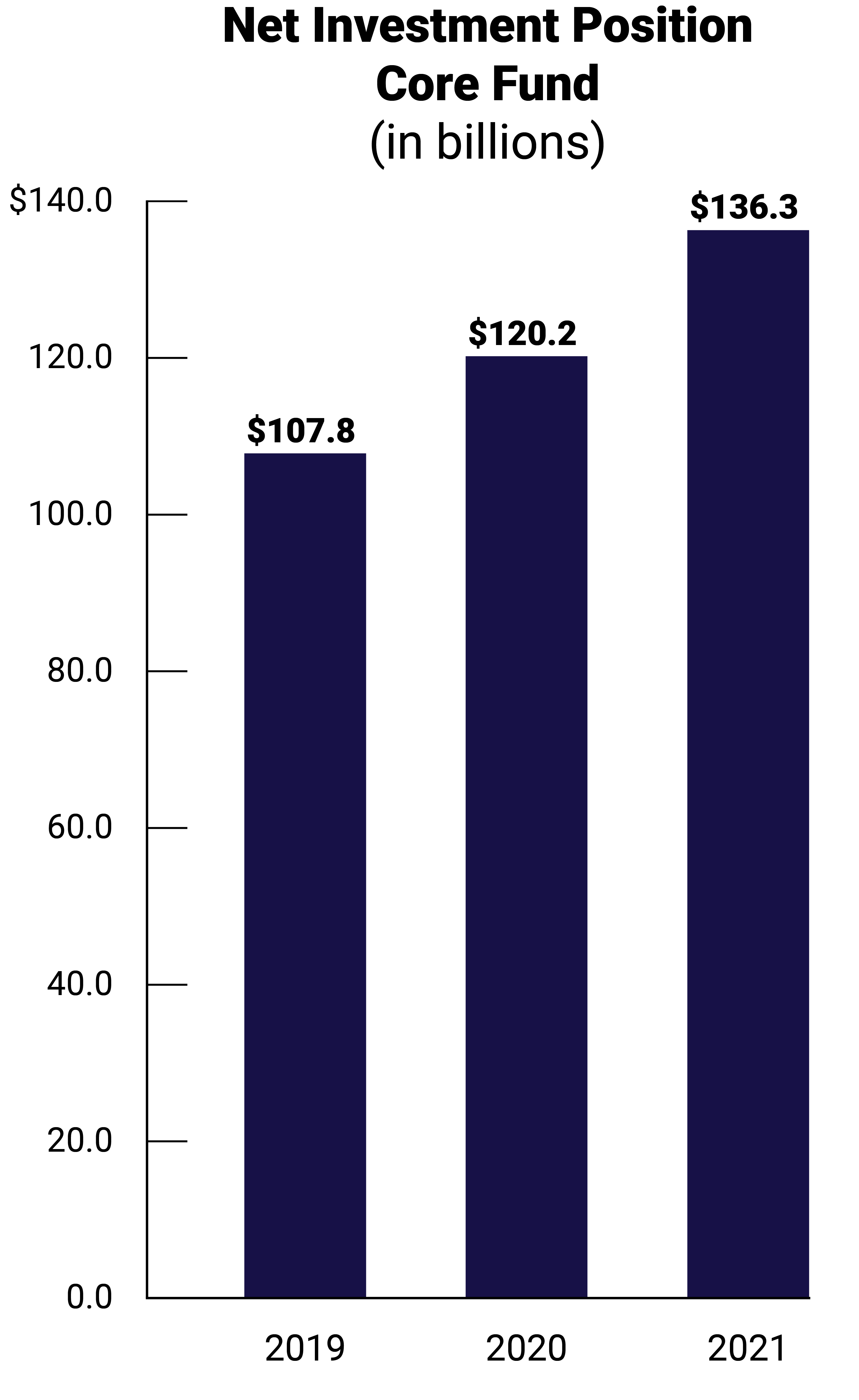

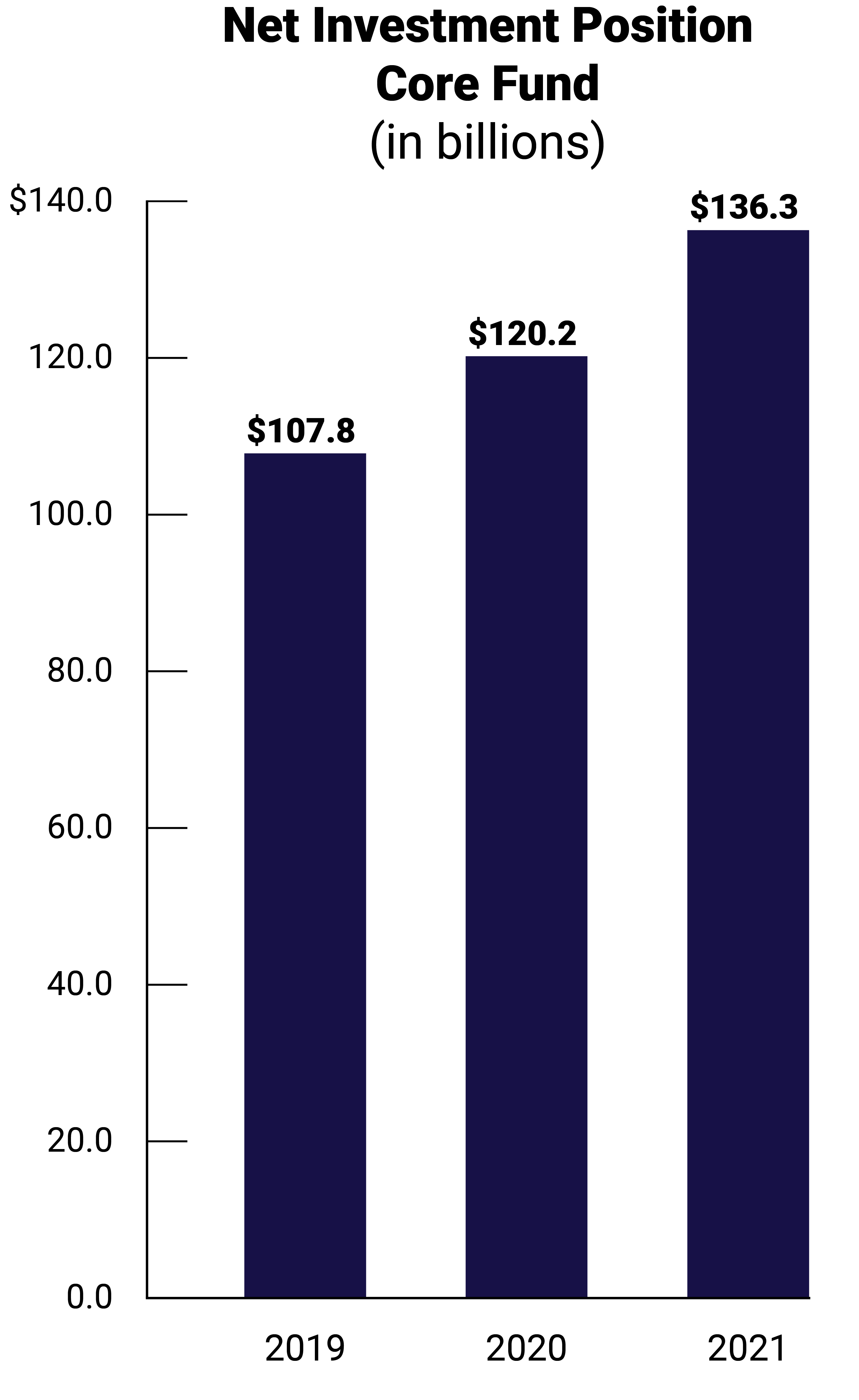

Net investment position is a measure of overall financial condition. The Core Fund reported net investment income of $15.9 billion in 2020 and $20.0 billion in 2021. The one-year investment return, net of all fees and costs, increased from 15.2 percent in 2020 to 16.9 percent in 2021 and exceeded the benchmark of 16.3 percent. The Core Fund investment return in 2021 is largely attributed to strong investment returns from private equity and public equity investments.

