Friends and Neighbors,

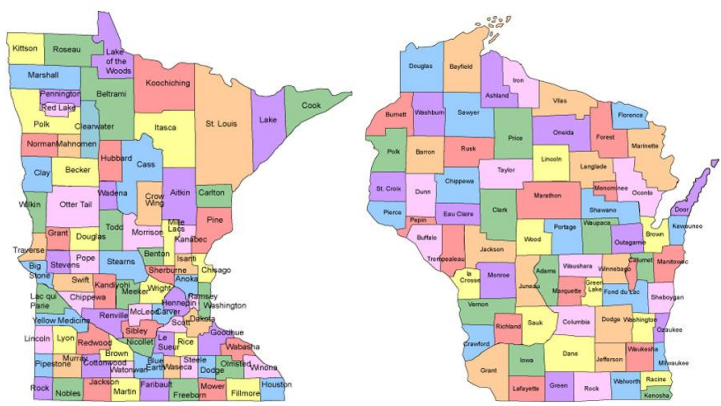

Each day I walk into the Capitol I am proud to fight for our community and the state we love to call home. Often we see setbacks, such as the Governor's 'not-so-special' special session which will give citizens a mere $13 in tax relief, while ignoring our growing jobs crisis, and our struggling public schools. We see our neighbors to the west, Minnesota, surpassing us with more jobs and lower health care costs.

However, my

colleagues and I continue to advocate for the

citizens of Wisconsin on the things that truly matter in

people's everyday lives. I am proud to co-sponsor the 'Higher

Ed, Lower Debt' bill which will give some much needed relief to

those who find themselves with high student loan debt and

significant monthly payments.

However, my

colleagues and I continue to advocate for the

citizens of Wisconsin on the things that truly matter in

people's everyday lives. I am proud to co-sponsor the 'Higher

Ed, Lower Debt' bill which will give some much needed relief to

those who find themselves with high student loan debt and

significant monthly payments. I also continue to work with Citizen Action and my fellow legislators to work to allow counties to accept the federal Medicaid expansion money which would ensure that our citizens continue to receive access to affordable health care.

As always, please contact my office if you have any items that you would like included in future issues of the Sargent Voice. 608-266-0960 or Rep.Sargent@legis.wi.gov.

Forward,

Property Tax Bill Offers Little Relief

|

The outcome of Gov. Walker’s

special session to ram through his $100 million property

tax cut is that the average Wisconsin property owner

will get a tax cut of just $13 this year and $20 next

year. I voted against this plan. |

|

Our plan would have done the following:

• Accept the federal Medicaid expansion outlined under the

Affordable Care Act, resulting in an addition of $119 million of

revenue and extending health care coverage to 92,000 people.

(Note: This plan would provide coverage and result in surplus

money for the state.)

• Use an alternative property tax mechanism targeted toward

middle-class homeowners that would provide the median value home

with $57 of additional savings over the governor’s plan while

spending the same amount of money.

• Index the Homestead Credit to inflation to ensure that our

most vulnerable citizens, who are often on fixed incomes, are

protected.

• Send $100 million to the state’s rainy day fund, buying down

the structural deficit facing the next Legislature (the state

would have faced a $672 million deficit under the Assembly

Democrats’ plan instead of a $725 million gap).

I believe that the Democrats' plan balanced the need to give tax

relief with the many other pressing needs facing our state.

I voted "no" on the Republican plan because it was an

ill-conceived, rushed bill that used an improper mechanism to

deliver help to our schools and property taxpayers. In no way

will this bill help pay for our schools, entice a Wisconsinite

to buy a home, or infuse money into our economy. In fact,

property owners in 82 school districts will see little to no

property tax relief under the GOP bill.

If we as a state are serious about tax policy reform, let's roll

up our sleeves and do it. The plan that passed was simply press

release politics. It may sound good on the evening news but

doesn’t do much at all for the middle class of our state.

In a time when our school districts are struggling to operate at

the same high standard that we have come to expect, this bill is

a slap in the face. At a time in which Wisconsin still lags

behind the rest of the Midwest in job creation, this was a

missed opportunity to invest in our work force.

I voted "no" because we need serious solutions to move Wisconsin

forward. The Assembly Democrats plan would have provided the tax

relief that Wisconsinites deserve, bolstered our rainy day fund,

and expand health care coverage. This would have been a win for

Wisconsin.

