Reports 23-14 through 23-20 | September 2023

The Department of Employee Trust Funds (ETF) is responsible for administering various benefits programs available to state and local government employees. These programs include the Wisconsin Retirement System (WRS), health and life insurance programs for active and retired employees, and sick leave programs for retired employees.

We provided unmodified opinions on ETF’s separately issued financial statements for the following programs:

- WRS (report 23-14);

- Retiree life insurance programs, which include the State Retiree Life Insurance program and the Local Retiree Life Insurance program (report 23-16); and

- Supplemental Health Insurance Conversion Credit (SHICC) program (report 23-19).

For 2022, ETF chose to separately issue its financial statements for these programs and plans to issue its 2022 Annual Comprehensive Financial Report (ACFR), which will include the financial statements of these programs as well as other programs administered by ETF, at a later date.

Employers, including the State of Wisconsin, that participate in the WRS and other postemployment benefits (OPEB) plans administered by ETF must meet specific financial reporting requirements in preparing their own financial statements using generally accepted accounting principles. To assist employers, ETF prepared employer schedules and related notes for the programs. We provided unmodified opinions on these schedules and related notes for the programs and issued the following reports:

- Wisconsin Retirement System Reporting for Participating Employers (report 23-15);

- State Retiree Life Insurance Reporting for the State of Wisconsin (report 23-17);

- Local Retiree Life Insurance Reporting for Participating Employers (report 23-18); and

- Supplemental Health Insurance Conversion Credit Program Reporting for Participating Employers (report 23-20).

We conducted this financial audit by auditing ETF’s financial statements and employer schedules in accordance with applicable government auditing standards, issuing our auditor’s opinions, reviewing internal controls, and issuing our auditor’s reports on internal control and compliance.

