Report 23-9 | June 2023

The Wisconsin Lottery sells instant tickets and lotto tickets, and participates in the multijurisdictional Powerball and Mega Millions lotto games. The Wisconsin Constitution and Wisconsin Statutes impose certain limitations on lottery expenses. The Wisconsin Constitution also requires that net proceeds from the Wisconsin Lottery be used exclusively for property tax relief for Wisconsin residents. Net proceeds from the Wisconsin Lottery are largely distributed to owners of primary residences in Wisconsin through the Lottery and Gaming Tax Credit.

We provided an unmodified opinion on the Wisconsin Lottery’s financial statements as of and for the years ended June 30, 2022, and June 30, 2021. These financial statements account for the financial position and activity of the Wisconsin Lottery, which is administered by the Department of Revenue. We conducted this financial audit by auditing the Wisconsin Lottery’s financial statements in accordance with applicable government auditing standards, issuing our auditor’s opinion, reviewing internal controls, and issuing our auditor’s report on internal control and compliance. We also assessed the Wisconsin Lottery’s compliance with certain statutory requirements.

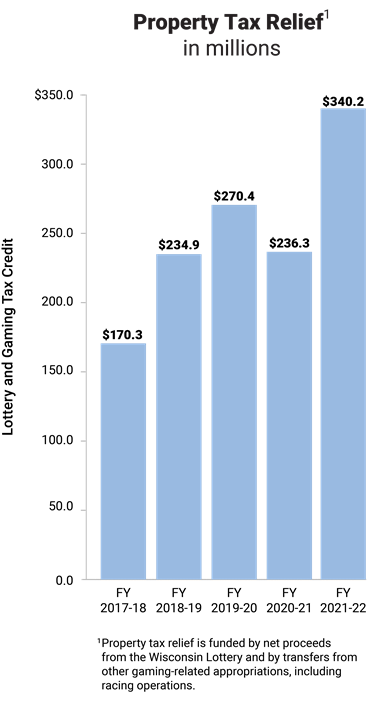

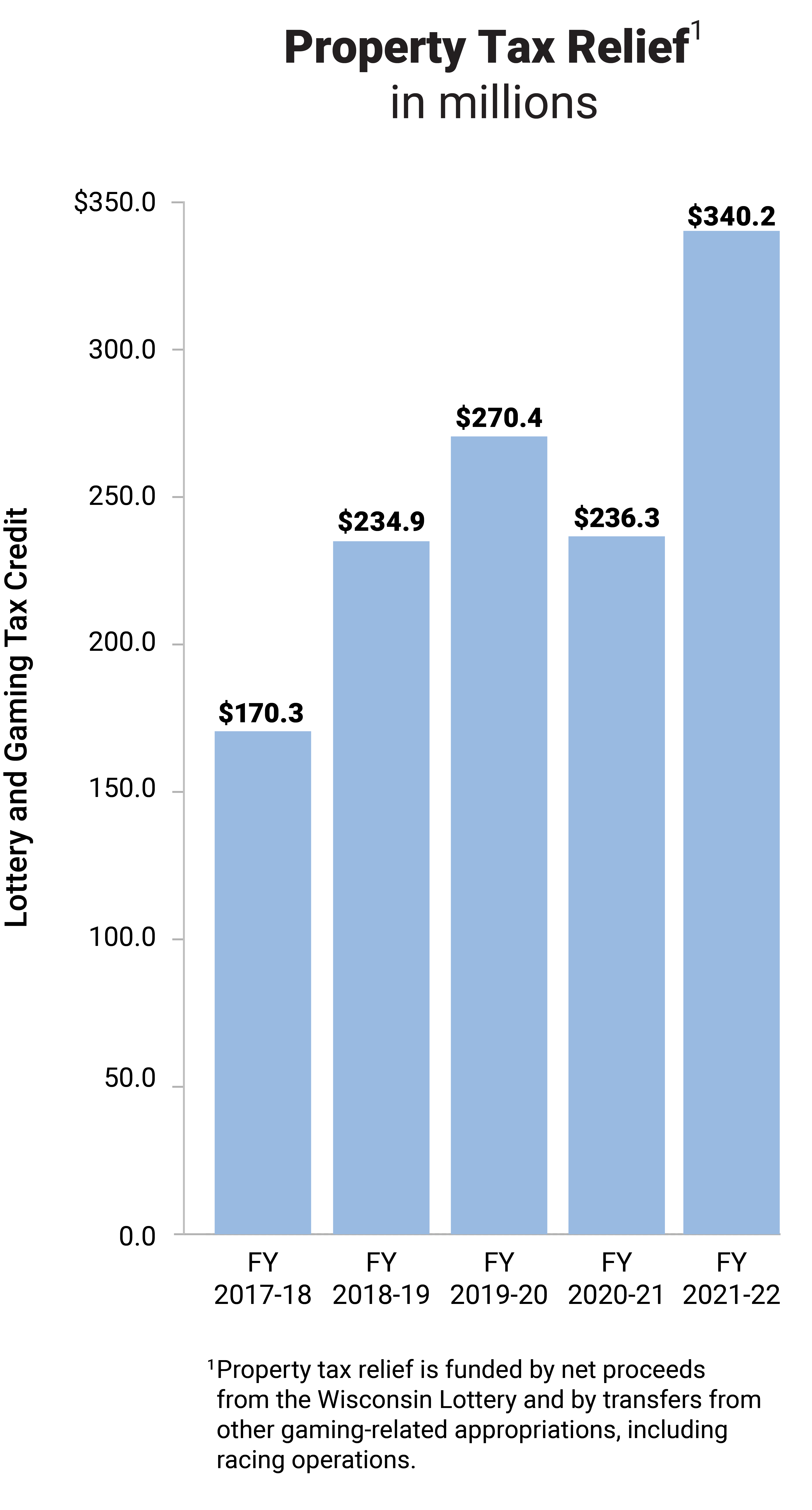

The Wisconsin Lottery was provided with general purpose revenue (GPR) of $72.9 million in fiscal year (FY) 2021-22 for retailer compensation expenses and vendor fees. The provision of GPR funding increased net lottery proceeds available for the Lottery and Gaming Tax Credit. The actual amount distributed for the Lottery and Gaming Tax Credit increased from $236.3 million in FY 2020-21 to $340.2 million in FY 2021-22, or by 44.0 percent, primarily due to higher than anticipated ticket sales during FY 2020-21.

In October 2022, the Department of Administration and the Legislature’s Joint Committee on Finance authorized the use of $319.9 million in net lottery proceeds for the FY 2022-23 Lottery and Gaming Tax Credit.