Instead, we have a tax cut that won’t even buy you your

Thanksgiving turkey.

Student Loan Bill - 'Higher

Ed, Lower Debt'

| Student debt is the only kind of household debt that continued to rise through the Great Recession, and is now the second largest consumer debt in our country, more than credit cards or auto loans. Having this money tied up in debt is a drain on our already struggling Wisconsin economy as the money spent on student loans could instead be spent on cars, new homes, and at local businesses in our communities. |

|

Over the years, exponential increases in

tuition and fees coupled with challenging economic times have

made it nearly impossible for students to work their way through

school. While 45% of 1992-93 bachelor's degree graduates

borrowed money from the government, private loan providers, or

family, according to a recent U.S. Department of Education

survey, approximately two-thirds of 2007-08 bachelor's degree

graduates borrowed money from the government or private lenders

(family loans were not considered in this figure). In fact, the

U.S. recently surpassed $1 trillion in outstanding student

loans, with nearly 40 million Americans holding approximately

$1.2 trillion in student loan debt nationally, meaning the

average per person debt totals about $30,000.

According to the U.S. Federal Reserve System there are 753,000

Wisconsin residents with federal student loan debt. Further,

college tuition costs have doubled over the last 12 years and

Wisconsin's student loan borrowers have an average debt of

$22,400. It is estimated that Wisconsin residents paying student

loans from obtaining a bachelor's degree are currently paying an

average of $388 per month for about 18.7 years.

I am proud to be a co-sponsor of The Higher Ed, Lower Debt

bill--authored by Senator Dave Hansen and Representative Cory

Mason--which would do the following:

- Allow Wisconsin's student loan

borrowers to deduct their student loan payments from their

income tax, resulting in annual tax savings of approximately

$172 for the typical borrower or as much as $392.

- Enable Wisconsin's student loan

borrowers to refinance their student loans at lower interest

rates, putting potentially hundreds of dollars back in their

pockets and into Wisconsin's economy annually.

- Provide students and parents with

detailed information about student loans, the best and worst

private lenders, and ensure that students receive loan

counseling so that Wisconsin's student loan borrowers can

make informed financial decisions about student loans.

- Ensure data is collected and tracked about student loan debt in Wisconsin to help policymakers and the public better understand the depth and breadth of the debt crisis in our state.

This proposal will go a long way in

helping current and future student loan borrowers to realize

significant savings. While savings under the bill will vary

depending on an individual's debt load and the interest rates,

student loan borrowers will now have the option to deduct

student loans from their income tax and/or refinance their

student loans. Both of these options are currently very

challenging or impossible for many Wisconsinites under current

law.

According to the nonpartisan Legislative Fiscal Bureau, the

average borrower could see an income tax savings of

approximately $172 under the Higher Ed, Lower Debt bill's income

tax deduction. However, borrowers who are paying more per year

in student loan payments would see tax savings up to $392

annually.

Additionally, depending on interest rates, borrowers and their

families could take advantage of the ability to refinance their

student loans and realize further savings. For example, a

borrower with an interest rate of 6.8% and the average

University of Wisconsin graduate's loan debt of $27,000 who

could lower their interest rate to 4% could save over $40 per

month. That would put nearly $500 back in their family's pocket

over the course of a year.

This legislation offers common sense solutions for real savings

on behalf of Wisconsinites managing student loan debt. I hope to

see broad bi-partisan support for this legislation that will

have long-lasting positive effects on our economy and our state.

Wisconsin vs. Minnesota in Health Care Costs

|

While the Packers may have

displayed their dominance over Minnesota on the football

field this past Sunday, Minnesota is beating Wisconsin

in something more vital: health care costs. A new report released this week by Citizen Action of Wisconsin reveals health consumers in Wisconsin will pay on average a stunning 79 to 99 percent more for health insurance than their counterparts in Minnesota on the new marketplaces created by the Affordable Care Act. |

|

The gap is so

dramatic that one Minnesota lawmaker has even called for placing

billboards on the Minnesota/Wisconsin border touting his state’s

more affordable health insurance rates.

Even more importantly the report shows that two critical

decisions made by the Walker administration explain a

substantial portion of the rate disparity.

