Report 21-6 | March 2021

As a condition of receiving federal funds, state agencies must meet the audit requirements of the federal Office of Management and Budget Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (Uniform Guidance), and the Single Audit Act of 1984, as amended. The Single Audit Act requires there to be one comprehensive audit of federal programs. This single audit also incorporates our annual audit of the State’s financial statements. These financial statements were included in the Comprehensive Annual Financial Report issued by the Department of Administration (DOA).

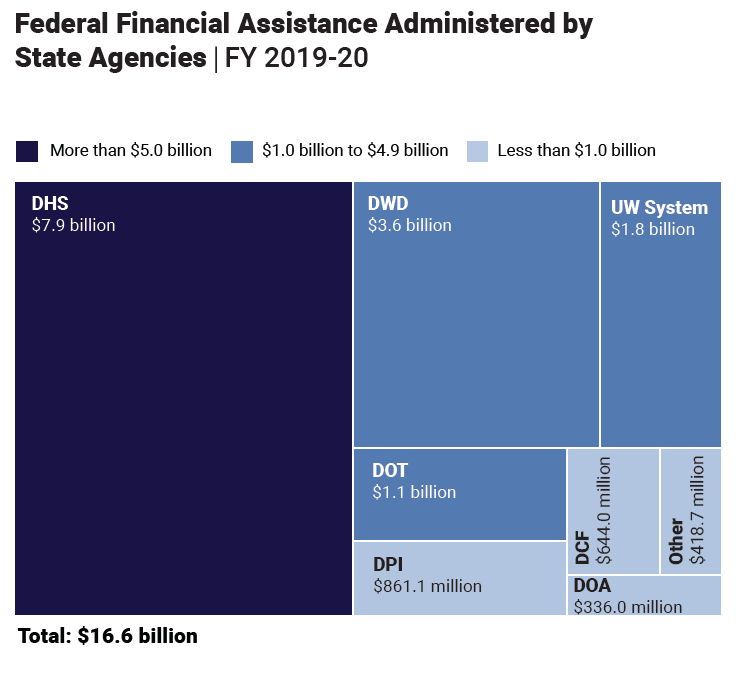

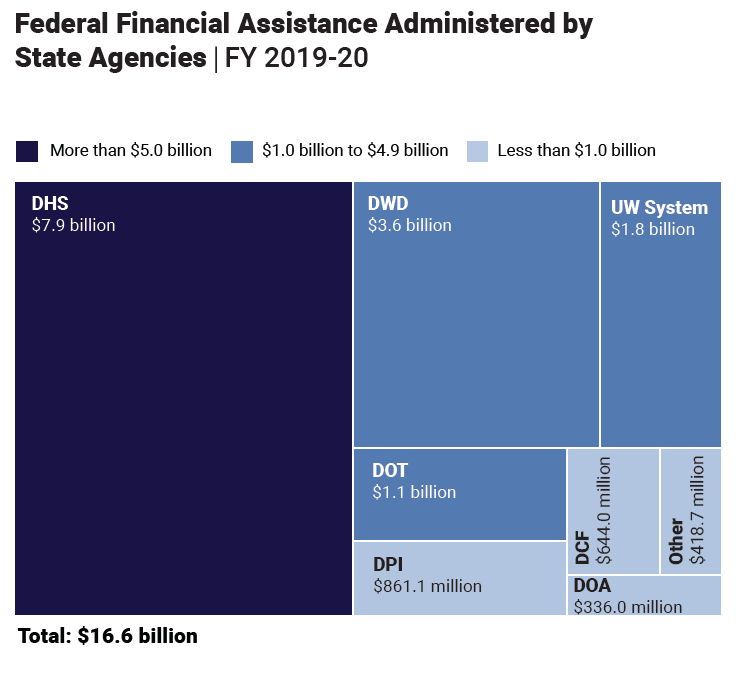

In fiscal year (FY) 2019-20, state agencies administered $16.6 billion in federal financial assistance, including $3.4 billion that was related to the public health emergency and that was separately identified in the State’s Schedule of Expenditures of Federal Awards (SEFA). Our audit focused on 22 federal programs that accounted for 77.0 percent of the federal financial assistance administered by state agencies in FY 2019-20. We found that state agencies generally complied with federal requirements, and we provided an unmodified opinion on federal compliance for 20 of the programs we reviewed. We qualified our opinion on compliance for certain requirements related to the Food Distribution Cluster and the Child Nutrition Cluster. We made 22 recommendations to improve the administration of federal programs and to address the internal control deficiencies we identified related to financial reporting. We also identified $1.6 million of questioned costs that state agencies charged inappropriately to federal funds. The federal government will work with state agencies to resolve the concerns we identified.

