Report 23-3 | January 2023

We provided unmodified opinions on the financial statements for the separate funds presented in the Department of Employee Trust Funds’ (ETF’s) 2021 Annual Comprehensive Financial Report (ACFR), which can be found on ETF’s website. These financial statements account for the financial position and activity of certain benefit programs available to state and local public employees. These programs include the Wisconsin Retirement System (WRS), health insurance, and life insurance programs for active and retired employees of the State and participating local governments. We conducted this financial audit by auditing ETF’s financial statements in accordance with applicable government auditing standards, issuing our auditor’s opinions, reviewing internal controls, and issuing our auditor’s report on internal control and compliance.

ETF chose to separately issue financial statements for certain programs it administered. We audited these financial statements as they were prepared by ETF and provided information about these programs in the following reports we issued in September 2022:

- Wisconsin Retirement System (report 22-13);

- Wisconsin Retirement System Reporting for Participating Employers (report 22-14);

- Retiree Life Insurance Programs (report 22-15);

- State Retiree Life Insurance Reporting for the State of Wisconsin (report 22-16);

- Local Retiree Life Insurance Reporting for Participating Employers (report 22-17);

- Supplemental Health Insurance Conversion Credit Program (report 22-18); and

- Supplemental Health Insurance Conversion Credit Program Reporting for Participating Employers (report 22-19).

We have provided this information again in this report to assist the users of the financial statements that are now presented in ETF’s ACFR.

