Serving Sheboygan, Manitowoc, Fond du Lac, and Calumet Counties

This Session

Here are a few highlights form this legislative session. For additional information, please visit the Legislature's website linked below.

2023-25 Wisconsin State Budget

The budget Governor Evers introduced earlier this spring was a flawed document. His recommendations would have raised taxes, expanded welfare, and turned a historic surplus into a record deficit. After months of hard work by the Joint Committee on Finance, we passed a budget (Senate Bill 70) that responsibly invests in core priorities and returns a record amount of money back to the taxpayers. Wisconsinites will see lower taxes, better local services – like police, fire and EMS – and stronger schools. Along with providing the largest tax cut in state history, the Legislature's budget repealed the personal property tax, made historic investments in healthcare and healthcare facilities, invested $125 million in PFAS Funds to address the threat to our clean drinking water, invested $1.55 billion in roads to keep our projects on track and much more.

Unfortunately, the governor chose to use his line item veto power to keep more than $2.7 billion in Madison rather than in the pockets of hardworking families. Here is the Legislative Fiscal Bureaus Summary of Provisions for Act 19, the State Budget signed into action.

After months of substantive, good-faith negotiations between both houses of the legislature and local government stakeholders from across the state, Wisconsin Act 12 was passed by the Legislature and signed into law on June 20, 2023. Now, a minimum of 20% of the state sales tax revenue is dedicated to local governments to make necessary investments for years to come. Everywhere throughout the state will not only see a fairer split of revenue but also an increase in revenue for their communities. Specific aid distributions to local governments can be found here.

Additional highlights:

- Historic increases in resources for local government to provide police, fire, and EMS services

- Incentivizes local government innovation and consolidation to provide better services in a more cost-effective manner

- Repeals the personal property tax

- Prohibits local government from defunding the police

- Prohibits race-based hiring in all Wisconsin local units of government

- Fixed revenue shortfall in Milwaukee, while requiring new funding to go to core priorities

This session the legislature had the opportunity to make record investments in school choice. We empowered parents to take back the reins in their children's education and provided them the tools to do so.

- $280 million in new resources to choice and charter schools

- Opening 20,000 new seats in the school choice program

- Funding parity for all students no matter where they go to school

Since 2011, legislative Republicans have reduced the tax burden on Wisconsinites by a cumulative $22 billion. Despite these bold reforms, our state government is still taxing its citizens too much. We began this session facing a projected record $7 billion dollar surplus. This proposal will fundamentally transform Wisconsin’s individual income tax and keep more money in the pockets of hardworking Wisconsinites.

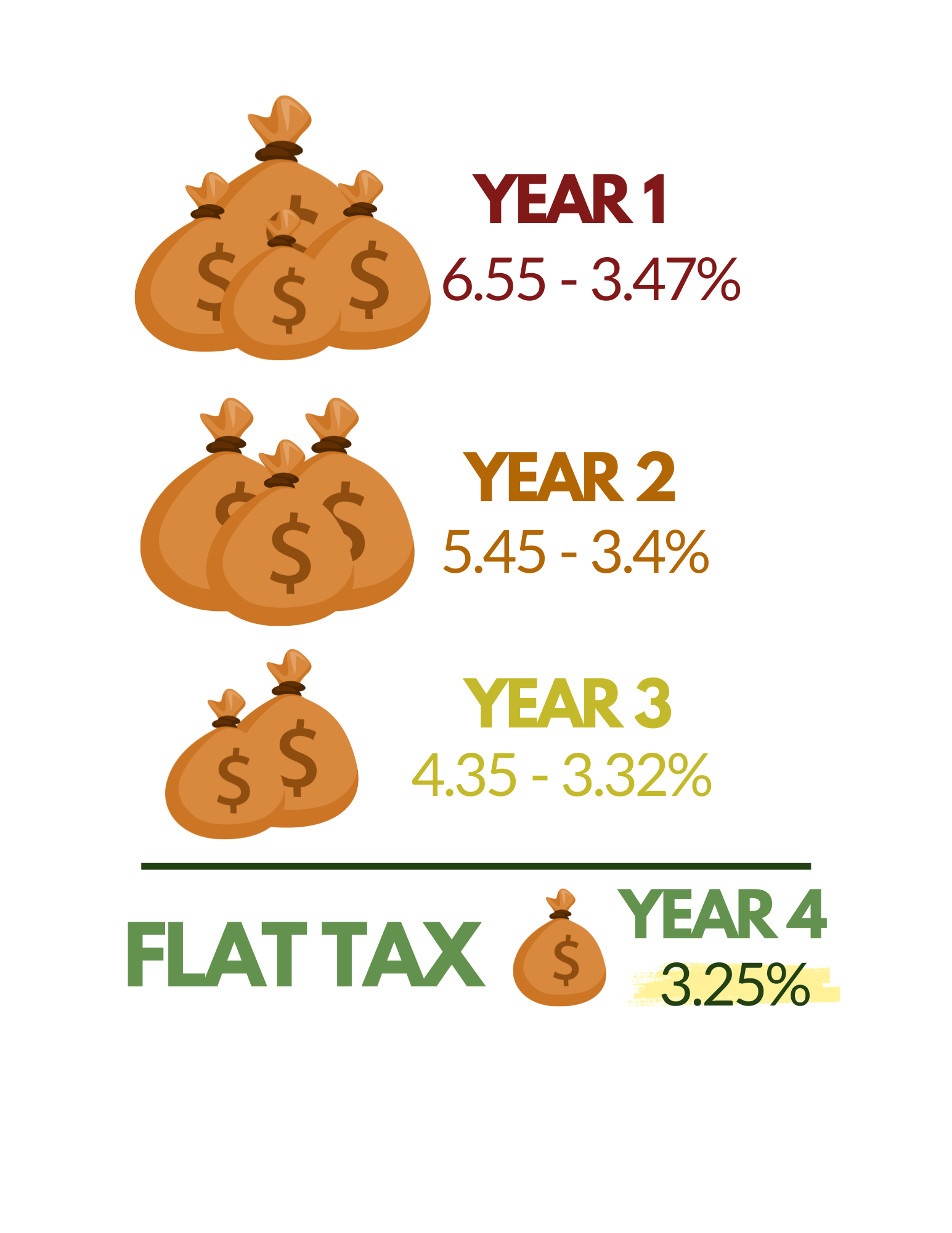

I introduced Senate Bill 1 to provide a once-in-a-lifetime opportunity to lead Wisconsin forward and deliver generational tax reform by phasing in a flat tax rate for all wage earners in Wisconsin. Currently there are four tax rates ranging from 3.54% to 7.65%, this legislation would begin to implement a flat rate of 3.25%

Only nine states have an individual income tax rate higher than Wisconsin’s top rate. Thirty-one states have a top individual income tax rate lower than Wisconsin’s third tax bracket of 5.3%. Nearly two-thirds of Wisconsin income tax filers fall into that third bracket.

I’m looking forward to continuing to work with the governor and the State Assembly to provide this much-needed tax relief for middle class Wisconsinites and main street businesses. You can listen to my AM 1130 WISN radio interview on the flat tax here.