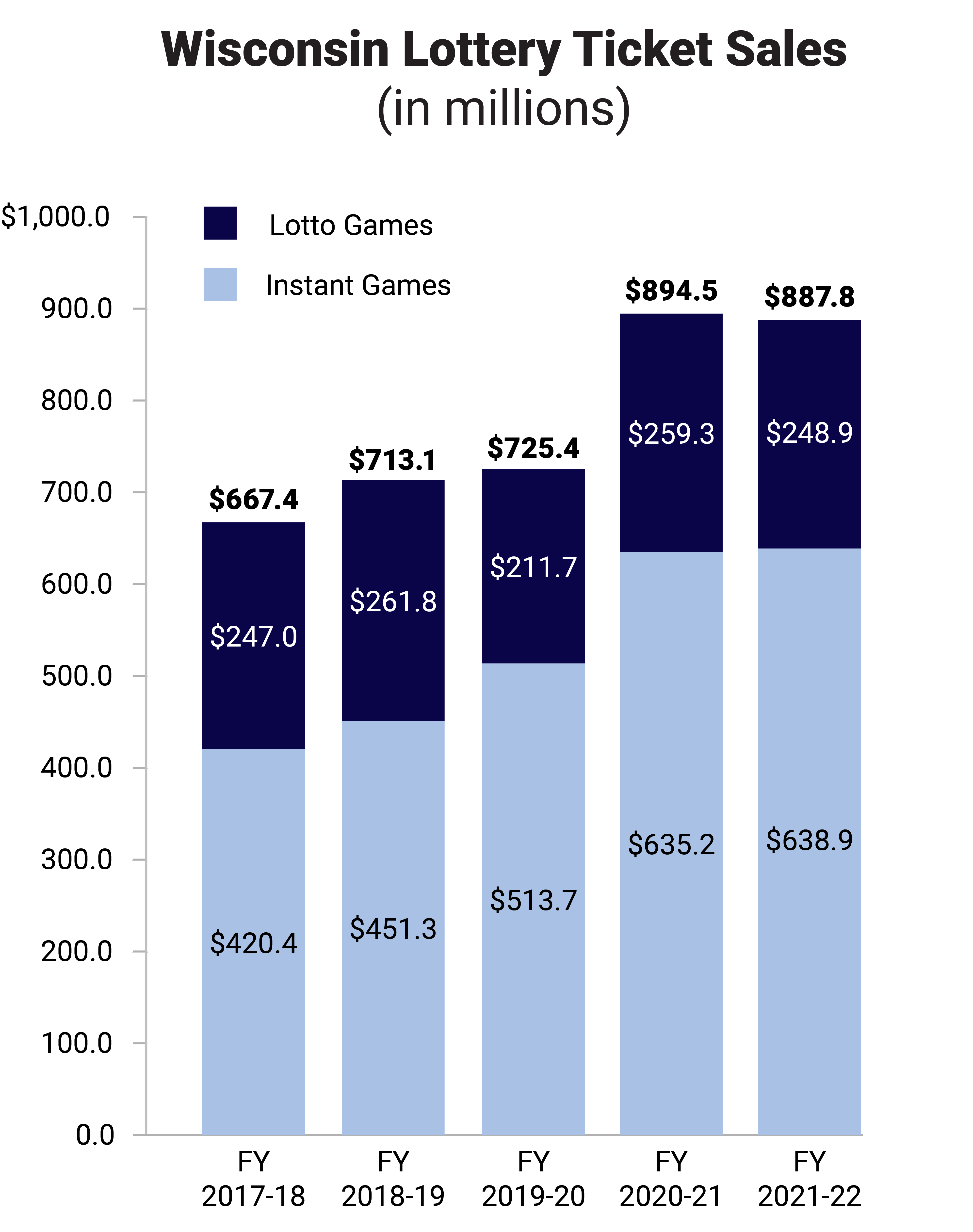

Sales of instant tickets, which are scratch-off and pull-tab tickets, increased by $3.7 million, or by 0.6 percent from FY 2020-21 to FY 2021-22. Lotto ticket sales decreased $10.4 million, or by 4.0 percent, due to decreased Mega Millions ticket sales in FY 2021-22.

