Capitol Update

| Helpful Wisconsin Links |

|

| Visiting Madison? |

| I would be happy to arrange a capitol tour for you. Call my office at (608) 266-0703 for more info. |

| Unsubscribe? |

| To unsubscribe, please send an email to Sen.Marklein@legis.wi.gov with ‘unsubscribe’ in the subject line. |

Dear Friends,

Earlier this week, the City of Monroe faced a tragic set of

events that required the diligent attention of local law

enforcement during the Green County Fair, when several law

enforcement assets were deployed to the fair.

I want to pass along my heartfelt gratitude to the deputies who

responded to this dangerous situation. The efforts of two Green

County Sherriff’s deputies prevented what could have been

further bloodshed and kept our community safe. The calm poise

and professionalism exhibited by Monroe Police Chief Fred

Kelley, Green County Sheriff Mark Rohloff, and both of their

departments was exemplary. It is my understanding that all law

enforcement personnel, including the Monroe Police Department,

Green County Sheriff’s Department, Green County District

Attorney, and the Wisconsin Department of Justice, performed

exactly as they had been trained to perform. My thanks to the

men and women who stand ready in these situations to keep us all

safe.

As a side note, the recent state budget included funding and

staffing for the Department of Justice to investigate officer

involved shootings. I must admit that we tend to think that

these officer involved shootings occur in the bigger cities of

our state. The recent event in Monroe reminds us that these rare

circumstances can happen anywhere.

Sincerely,

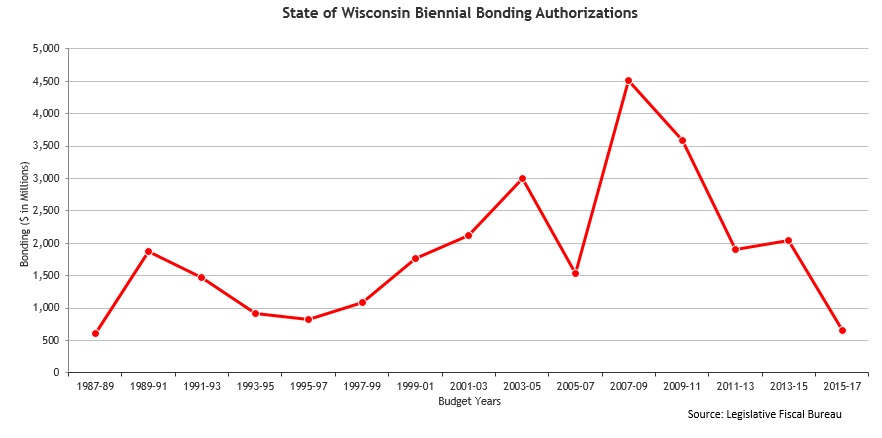

The State of Wisconsin’s Credit Card

When I ran first ran for office one of my top concerns was the

condition of Wisconsin’s “credit card.” For many years we had

been taking on a considerable amount of debt, were pushing off

payments on that debt into the future, and were not properly

dealing with our commitments. With the signing of the 2015-2017

budget, it’s useful to look at a snapshot of what kind of

progress we have made on slowing our borrowing and paying off

what’s been borrowed in the past.

As we have discussed over the last several months, every two

years the State of Wisconsin tackles a new budget. These budgets

determine how we spend the revenue we collect through taxes and

fees. We also authorize specific amounts of bonding – or

borrowing – for each two year period. The authorization of

borrowing is similar to the maximum level you can borrow on your

credit card. The 2015-2017 state budget contains $652 million in

bonding, the lowest level of authorized bonding since 1987.

This is a very positive development for the State of Wisconsin. As we borrow less it becomes easier for us to manage our current and future payments. What we don’t borrow now, we don’t have to repay latter.

Some level of borrowing, particularly for projects that encourage strong economic growth, is not necessarily a bad thing. Borrowing becomes a problem when we reach levels of debt that we are unable to pay back. This was the case for several years in Wisconsin’s past. From 2007 to 2011 Wisconsin restructured debt payments and pushed more than $1.5 billion dollars of payments on debt into the future.

Annual GPR Debt Service ($ in Millions)

| Year | Debt Payment Owed | Actual Payment | Payments Deferred |

| 2000-01 | $330.9 | $330.9 | $ 0.0 |

| 2001-02 | 334.2 | 232.2 | 102.0 |

| 2002-03 | 351.8 | 326.8 | 25.0 |

| 2003-04 | 339.2 | 164.2 | 175.0 |

| 2004-05 | 314.2 | 314.2 | 0.0 |

| 2005-06 | 413.6 | 413.6 | 0.0 |

| 2006-07 | 453.8 | 543.8 | 0.0 |

| 2007-08 | 494.3 | 430.7 | 63.6 |

| 2008-09 | 499.6 | 438.0 | 61.6 |

| 2009-10 | 507.9 | 145.3 | 362.6 |

| 2010-11 | 510.9 | 213.8 | 297.1 |

| 2011-12 | 523.3 | 155.1 | 368.2 |

| 2012-13 | 616.7 | 616.7 | 0.00 |

| 2013-14 | 717.1 | 717.1 | 0.00 |

| 2014-15 | 636.8 | 528.8 | 108.0 |

| 2015-16 | 619.8 | 619.8 | 0.0 |

| 2016-17 | 592.5 | 592.5 | 0.0 |

| Totals | $8,256.6 | $6,693.5 | $1,563.1 |

*Source: Legislative Fiscal Bureau

The table above shows the struggle that Wisconsin was under in paying its obligations. We had run up too much debt on our “credit card” and instead of making the required payments, we were delaying them into the future. For anyone who has put together a household budget, we know this can’t go on forever.