The fundamental difference between the two states is that

Minnesota has embraced the national health care reform law and

is using the tools it provides to deliver more affordable health

insurance, while the Walker administration has tried to

undermine the law at every turn.

Gov. Scott Walker’s decision to turn down enhanced federal

Medicaid dollars, and his administration's decision not to

implement more robust rate review, can explain a substantial

portion of the premium gap with Minnesota.

Walker’s decision to reject the Medicaid funding to strengthen

BadgerCare cost the state budget $119 million more to cover

fewer people. This report shows that forcing more low-income

Wisconsinites into the new marketplaces (also known as

exchanges) will also increase the health insurance premiums for

everyone else.

A recent Rand Corporation report estimated that states rejecting

enhanced federal Medicaid dollars will increase premiums from 8

to 10 percent by making the overall insurance pool less healthy

and therefore more costly. The reason is that lower-income

people are relatively less healthy, and low-income people with

health conditions are more motivated to enroll, pay higher

premiums and cost share. This means that insurance premiums on

the Wisconsin marketplace on a typical plan will cost an average

$207 more per year because the Walker rejected enhanced federal

BadgerCare dollars.

Another key difference is the two states’ dramatically different

approaches to rate review. An important provision of the

Affordable Care Act tasks state regulators with reviewing health

insurance premium rate increases to determine if they are

excessive.

Overall, the report concludes that Walker’s decision not to use

the tools made available by the national health care reform law

may cost Wisconsin consumers as much as $1,000 more per year in

health insurance premiums. This dwarfs the meager $13 tax

reduction Walker and his conservative allies are touting.

These numbers ought to shake up the health care debate in

Madison. Most Wisconsinites are tired of the consistent effort

to sabotage health care reform. Few doubt that access to quality

affordable health insurance is not a luxury, but is

indispensable to the opportunity to thrive, prosper and achieve

the American dream in the 21st century. Shockingly higher

premiums ought to be a clarion call for lawmakers to put aside

the ideological divisions that have plagued the health care

debate, and work cooperatively to secure the full benefits of

national health care reform for Wisconsin.

Frac Sand Mining Bill Attacks Local Control

|

A bill to restrict the ability of

local communities to regulate Wisconsin’s frac sand

industry had a public hearing in the state senate last

week. |

|

Under this type of mining, companies

mine highly desirable sand for oil and natural gas producers.

The particles are used in a process known as hydraulic

fracturing, or "fracking," where sand, chemicals and water are

injected underground at high pressure to extract oil or natural

gas that had been too difficult to remove.

The mines require large-scale excavation and industrial-size

processing. They also create increased truck and rail traffic.

As the sand industry has grown, some local units of government

have placed restrictions on projects, such as setting standards

for operations, making new requirements for environmental

monitoring and imposing stiff costs for road repair.

We all want to know that the air we breathe and the water that

comes out of our wells is safe for our families, crops and

livestock. Wisconsin has a rich history of protecting our health

by bringing industry, regulators and citizens to the table to

use science and the rule of law to come to an agreement about

how to properly implement and enforce laws that protect our air

and water. Mining companies excavate rock with asbestos

minerals, process frac sand and create carcinogenic dust, or use

high-capacity wells to pump tens of thousands of gallons of

groundwater for irrigation of our state’s largest industrial

farms without considering the effects on our citizens.

Eliminating the power of local elected officials to protect

their community’s air and water takes away the influence the

public has over whether they have a safe and clean environment.

Tying the hands of local government – who have increasingly

taken on responsibilities that our Department of Natural

Resources can’t or won’t – weakens not just our natural

resources, but our public health and our democracy.

More public input is needed in all areas where the effects of

decisions will be directly felt by the people living around the

mines. We cannot let business interests trump the health and

well-being of the people of Wisconsin.

While the bill is moving through the state senate, Assembly

Speaker Robin Vos said earlier this week he is not planning to

hold a vote until the spring, at the earliest.

