2017 Wisconsin Act 58 created the Electronics and Information Technology Manufacturing Zone program that is administered by the Wisconsin Economic Development Corporation (WEDC). In April 2021, WEDC executed an amended and restated $80.0 million contract with four corporations that are collectively referred to as “Foxconn.”

Beginning in 2018, statutes require us to annually evaluate for five years WEDC’s process for verifying information submitted by recipients of program tax credits, as well as whether WEDC adhered to statutory and contractual requirements when it verified the amount of program tax credits to award these recipients. This is the last of five statutorily required annual evaluations of these issues.

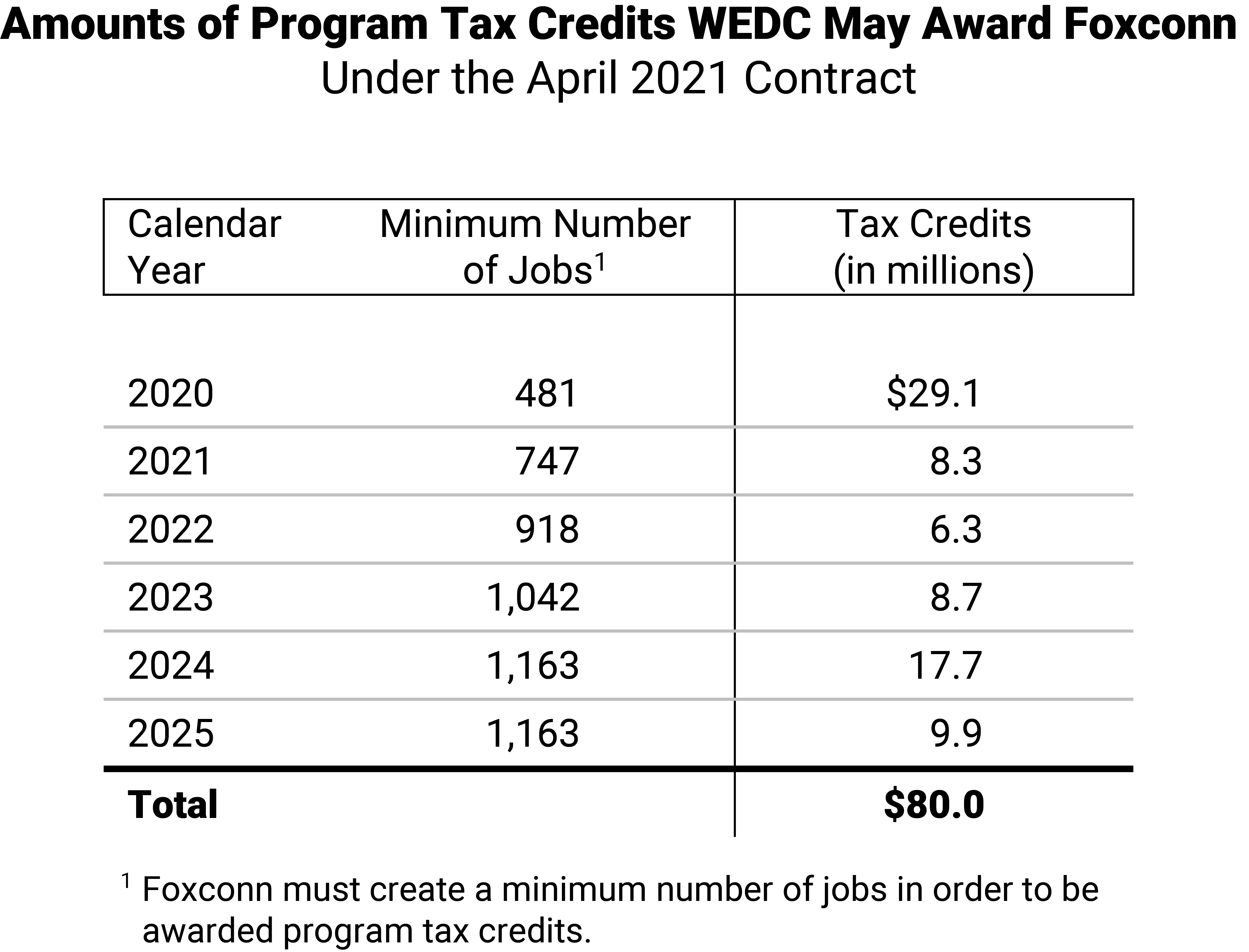

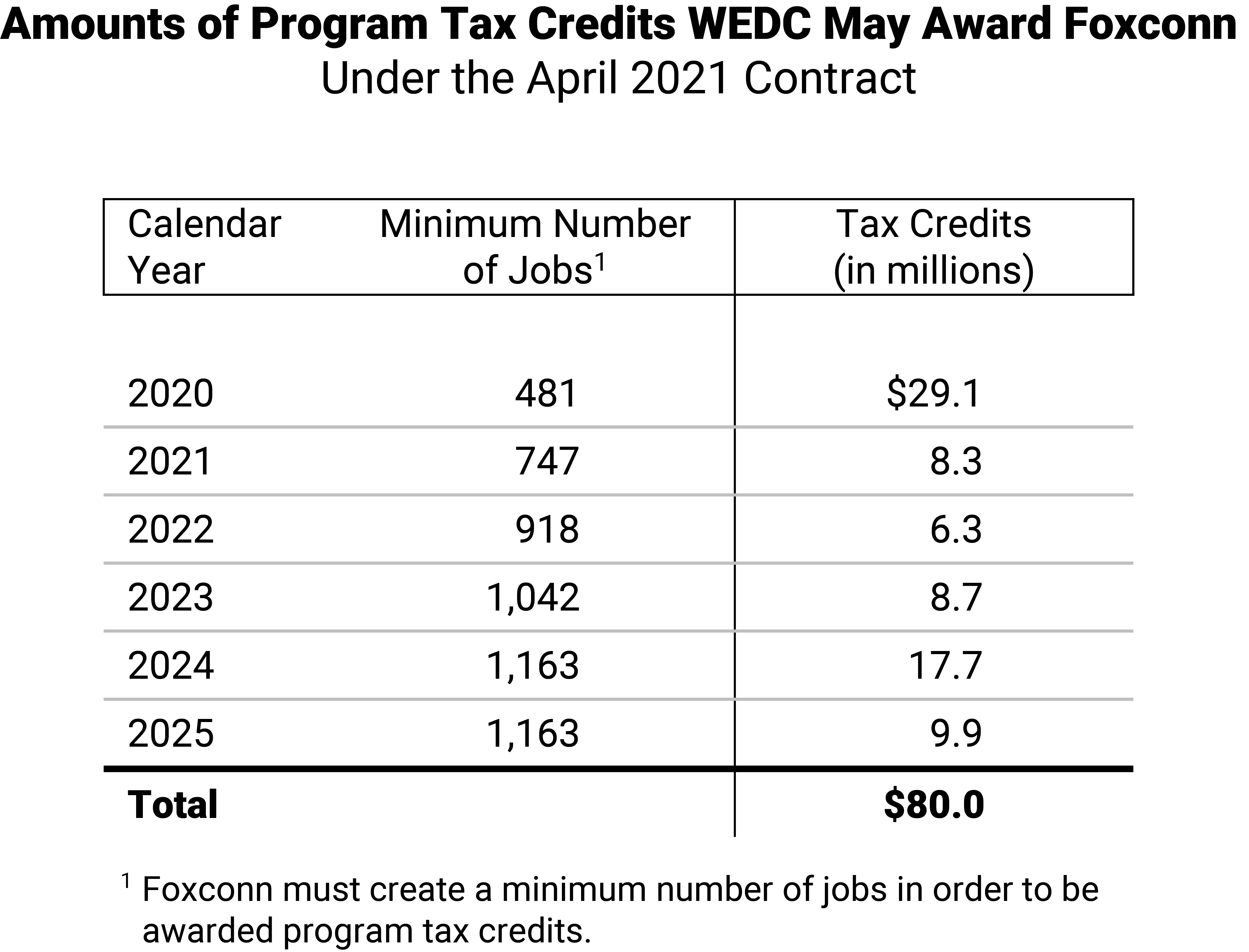

The April 2021 contract establishes minimum numbers of jobs that Foxconn must create in order to be awarded program tax credits. Under this contract, Foxconn may be annually awarded program tax credits for creating jobs and for making capital investments from 2020 through 2024, and it may be awarded performance tax credits if it has created more than 1,163 jobs filled by eligible employees in 2024 and 2025.