Unfortunately, because of those past decisions we are now making

larger payments on our debt, but I am confident we can bend the

cost curve downward.

The budget that was just signed by Governor Scott Walker was

good news for Wisconsin’s “credit card” in multiple ways. Not

only did we budget to make full payments on past debt, but we

created the lowest level of debt in 30 years. This is an

extremely positive development for our state, and I’m hopeful we

can continue these trends in the future.

For more information and to connect with me, visit my website http://legis.wisconsin.gov/senate/17/marklein and do not hesitate to call 800-978-8008 if you have input, ideas or need assistance with any state-related matters.

|

In the District |

|

Woodford State Bank Celebrates 100 Years!

*Scott DeNure, Woodford State Bank President and CEO and Senator Howard Marklein

*Daryll Lund, Executive Vice President and Chief of Staff for Wisconsin Bankers Association, Scott DeNure, Woodford State Bank President and CEO, Senator Howard Marklein, and Tim Daly, Vice President of Independent Community Bankers of America

|

|

Helpful Information |

Wisconsin Local Employment and Unemployment Estimates

The Department of Workforce Development (DWD) released the U.S.

Bureau of Labor Statistics’ (BLS) estimates of unemployment and

employment statistics for metro areas, major cities and counties

in Wisconsin. The estimates include revisions for May 2015 and

preliminary estimates for June 2015.

The following table shows the local unemployment rates from June

2014 and June 2015 for the counties in our district.

I continue to hear from a number of employers within the

district that there are a number of job openings.

| County | June-15 RATE | June-14 RATE |

| Grant | 4.7 | 5.1 |

| Green | 4.0 | 4.8 |

| Iowa | 4.2 | 5.0 |

| Juneau | 5.2 | 6.4 |

| Lafayette | 3.9 | 4.3 |

| Monroe | 4.6 | 5.5 |

| Richland | 4.4 | 5.1 |

| Sauk | 4.2 | 4.8 |

| Vernon | 4.4 | 4.8 |

*Department of Workforce Development

Homeowners: Be on Alert for Storm Chasers

A recent release from the Wisconsin Department of Agriculture,

Trade and Consumer Protection (DATCP) warns homeowners who have

experienced storm damage to be on alert for home improvement

workers who plan to rip you off. We’ve already seen a number of

storms come through the 17th Senate District, it’s important to

be on the lookout. See their release below:

MADISON – Summer storms in Wisconsin can be brutal. If

your property is damaged due to severe weather, it’s good to

remember that another kind of storm may be brewing: transient

home improvement workers who rip off homeowners. The Wisconsin

Department of Agriculture, Trade and Consumer Protection (DATCP)

warns Wisconsin residents to be on the lookout for these “storm

chasers.”

“Every year we hear from consumers who have been conned by storm

chasers,” said Frank Frassetto, Division Administrator for Trade

and Consumer Protection. “Don’t be hasty when doing your

homework on the contractor you hire.”

Storm chasers charge high prices for shoddy work, or offer a low

price to get an upfront payment and then run off with a victim’s

money. The workers are often from out of state and move quickly

from town to town, making them difficult to track. The workers

pressure homeowners for a down payment, and sometimes increase

the price of the job when they ask for the final payment.

“Never let these workers into your home and don’t give in to

high-pressure tactics,” said Frassetto.

A Wisconsin state law – “The Storm Chaser Law” – gives DATCP

enforcement tools to protect consumers and honest businesses and

aims to prevent insurance fraud. Highlights of the law include:

-

Contractors cannot promise to pay all or some of a property insurance deductible.

-

Contractors cannot represent or negotiate with the customer’s homeowner’s insurer on behalf of the customer. The contractor can, with the consent of the customer, discuss damages and costs associated with the repairs with the insurer.

-

Before entering into a contract with a customer, the contractor must give the customer a questionnaire to determine whether the work requested is related to an insurance claim.

-

Customers have a right to cancel the contract within three business days of being notified that their insurer has denied all or any part of the claim for work. Contractors must notify customers of this right.

Here are additional Consumer Protection tips for homeowners with storm damage:

-

Hire a contractor based on referrals. Ask friends and neighbors for recommendations and ask contractors for references. Before you sign a contract, contact DATCP to see if we have received complaints about the business.

-

Try to get a local contractor. Ask contractors if they are subcontracting your job. Be careful if local contractors are using outside subcontractors.

-

Get lien waivers from anyone you pay for home repairs. Lien waivers protect you if the person collecting the money does not pay the suppliers or workers.

-

Get a written contract with a start and completion date and warranty information. Also, make certain that the contract states exactly what work is to be done and what materials are to be used. Never rely on a verbal commitment.

-

Ask to see the contractor’s state registration card. Make sure that any contractor you are considering hiring shows you their state registration card.

-

Have someone watch the work being done. Check with your local building inspector to see if the work requires a permit. Make sure an inspector visits the job site before you make a final payment.

Request

a copy of the contractor's certificate of liability

insurance.For additional information or to file a complaint,

visit the Consumer Protection Bureau at datcp.wisconsin.gov,

send an e-mail to

datcphotline@wisconsin.gov or call the Consumer Information

Hotline toll-free at 1-800-422-7128.

*Senator Marklein is pleased to provide this

legislative E-Update to the constituents of the 17th State

Senate District. Please feel free to share this update with

other interested citizens and taxpayers. You are receiving this

update because you have either subscribed or contacted Senator

Marklein directly.

Please Note: If you have contacted the Senator with specific

input or questions, a personal response is forthcoming.

UNSUBSCRIBE: If you would like to remove your e-mail address

from my E-update mailing list, please reply to this message with

the word “unsubscribe” in the subject line.

State Capitol - Room 8 South - Post Office Box 7882 - Madison, Wisconsin 53707 - Phone: (608) 266-0703