Pregnant Workers Fairness Act

Introduced

|

I am proud to be a co-author of The "Pregnant Workers

Fairness Act" which was introduced last week by

Representative Eric Genrich (D-Green Bay). Federal law already bans employers from firing or refusing to hire a  pregnant woman. But it does not regulate treatment of

women who become pregnant while on the job. This can be

a big issue, especially if a woman has a physically

demanding job.

pregnant woman. But it does not regulate treatment of

women who become pregnant while on the job. This can be

a big issue, especially if a woman has a physically

demanding job.The bill would require employers to make provisions so a woman could continue to work. It would also expose employers to legal action, within reason. There is a provision in the bill that allows employers to be exempt if they can prove that these accommodations would cause an undue hardship on their business which mirrors provisions in current federal law on pregnancy discrimination, and also mirrors state law on some discrimination statutes. This bill is a wonderful first step towards ensuring that pregnant women are not discriminated in the workplace. |

If you would like to have your name removed from this email list, please reply to this message with “Unsubscribe” in the subject line.

October 29, 2013

Issue 20

Contact Me

State Capitol

P.O. Box 8953

Madison, WI 53708

Office: (608) 266-0960

Email:

Rep.Sargent@legis.wi.gov

On the Web: sargent.assembly.wi.gov

Stat of the Week

Data from the Department

of Public Instruction shows that 79% of students who

received vouchers in Wisconsin did not attend a

Wisconsin public school last year. Your tax money should

not go to subsidize tuition for families already able to

afford private schools.

|

|

In the Capitol

|

Bills of interest:

|

In the District

|

Learn About Social

Networking and Identity Theft

5¢ Bingo |

District Outreach

|

Team Sargent did a little math and added up our outreach in

district. I knew we were pounding the pavement but was shocked when the numbers added up to more than 8,250 doors in the last 3 months. Great conversations. Great neighborhoods. Great people. It is my honor to represent the 48th Assembly District. |

Halloween Safety Tips

|

WI gets good marks for Dental Health

|

From our friends at

the Wisconsin Dental Association A new Oral Health America report gives Wisconsin a score of 85 out of 100 and ranks our state fifth in the nation in terms of seniors’ oral health. While Wisconsin is doing a good job, we must continue to reduce barriers to oral health care for our state's most vulnerable residents. For example, the state could pursue reimbursing all dental Medicaid providers their costs. Currently, government reimburses Federally Qualified Health Centers their full costs, but other dental providers are paid considerably below the cost of care. Engaging all providers will increase access for those most in need. WDA Healthy Choices proposals also include student loan forgiveness and grants programs to encourage dentists to settle in underserved areas.  |

10 Ways to Enjoy More Fruits and Vegetables

|

Provided to you by the Academy of

Nutrition and Dietetics Building a healthy plate is easy when you make half your plate fruits and vegetables. It's also a great way to add color, flavor and texture plus vitamins, minerals and fiber. All this is packed in fruits and vegetables that are low in calories and fat. Make 2 cups of fruit and 2.5 cups of vegetables your daily goal. Try the following tips to enjoy more fruits and vegetables every day. 1. Mix up a breakfast smoothie made with low-fat milk, frozen strawberries and a banana. 2. Try crunchy vegetables instead of chips with your favorite low-fat salad dressing for dipping. 3. Add color to salads with baby carrots, grape tomatoes, spinach leaves or mandarin oranges. 4. Keep cut vegetables handy for mid-afternoon snacks, side dishes, lunch box additions or a quick nibble while waiting for dinner. Ready-to-eat favorites: red, green, or yellow peppers, broccoli or cauliflower, carrots, celery sticks, cucumbers, snap peas or whole radishes. 5. Keep a bowl of fresh, just ripe whole fruit in the center of your kitchen or dining table for a quick on-the-go snack. 6. Wake up to fruit. Make a habit of adding fruit to your morning oatmeal, cereal, or yogurt. 7. Stock your freezer with frozen vegetables to steam or stir-fry for a quick side dish. 8. Make your main dish a salad of dark, leafy greens and other colorful vegetables. Add chickpeas or edamame (fresh soy beans). 9. Variety abounds when using vegetables as pizza topping. Try broccoli, spinach, green peppers, tomatoes, mushrooms, and zucchini. 10. Make a veggie wrap with roasted vegetables and low-fat cheese rolled in a whole wheat tortilla.  |

Congrats to Virent!

|

Virent won third place and a $15,000 prize in the Emerging Innovation Award competition presented Wednesday by Securing America's Future Energy (SAFE), a nonpartisan, Washington, D.C. organization whose goal is to reduce U.S. dependence on oil. Madison-based Virent has developed technology used to turn plant sugars into various types of fuel as well as chemicals used for plastics. |

|