October 17, 2017

|

Wisconsin fiscal year

ends with $579 million surplus |

|

This week, the Wisconsin Department of Administration issued its annual fiscal report showing the state ended fiscal year 2017 with a $579 million surplus, the second largest closing balance since 2000. It is evident from the aforementioned statistics that our pro-growth, pro-taxpayer reforms are working. Wisconsin has ended every fiscal year, since Republicans regained control of the legislature, with a surplus. My colleagues and I will continue to be good stewards of the hard-working taxpayers' money and work tirelessly to provide an accountable government for every Wisconsinite. This surplus affords Wisconsin with the ability to weather a potential downturn in the economy or to invest in infrastructure over the next biennium.

Property Tax Assessment Bills approved by Senate Committee This week, the Senate Committee on Revenue, Financial Institutions and Rural Issues, unanimously approved Senate Bills 291 and 292 that I coauthored with Senators Duey Stroebel (R-Cedarburg) and Roger Roth (R-Appleton), respectively. In addition to being approve unanimously, more than fifty percent of legislators in both houses are cosponsors of these proposals. The litigation and tax refund costs associated with with is commonly referred to as the "Dark Store Theory," could devastate local units of government. As such, innumerable municipalities have contacted my asking that a workable solution is formulated. Senate Bills 291 and 292, quite simply, clarify the best practices as proscribed by the Wisconsin Property Tax Assessment Manual. Moreover, they seek to provide clarity and direction to the Board of Review and Court when determining the value of a property. The intent of these proposals is to prevent further potential tax shifts by ensuring assessments are fair and equitable for all taxpayers.

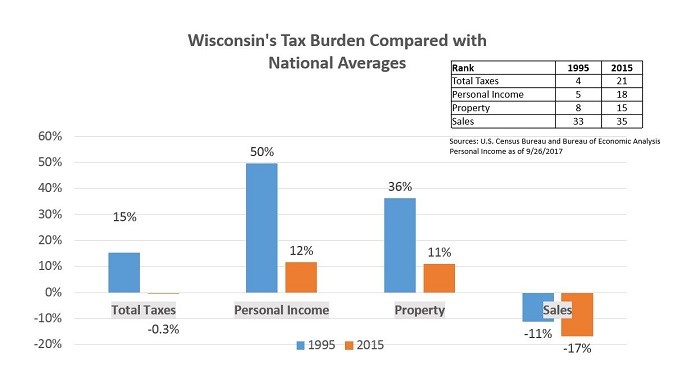

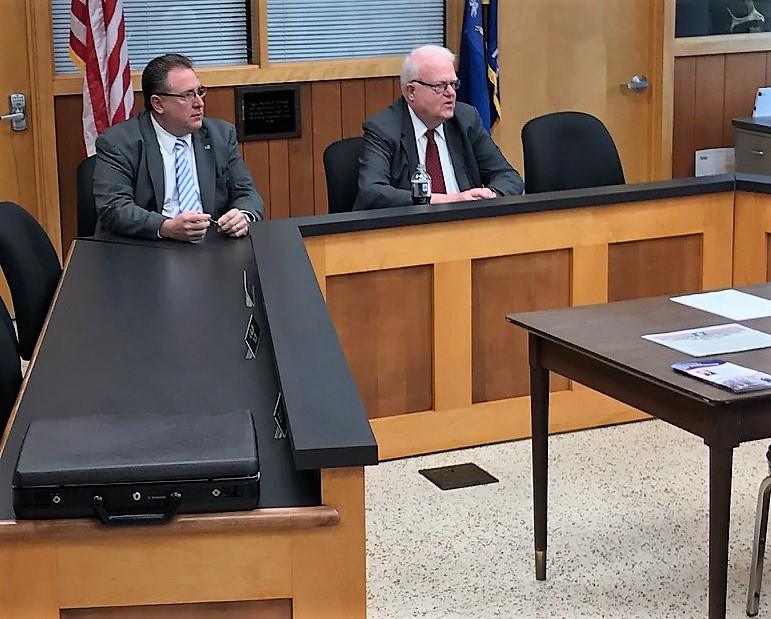

Testifying with Senator Roger Roth (R-Appleton) before the Senate Committee on Revenue, Financial Institutions, and Rural Issues, on Senate Bills 291 and 292. Wisconsin Tax Burden Below National Average According to the Wisconsin Department of Revenue, Wisconsin's tax burden is below the national average. The United States Census Bureau recently released data for 2015, the most recent year available, showing that Wisconsin's state-local tax burden was 0.3 percent below the national average. Additionally, Wisconsin's tax burden dropped to 21st in the nation. Just last year, Wisconsin's tax burden was ranked 16th. This continues a trend that shows Wisconsin's strong record of tax reform through property tax controls and income tax rate cuts has lowered the overall burden on Badger State taxpayers. In 1995, Wisconsin's state and local tax burden was ranked 4th highest in the nation; in 2010, on the contrary, it was ranked 9th. Adding to the good news is that this is Wisconsin's best state-local tax burden ranking in more than fifty years.