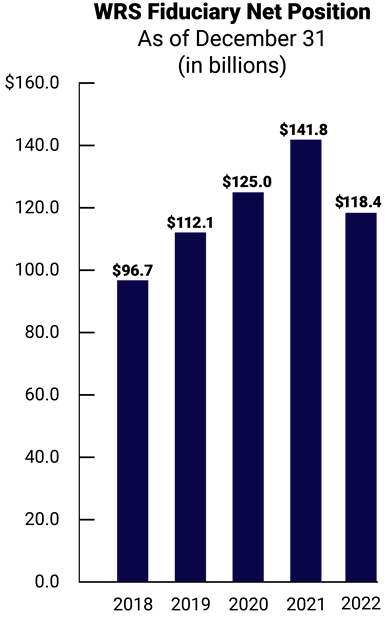

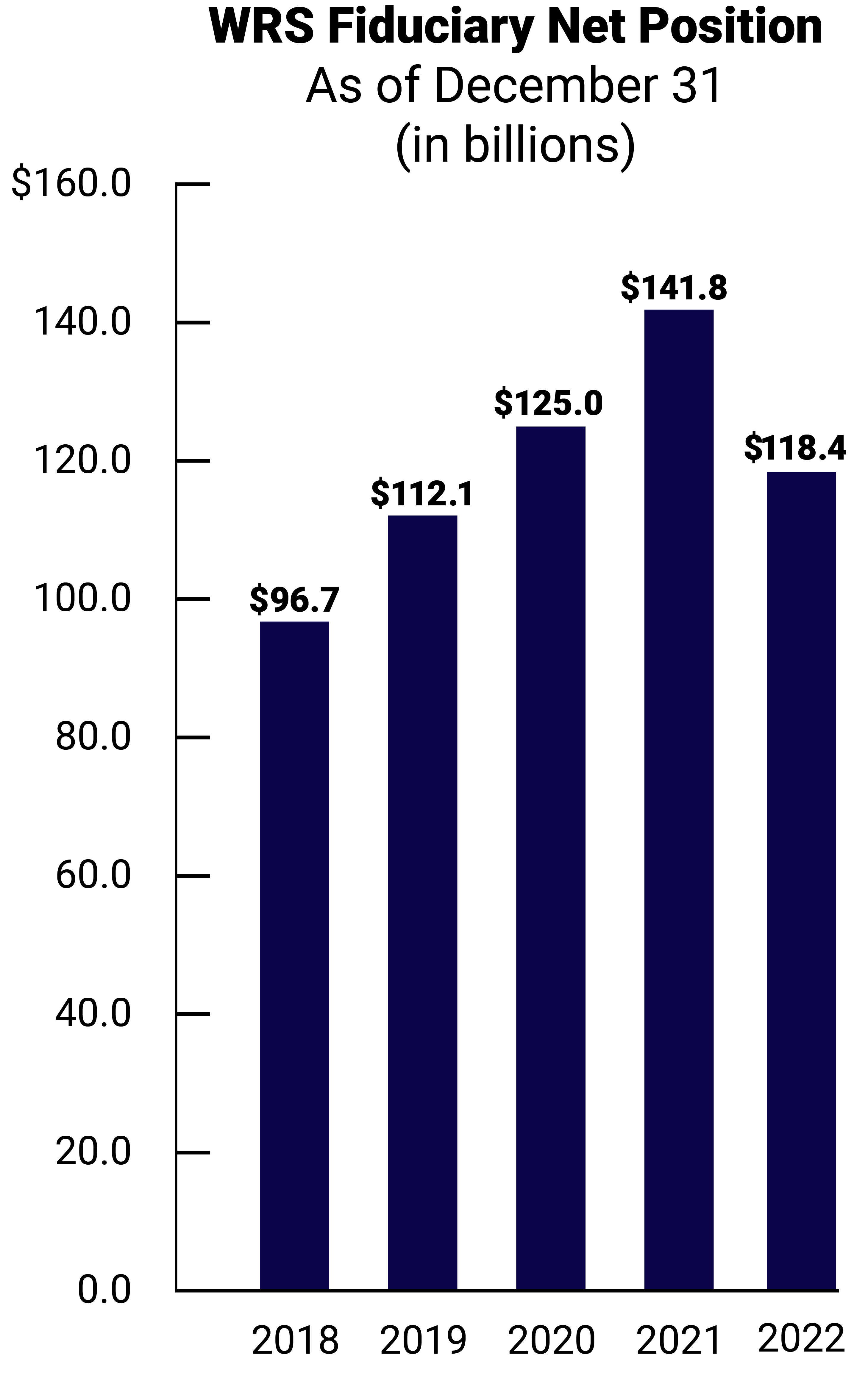

The WRS is one of the ten largest public pension plans in the United States. The WRS fiduciary net position, which represents those resources available to pay pension benefits, decreased from $141.8 billion as of December 31, 2021, to $118.4 billion as of December 31, 2022. The decrease in the WRS fiduciary net position is primarily attributable to a decrease in the value of investments.

ETF reported a net pension liability of $5.3 billion as of December 31, 2022, compared to a net pension asset of $8.1 billion as of December 31, 2021. The fluctuation between a net pension liability and a net pension asset is largely associated with the change in fair market value of investments. The WRS has reported a net pension liability in two of the last five years.

We collected information from other pension plans that were part of a WRS peer group and found that WRS had a funded ratio of 95.7 percent, which was the second highest among these plans.

The State Retiree Life Insurance and Local Retiree Life Insurance programs provide postemployment life insurance coverage to all eligible employees of participating employers. The fiduciary net position for the State Retiree Life Insurance program decreased from $319.6 million as of December 31, 2021, to $303.2 million as of December 31, 2022, or by 5.1 percent. The fiduciary net position of the Local Retiree Life Insurance program decreased from $248.2 million as of December 31, 2021, to $241.6 million as of December 31, 2022, or by 2.7 percent. These decreases are a result of expenses exceeding contributions and investment income.

The State Retiree Life Insurance program and the Local Retiree Life Insurance program are each considered an OPEB plan. OPEB refers to the benefits, other than pensions, that a state or local government employee may receive after they have left employment, generally upon retirement.

As of December 31, 2022, the net OPEB liability for each of these programs was:

- $659.7 million for the State Retiree Life Insurance program; and

- $381.0 million for the Local Retiree Life Insurance program.

ETF administers two sick leave programs: the basic Accumulated Sick Leave Conversion Credit program and the SHICC program. These programs convert unused sick leave balances earned by participating employees during employment, and additional amounts under certain circumstances, for use in paying postemployment premiums for state group health insurance coverage.

The SHICC program is considered an OPEB plan. As noted, OPEB refers to the benefits, other than pensions, that a state or local government employee may receive after they have left employment, generally upon retirement.

The SHICC fiduciary net position decreased from $1.4 billion as of December 31, 2021, to $1.1 billion as of December 31, 2022, or by 16.3 percent. This decrease is primarily attributable to the decrease in the value of investments.

As of December 31, 2022, the net OPEB asset of the SHICC program was $102.8 million.