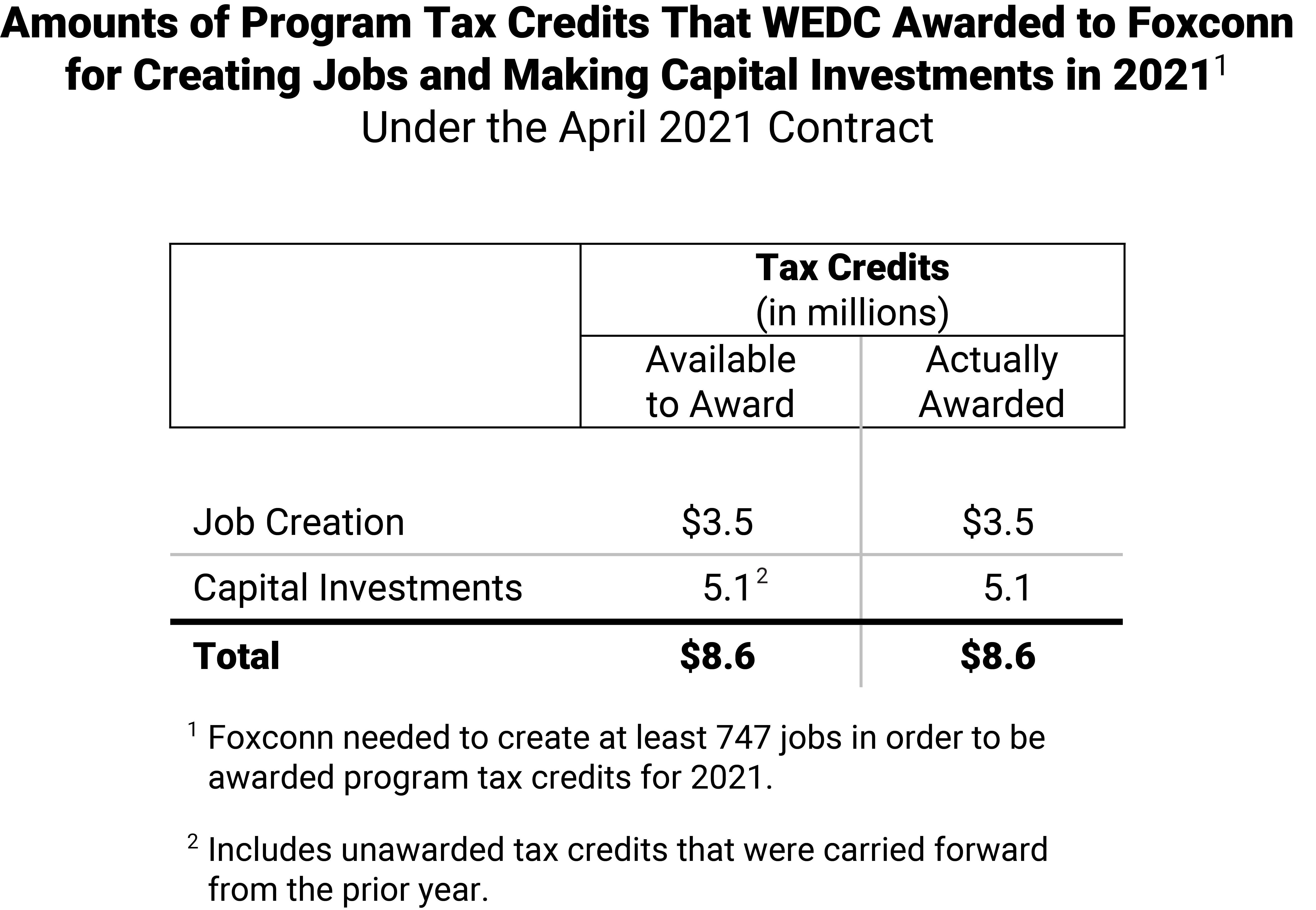

The April 2021 contract establishes that Foxconn needed to create at least 747 jobs filled by eligible employees at the end of 2021 in order to be awarded any program tax credits for 2021. WEDC determined that Foxconn had created 768 such jobs. After Foxconn creates jobs or makes capital investments in a given year, WEDC determines the amount of program tax credits to award in subsequent years. Foxconn was contractually eligible to be awarded up to $8.6 million in program tax credits for creating jobs and making capital investments in 2021.

In November 2022, WEDC awarded Foxconn all $8.6 million in available program tax credits for creating jobs and making capital investments in 2021.

We reviewed the information that WEDC provided to us on how it verified the amount of program tax credits it awarded to Foxconn for 2021. We found that WEDC adhered to statutory and contractual requirements, as well as its written procedures, when it verified the program tax credits it awarded to Foxconn in November 2022.