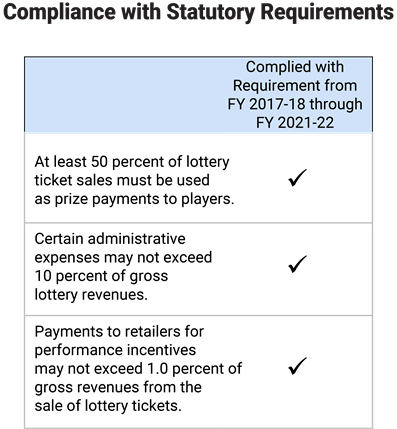

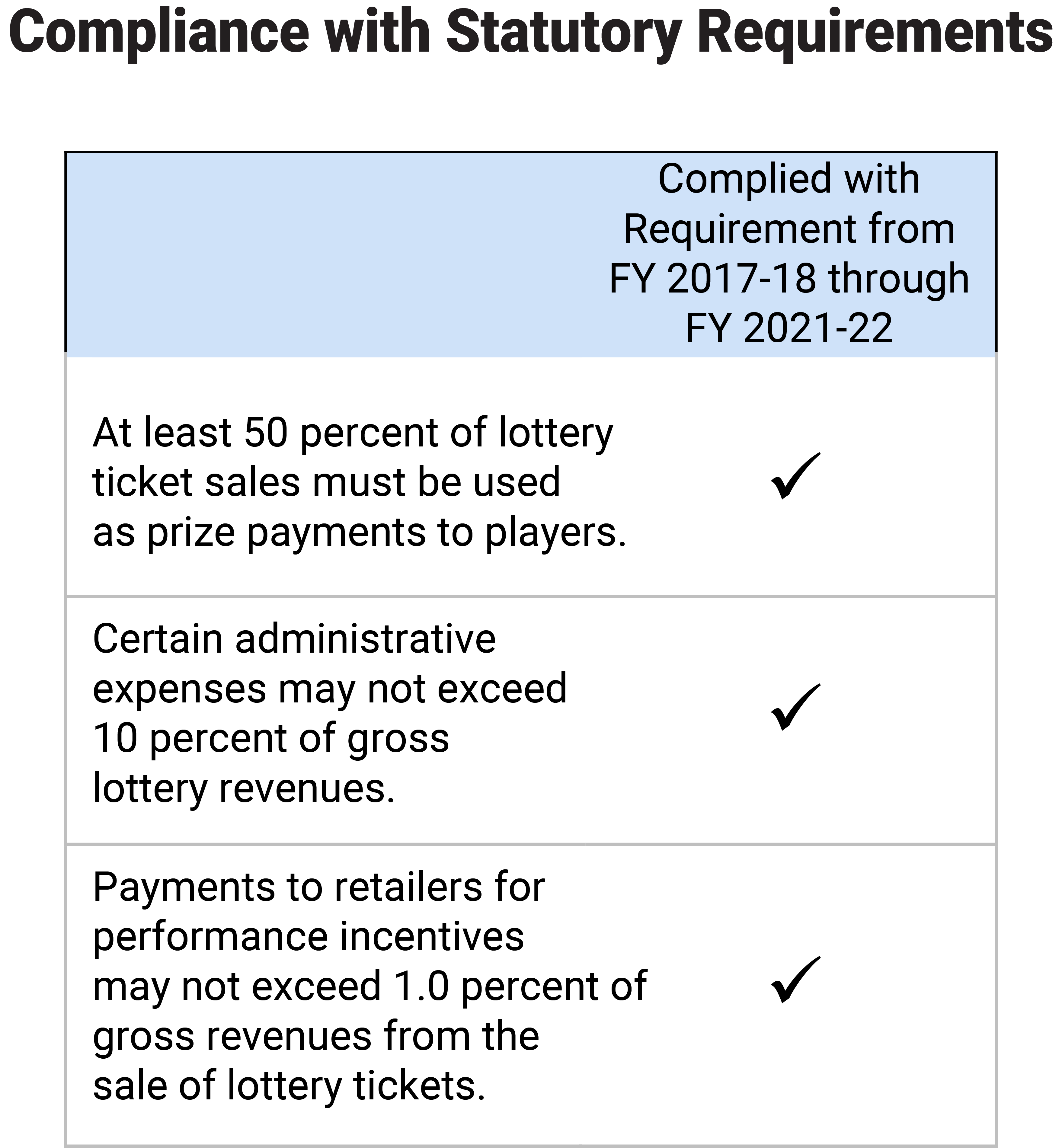

Wisconsin Statutes impose limitations on certain types of lottery expenses, including requirements that:

- at least 50 percent of lottery ticket sales must be used as prize payments to players;

- certain administrative expenses may not exceed 10 percent of gross lottery revenues; and

- payments to retailers for performance incentives may not exceed 1.0 percent of gross revenues from the sale of lottery tickets.

Through this and other annual audits of the Wisconsin Lottery, we found the Wisconsin Lottery to be in compliance with the statutory requirements during the five-year period from FY 2017-18 through FY 2021-22.

Statutes establish maximum compensation rates for basic commissions and performance program payments to retailers who sell lottery tickets. Basic commission rates, established in Wisconsin Statutes, are currently 5.5 percent of the retail price for lotto tickets and 6.25 percent for instant tickets.

The Retailer Performance Program includes sales incentives for retailers that increase ticket sales, a bonus for retailers that sell winning tickets, and short term incentives for retailers that increase ticket sales of certain games for specific time periods. During FY 2021-22, performance payments for the sales incentives for increased ticket sales accounted for 69.3 percent of the total incentive payments, winning ticket bonuses accounted for 23.9 percent, and short-term incentives accounted for 6.8 percent.

There were seven short-term incentives during FY 2021-22. Total payments for each of the seven short-term incentives ranged from $3,705 to $191,350; and the number of retailers who participated in each of these short term incentives ranged from 741 retailers to all retailers, which was 3,645 retailers as of June 30, 2022.

The Wisconsin Lottery is statutorily required to provide quarterly reporting to the Legislature on the operations of the Wisconsin Lottery. We found that, due to staff turnover, the Wisconsin Lottery did not file the report for the quarter ended September 2022. After we raised this issue with the Department of Revenue, information for the quarter ended September 2022 was submitted in June 2023.

Please see our recommendation on our website.