The State Retiree Health Insurance program, which is one of the other postemployment benefits (OPEB) plans offered by the State of Wisconsin to eligible retirees, is administered by the Department of Employee Trust Funds (ETF). OPEB refers to the benefits, other than pensions, that a state or local government employee may receive after they have left employment, generally upon retirement. The program offers retirees who are not yet eligible for Medicare the option to participate in the State’s Group Health Insurance program. Premiums are established and collected based on the current needs of the program, and assets are not accumulated to pay future benefits.

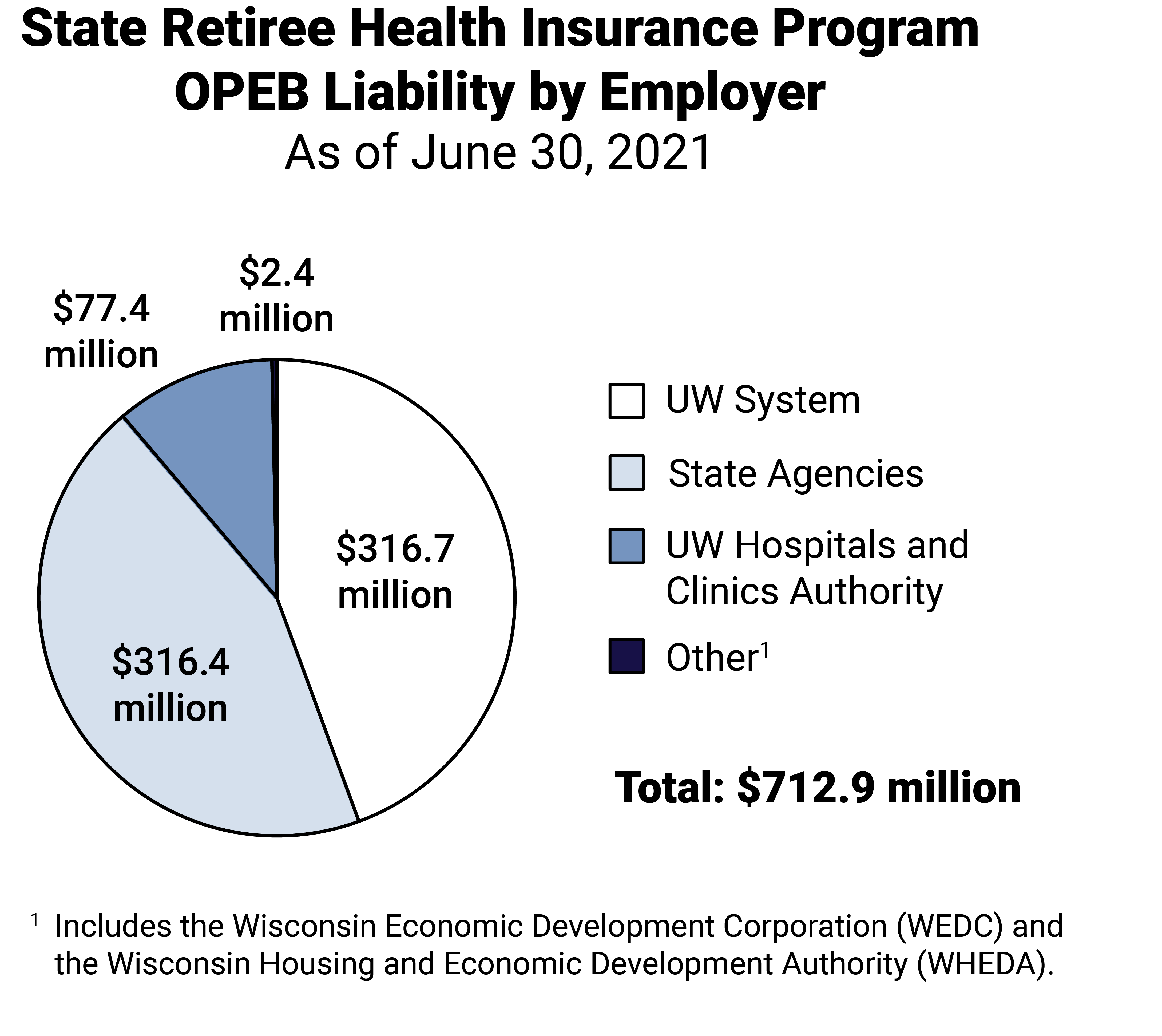

The Department of Administration (DOA) is responsible for preparing the financial statements of the State of Wisconsin, including calculating the total OPEB liability for the program. To assist state agencies, such as the University of Wisconsin (UW) System, and various authorities, including the UW Hospitals and Clinics Authority, in preparing their own financial statements following generally accepted accounting principles (GAAP), DOA prepared employer schedules and notes for the program.

We provided unmodified opinions on the employer schedules and related notes of the State Retiree Health Insurance program as of and for the year ended June 30, 2021. The schedules provide a fair view of the allocations and total amounts related to the program. We conducted our audit by auditing the employer schedules and related notes in accordance with applicable government auditing standards, issuing our auditor’s opinions, reviewing internal controls, and issuing our auditor’s report on internal control and compliance. We also retained an actuary to conduct an independent review of the program’s actuarial calculations and actuarial valuation report.