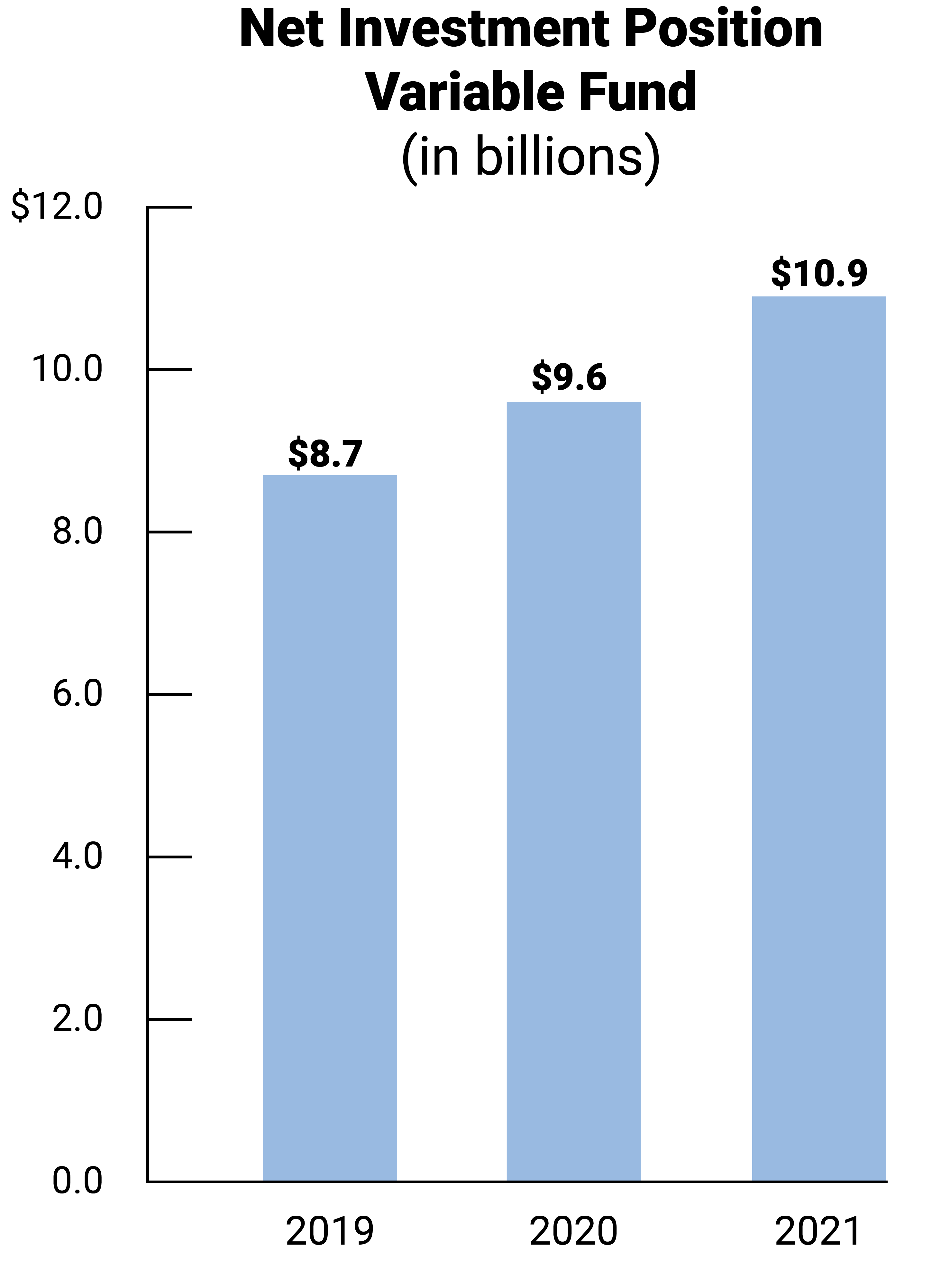

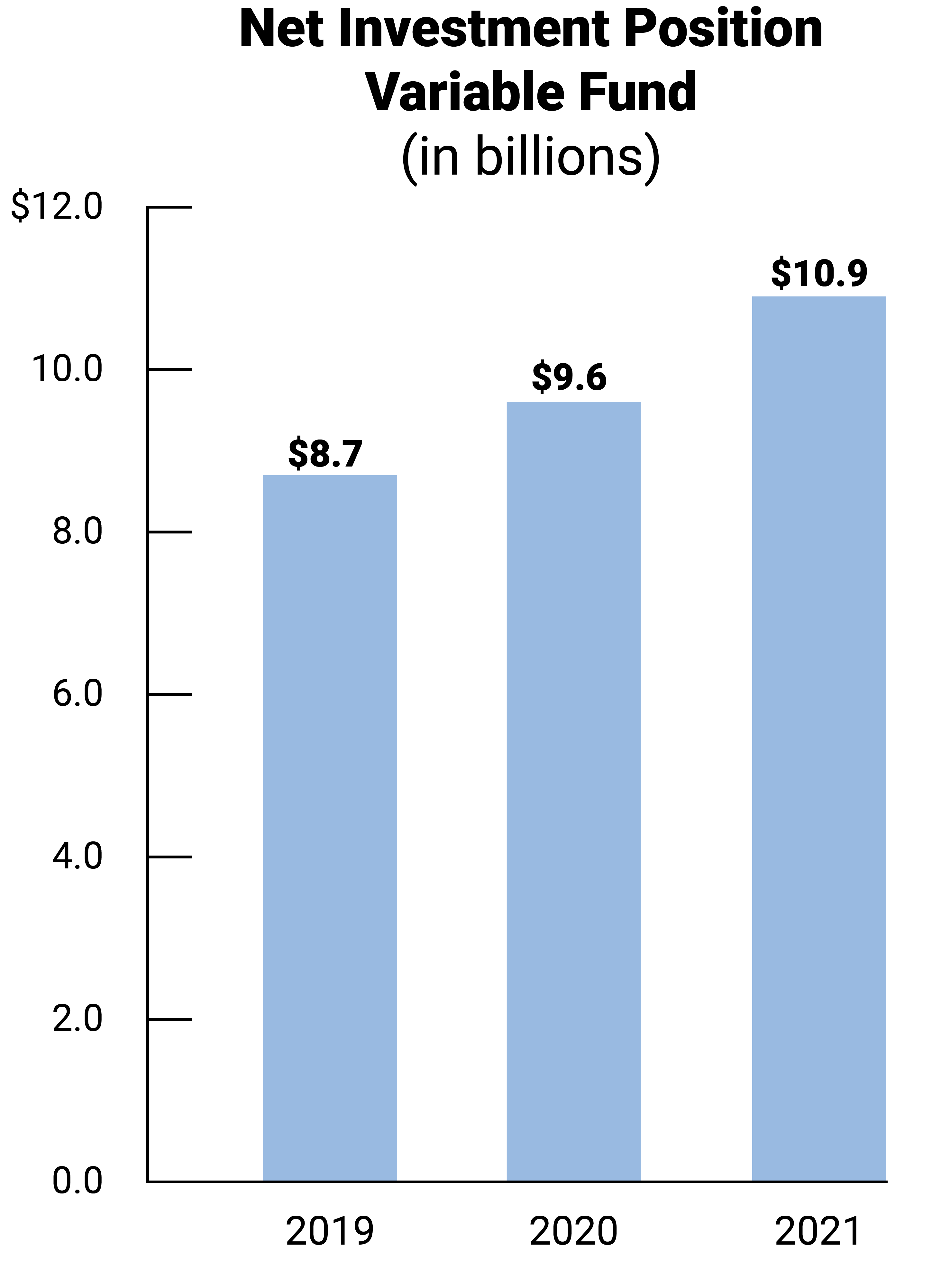

As noted, net investment position is a measure of overall financial condition. The Variable Fund reported net investment income of $1.4 billion in 2020 and $1.8 billion in 2021. The one-year investment return, net of all fees and costs, for the Variable Fund increased from 17.5 percent in 2020 to 20.0 percent in 2021, and lagged the benchmark of 20.2 percent. The Variable Fund investment return in 2021 is attributed to strong returns from public equity investments.