An auditor provides a qualified opinion on compliance when the internal control and compliance concerns are material in relation to a specific compliance area tested for a federal program or cluster.

We qualified our opinion on compliance related to physical inventory requirements for the Food Distribution Cluster at DHS. Specifically, we found DHS did not ensure that an annual physical inventory of food commodities donated from the U.S. Department of Agriculture (USDA) was performed.

We also qualified our opinion on compliance related to physical inventory requirements for the Child Nutrition Cluster at DPI. Specifically, we found DPI did not ensure that an annual physical inventory of USDA-donated food commodities was performed.

We made 17 recommendations to improve the administration of federal programs and 5 recommendations related to internal controls over financial reporting. The recommendations pertained to 22 findings, and we consider 4 of the findings to be material weaknesses and 15 to be significant deficiencies.

We also identified $1.6 million of questioned costs that state agencies charged inappropriately to federal funds. These questioned costs relate to the CRF, the Medical Assistance program, HEERF, Foster Care—Title IV-E, and the Children’s Health Insurance Program.

Finally, we followed up on the progress of state agencies to address 25 recommendations we made in our FY 2018-19 single audit report (report 20-3). The federal government will work with state agencies to resolve the new and continuing concerns we identified.

| Findings by Type | ||||

| Agency | Material Weakness1 | Significant Deficiency2 | Other3 | Total |

| DOA | 3 | 3 | ||

| DCF | 1 | 1 | ||

| ETF | 1 | 1 | ||

| DHS | 1 | 8 | 2 | 11 |

| DPI | 1 | 1 | ||

| DWD | 1 | 2 | 3 | |

| UW System | 1 | 1 | 2 | |

| Total | 4 | 15 | 3 | 22 |

| Federal Program | Questioned Costs | |||

| Coronavirus Relief Fund | $ 741,766 | |||

| Medical Assistance Program | 428,765 | |||

| Higher Education Emergency Relief Fund | 400,000 | |||

| Foster Care—Title IV-E | 7,597 | |||

| Children's Health Insurance Program | 2,966 | |||

| Total | $1,581,094 | |||

1 A material weakness is a deficiency, or a combination of deficiencies, in internal control over compliance or financial reporting, such that there is a reasonable possibility that a material misstatement or material noncompliance will not be prevented, or detected and corrected, on a timely basis.

2 A significant deficiency is a deficiency, or a combination of deficiencies, in internal control over compliance or financial reporting that is less severe than a material weakness in internal control, yet important enough to merit attention by those charged with governance.

3 A noncompliance finding that does not have a related material weakness or significant deficiency.

| Findings by Type | ||||

| Agency | Material Weakness1 | Significant Deficiency2 | Other3 | Total |

| DOA | 3 | 3 | ||

| DCF | 1 | 1 | ||

| ETF | 1 | 1 | ||

| DHS | 1 | 8 | 2 | 11 |

| DPI | 1 | 1 | ||

| DWD | 1 | 2 | 3 | |

| UW System | 1 | 1 | 2 | |

| Total | 4 | 15 | 3 | 22 |

1 A material weakness is a deficiency, or a combination of deficiencies, in internal control over compliance or financial reporting, such that there is a reasonable possibility that a material misstatement or material noncompliance will not be prevented, or detected and corrected, on a timely basis.

2 A significant deficiency is a deficiency, or a combination of deficiencies, in internal control over compliance or financial reporting that is less severe than a material weakness in internal control, yet important enough to merit attention by those charged with governance.

3 A noncompliance finding that does not have a related material weakness or significant deficiency.

| Federal Program | Questioned Costs | |||

| Coronavirus Relief Fund | $ 741,766 | |||

| Medical Assistance Program | 428,765 | |||

| Higher Education Emergency Relief Fund | 400,000 | |||

| Foster Care—Title IV-E | 7,597 | |||

| Children's Health Insurance Program | 2,966 | |||

| Total | $1,581,094 | |||