Under the program, the State offers retirees who are not yet eligible for Medicare the option to participate in the State’s Group Health Insurance program. Although the State does not directly pay any portion of the premium for retirees who choose to participate in the program, the State does pay higher premiums for its active employees than it otherwise would if retirees were excluded. Therefore, the State implicitly subsidizes the premiums paid by participating retirees by offering these individuals access to health insurance coverage at a lower rate than they might otherwise pay based upon their age. This, in turn, creates an OPEB liability the State must recognize for purposes of financial reporting.

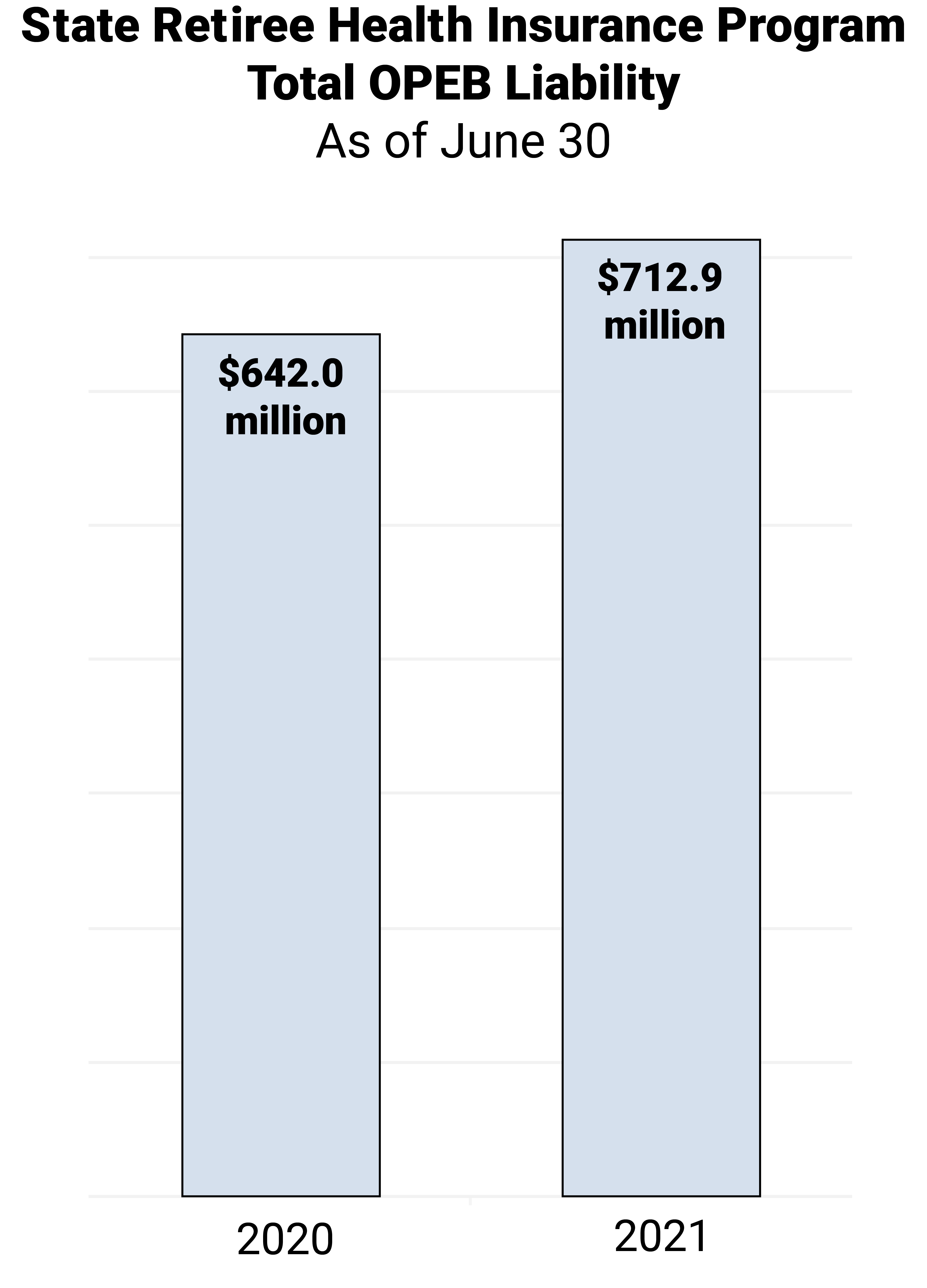

The $712.9 million total OPEB liability will be reported in the State’s financial statements, which will be included in the State of Wisconsin’s Annual Comprehensive Financial Report (ACFR) for the year ended June 30, 2022. In addition, some state agencies, such as UW System, and various authorities, including the UW Hospitals and Clinics Authority, that are reported in the State’s ACFR also separately issue GAAP-based financial statements. To assist each of these agencies and authorities in determining its proportionate share of the total OPEB liability, DOA prepared employer schedules that include these amounts.

This increase is primarily related to changes in actual benefit payments and contributions paid and changes in the health care cost trend rates and the discount rate assumptions.

These errors related to the application of certain rates and assumptions. The consulting actuary agreed with the results and revised the actuarial valuation to address four of the errors, which reduced the total OPEB liability for the program by $3.5 million. Further, the consulting actuary stated that they would address the remaining errors and incorporate the recommendations in future valuations.