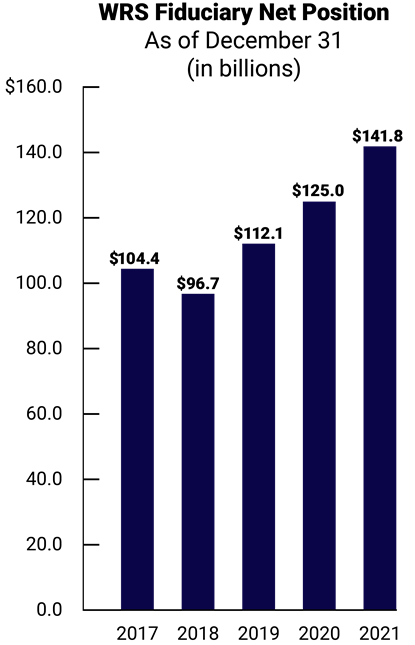

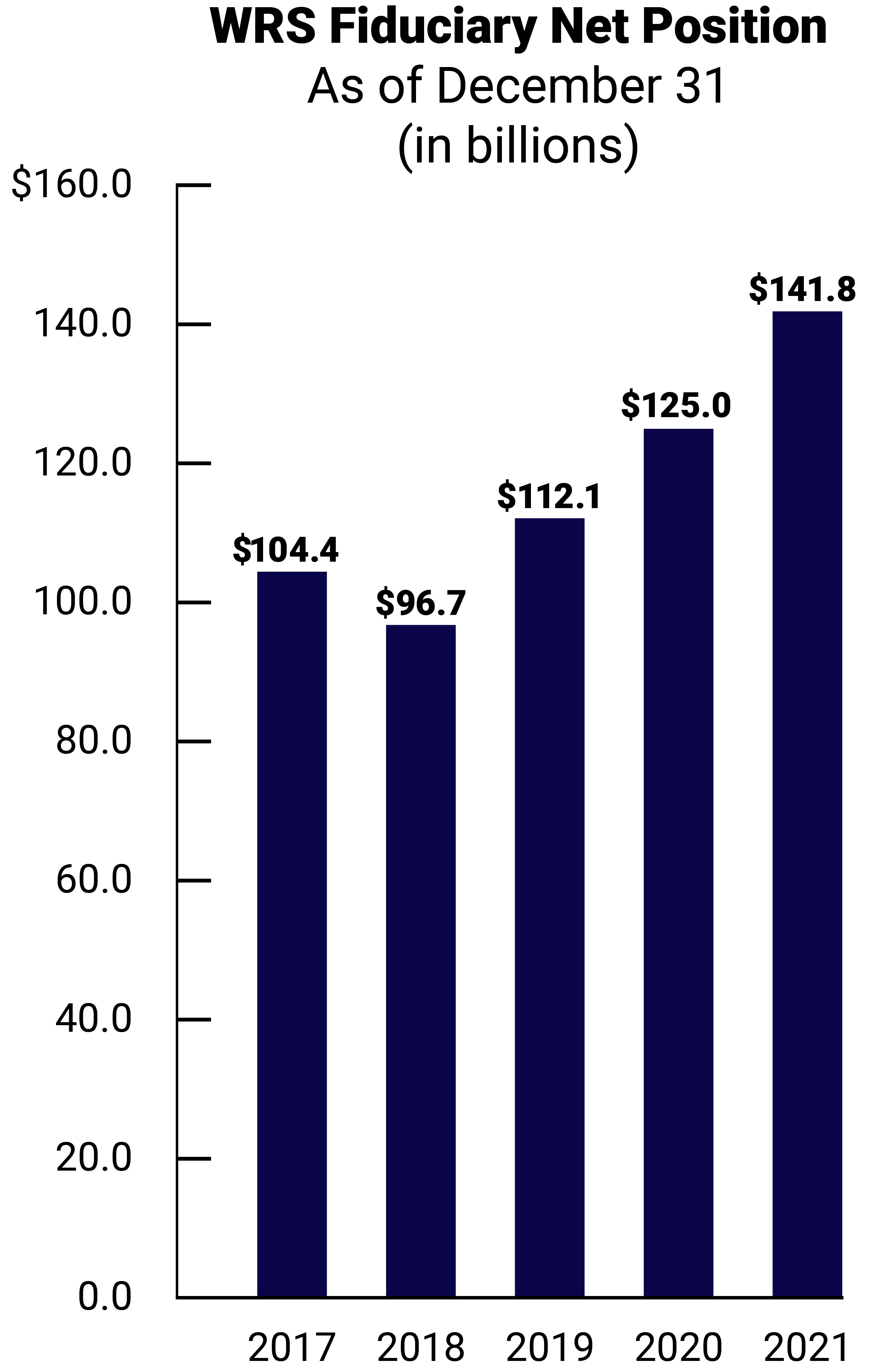

The WRS is one of the 10 largest public pension plans in the United States. The WRS fiduciary net position, which represents the resources available to pay pension benefits, increased from $125.0 billion as of December 31, 2020, to $141.8 billion as of December 31, 2021, or by 13.5 percent.

ETF reported a net pension asset of $8.1 billion as of December 31, 2021. The WRS has reported a net pension asset in four of the last five years. We collected information from other pension plans that were part of the WRS peer group and found that WRS had a funded ratio of 106.0 percent, which was the highest among these plans.

Other postemployment benefits (OPEB) refer to the benefits, other than pensions, that a state or local government employee may receive after they have left employment, generally upon retirement. An OPEB plan can include medical, prescription drug, dental, vision, and other health-related benefits. The five OPEB plans administered by ETF are the State Retiree Life Insurance program, the Local Retiree Life Insurance program, the Supplemental Health Insurance Conversion Credit (SHICC) program, the State Retiree Health Insurance program, and the Local Retiree Health Insurance program.

The State Retiree Life Insurance and Local Retiree Life Insurance programs provide postemployment life insurance coverage to all eligible employees of participating employers. As of December 31, 2021, the fiduciary net position of the State Retiree Life Insurance program was $319.6 million and the fiduciary net position of the Local Retiree Life Insurance program was $248.2 million.

As of December 31, 2021, the net OPEB liability for each of these programs was:

- $947.8 million for the State Retiree Life Insurance program; and

- $591.0 million for the Local Retiree Life Insurance program.

The SHICC program provides certain eligible employees additional sick leave hours at the time of termination that increases the balance available to pay for health insurance premiums.

The SHICC fiduciary net position increased from $1.2 billion as of December 31, 2020, to $1.4 billion as of December 31, 2021, or by 13.5 percent. This increase is primarily attributable to higher returns on investments. As of December 31, 2021, the net OPEB asset of the SHICC program was $329.0 million.

The State Retiree Health Insurance program and the Local Retiree Health Insurance program do not accumulate assets dedicated to providing benefits to plan members. The OPEB liabilities for these programs are not calculated by ETF for purposes of financial reporting.