2017-2018 Wisconsin State Blue Book now available Everyone's favorite almanac of state government, the Wisconsin State Blue Book, is now available. Published biennially since 1853, the Wisconsin State Blue Book is the oldest publication in Wisconsin. Initially, the Wisconsin State Blue Book served as a manual for the State Assembly, a pocket-size volume of less than 100 pages, and designed for legislators to have information about state government at their fingertips. According to the Wisconsin Legislative Reference Bureau, the principal authors of the venerable publication, "Over the decades, the Blue Book evolved in size, scope, and purpose. The Blue Book's many iterations were caused by the increased availability of information about state government and the public. By 2015, the Blue Book exceeded 1,000 pages and was laden with dense statistical information that history buffs and political junkies would find engrossing; everyday citizens, conversely, would find this information uninteresting. The newly-revised State of Wisconsin Blue Book is designed to provide everyday citizens with enthralling content about Wisconsin history and government. Recognizing that the Blue Book was becoming too lengthy and dense, the Wisconsin Legislative Reference Bureau undertook a Herculean effort: revamping this esteemed repository of information about our state and its history. The 2017-2018 Wisconsin State Blue Book is intended to serve as an introduction to state and local government, not the primary source for information regarding these entities. More substantive and timely information about state government can be accessed through the Internet than could ever be accessed by a team of researchers tasked with penning a book. Recognizing this, the 2017-2018 Blue Book contains biographies of all legislators, descriptions of executive and judicial agencies, and statistics on Wisconsin government and elections. It does not, however, reproduce information that is archaic, or can be more easily obtained and accurately elsewhere. If you are interested in obtaining a copy of the 2017-2018 Wisconsin State Blue Book, please contact my office with your name and address. My staff and I will make it a priority to ensure that your copy arrives in a timely manner.

Updated 2016-2017 Wisconsin wildlife reports are now available Wisconsinites can find the latest results of the wide-ranging wildlife surveys, conducted in 2016 and 2017, pertaining to harvest results, and wildlife observations, to name just a few, are now available on the Wisconsin Department of Natural Resources' website. The aforementioned reports include data collected from small game, big game, furbearer and non-game categories. The reports were made possible by Pittman-Robertson funding. You can find the following reports by searching

the DNR website, www.dnr.wi.gov,

for keyword reports:

Big Game:

Furbearers:

Non-game:

Listening Sessions On Friday, October 20, 2017, I will accompany United States Representative Jim Sensenbrenner at his third round of office hours for 2017, in the 60th Assembly District. Representative Sensenbrenner will host one half-hour listening session in the Sixtieth Assembly District to respond to constituent inquiries, questions, and concerns affecting Wisconsin. Representative Sensenbrenner and I will visit the following locations on October 20, 2017: 9:00-9:30 a.m.: Newburg Village Hall--614 Main Street, Newburg. I am also available for one-on-one meetings in the district, particularly on Mondays and Fridays. If you are interested in scheduling a time to meet, do not hesitate to contact my office.

Participating in a town hall meeting with Congressman Jim Sensenbrenner |

|

Have a great week,

Stay up to date One of the best ways to stay up to date with what is happening in Madison is to sign up for the legislature's notification tracking service. This service affords you with the opportunity to track legislative activities in Madison. Upon creation of a free account, you can sign up to receive notifications about specific bills or committees as well as legislative activity pertaining to a subject area (i.e. real estate, education, health). You can sign up for this service at any time. You can also follow me on

Facebook and

Twitter to see what

I have been doing in Madison and around the 60th Assembly

District.

Please recommend the page to your friends and family members.

|

If you would like to be removed from future mailings, email me to unsubscribe.

State Capitol Room 309 North-PO Box 8952, Madison, WI 53708

(608) 267-2369

Email: Rep.Rob.Brooks@legis.Wisconsin.gov