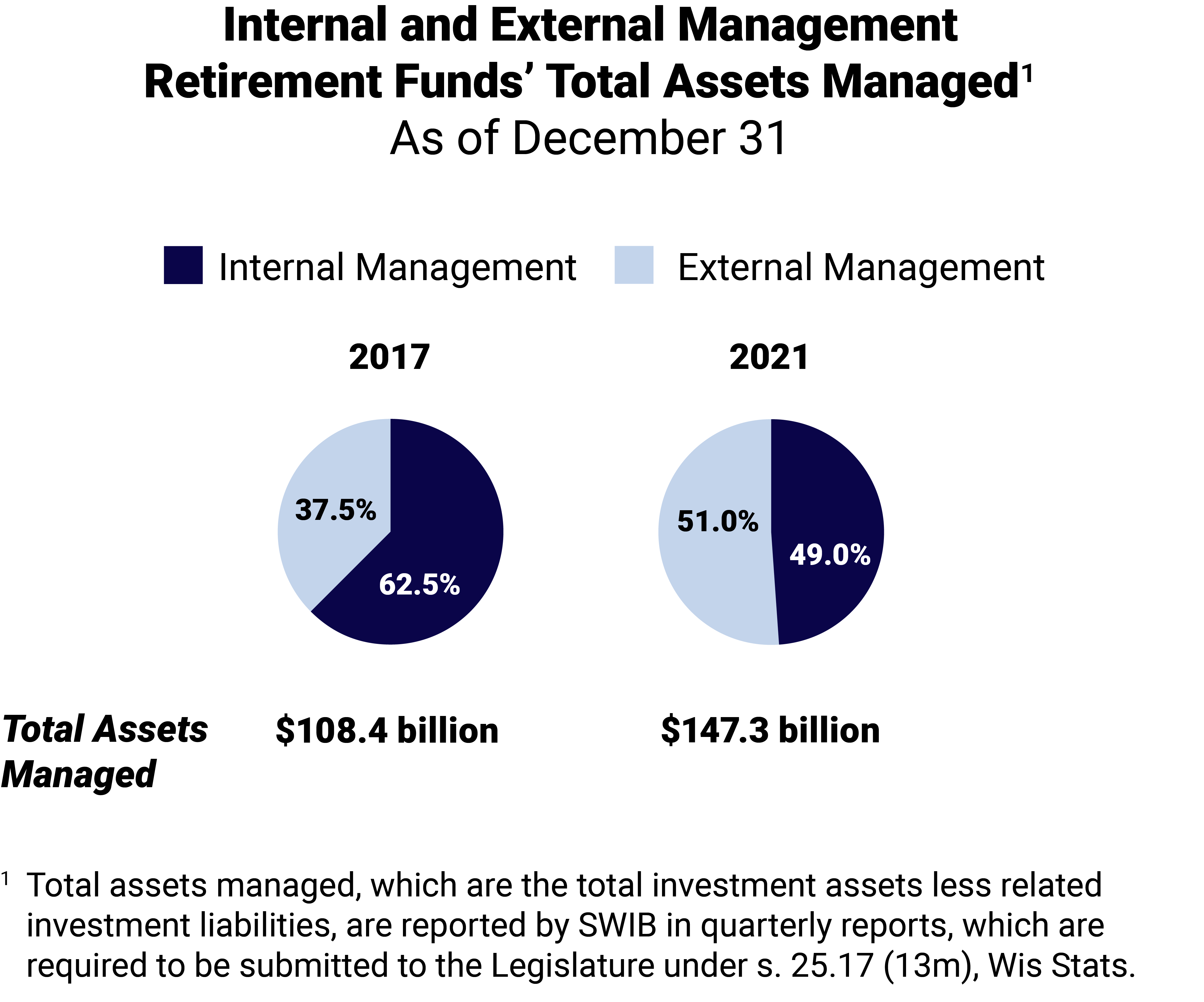

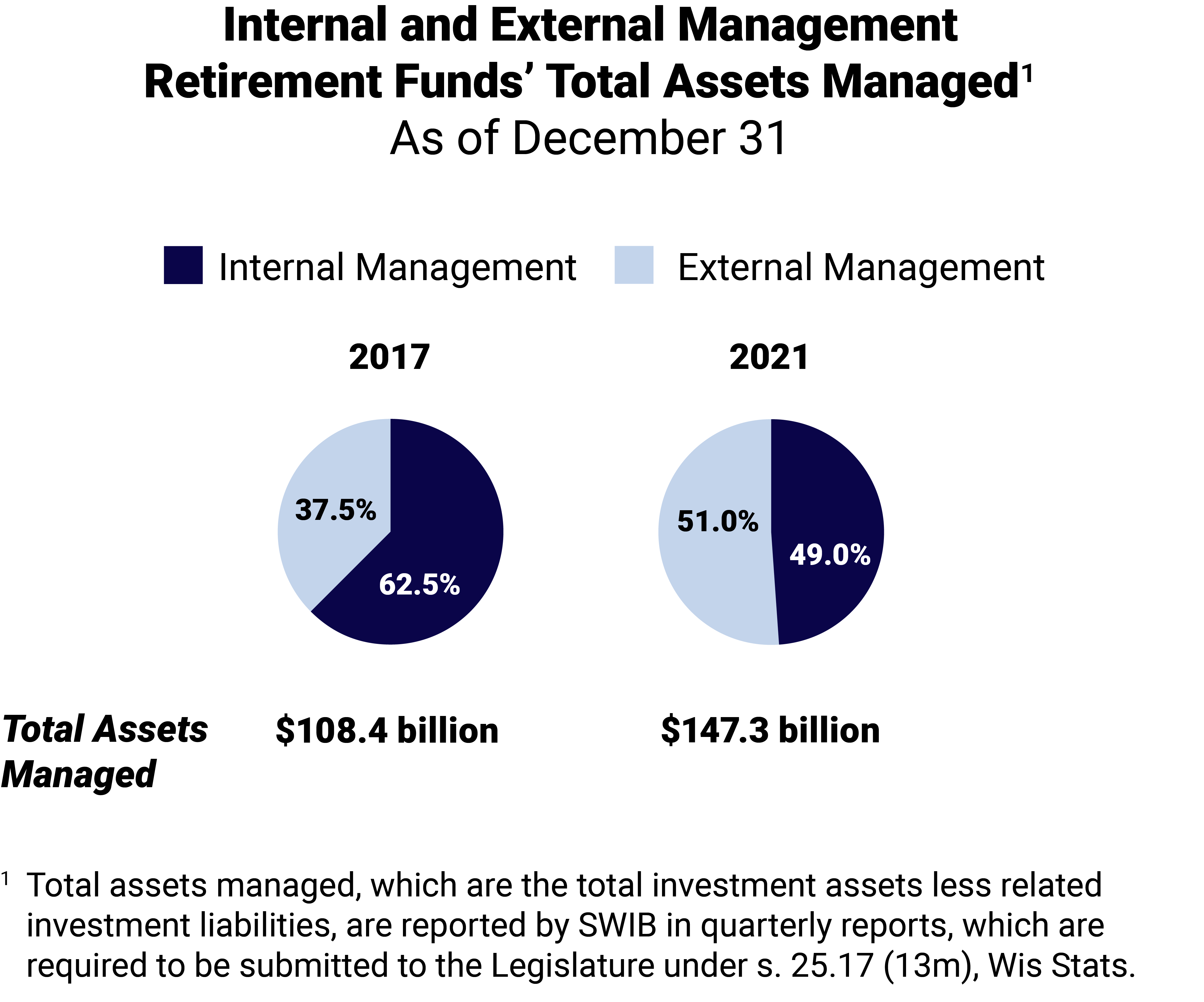

Historically, SWIB’s goal has been to increase the percentage of assets managed internally because external management is more expensive. The percentage of assets managed internally has decreased from 62.5 percent in 2017 to 49.0 percent in 2021. As noted in report 22-8, SWIB staff attributed increases in external management of investments to the use of more complex active investment strategies. SWIB also noted that it continues to improve its technology and recruit staff with expertise to manage a portion of the assets managed by external managers.

SWIB reported $49.5 million in external investment management fees in its 2021 financial statements, compared to the $432.4 million it reported in 2020. The lesser amount reported in 2021 is not the result of a reduction in external investment management fees, which SWIB indicated totaled $571.5 million in calendar year 2021. Rather, SWIB changed how it accounts for certain external investment management fees beginning in 2021. We recommend SWIB provide specific information on external investment management fees in its future annual financial reports.

Under this new strategy, called a cash release program, securities lending cash collateral is transferred from the custodial bank to SWIB’s cash accounts to provide SWIB liquidity for other investment strategies. As of December 31, 2021, SWIB transferred a total of $761.0 million from the securities lending cash collateral pool under the new strategy. Each of the nine public pension plans we contacted indicated that they did not participate in a similar program.

Please see the complete list of our recommendations here.