Walk back in time with me for a moment to the year 2009. Jim Doyle was Governor; Democrats controlled the Legislature. Nancy Pelosi was then, as now, Speaker of the House of Representatives in Washington. About that time, President Obama's chief of staff Rahm Emanuel infamously said, "You never want a serious crisis to go to waste," and Congress passed the American Recovery and Reinvestment Act of 2009, an $830 billion spending bill which Vice President Joe Biden promised would ignite a "Summer of Recovery" with all kinds of shovel-ready construction projects and new jobs. Unfortunately, much of that spending had nothing to do with economic recovery (remember the "cash for clunkers" car trade-in program?) and everything to do with advancing liberal agenda items such as expanding Medicaid.

Anyway: in those days, Wisconsin Democrats passed legislation that required the legislature's Joint Finance Committee to participate in the decisions about how to spend all the federal money that our state received as part of that federal legislation.

Actually, that's a pretty good idea. In a republic like ours, it should never be up to just one person (even if that person is the Governor) to determine how to deploy unexpected money. It makes sense for many reasons for legislatures, whether at the federal or state level, to have the power of the purse. Legislators are most directly accountable to the people and bring a diverse set of experiences to the negotiating table that help identify smart, workable, effective policies.

Fast forward to 2021. This time, Congress has spent $1.9 trillion of your money that they don't have (nearly three times as much spending as in 2009). The spending again has relatively little to do with the coronavirus-related problems at hand but plenty to do with forcing the creation or growth of Democrats' favorite government programs. (Our Wisconsin GOP Congressmen reported recently that only about 9 percent of the $1.9 trillion is actually being used for Covid-19 related measures.) This time, Wisconsin will be receiving about $5.7 billion in one-time federal money, and it could be in the hands of just one person. About half of states (including "big blue" states such as New York and traditionally "red" Midwestern states alike) already have measures in place to involve legislative oversight of unanticipated funds, but Wisconsin isn't among them.

This week, I voted to advance a bill that, frankly, is a very reasonable compromise and would be even easier to execute than the Democrats' 2009 concept. The Truth in Spending Act provides that the Governor's spending decisions regarding these billions of unanticipated federal dollars would receive passive review by the Legislature's Joint Finance Committee. It's a process that is used routinely to approve state agencies' ideas for amending their budgets. Republicans and Democrats alike have opportunities to offer improvements and suggestions. Perhaps most importantly of all, this mechanism will provide transparency and public access to decisions that affect the whole state but which are presently being made by the Governor alone without any public input.

The enrolled bill, Senate Bill 153, was presented to Governor Evers yesterday for his decision. It is yet another opportunity for him to choose whether he will cooperate with the Legislature or keep going it alone on the hard questions.

Also advancing on the Assembly floor this week were equally important measures aimed at protecting you during times of crisis. I voted in favor of bills that prohibit government or your employer from punishing those who prefer not to receive Covid-19 vaccines; prohibit government closures of places of worship; and require the Governor to publish a plan for returning state employees to the jobs that you pay them to perform.

I'm eager to receive your feedback on these ideas and any other topics that you'd like to address. Senator Devin LeMahieu, Representative Tyler Vorpagel and I will be available at a series of public meet-n-greet events this coming Monday, March 29, across Sheboygan County; all the details are available online here. As always, if you can't join us then, contact me anytime via e-mail (rep.katsma@legis.wi.gov) or phone (608-266-0656).

Best wishes on your weekend... and I hope to see you on Monday at one of our listening session events!

On the Road to Recovery

Great news! Wisconsin's unemployment rate stands today at 3.8 percent, which is significantly better than the nationwide rate of 6.2 percent. For perspective: economists generally consider anything less than 4 percent as "full employment" and a sign of a very strong economic climate. Just prior to the coronavirus outbreak, our unemployment rate was 3.3 percent (nearly a record low after a decade of pro-growth policies).

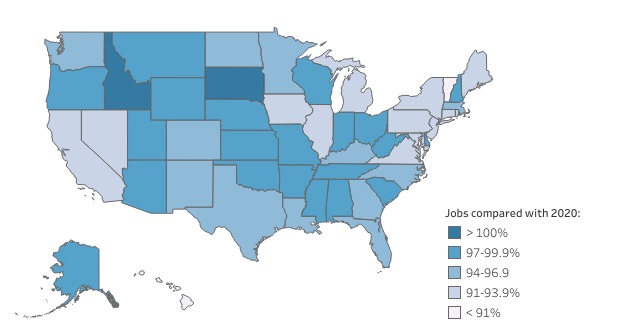

This map (compiled using U.S. Bureau of Labor Statistics data) helps illustrate that, thankfully, Wisconsin's recovery has been much swifter and more complete than many. It's been nearly a year since the Wisconsin Supreme Court put an end to Governor Evers' unilateral statewide shutdown, and I can't help but wonder how much worse the damage might have been if the Court hadn't intervened when they did.

And, I should add: if you're looking for work, there are many employers who hope to meet you! The Job Center of Wisconsin website presently lists no fewer than 95,741 job postings. Our businesses want to grow, and they need you!

It's Even Worse Than We Thought

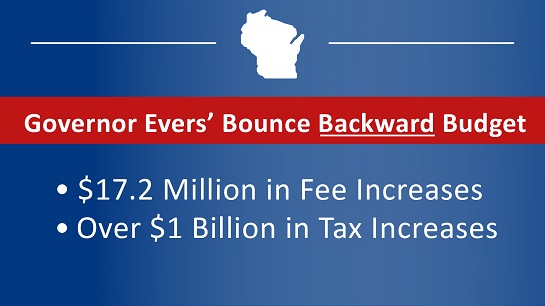

In one of my recent newsletters, I shared what we knew at the time about Governor Evers' tax increases that he has proposed for the next two years and beyond. At the time, we knew about his proposed 10 percent increase in total government spending; doubling the "Focus on Energy" tax on your electric bill; record-high new borrowing; and new deficits in places where we presently have surpluses.

Guess what? According to new information from the nonpartisan Legislative Fiscal Bureau, we underestimated how big the Governor's tax increases really are. Our early estimates didn't fully account for $17 million in new fees and $78 million worth of "enhanced collection measures."

I've said it before and I'll say it again: we aren't raising taxes by more than $1.1 billion while the economy is still recovering.

Office of Representative Terry Katsma

State Capitol, Room 306 East

P.O. Box 8952

Madison, WI 53708

(608) 266-0656

Rep.Katsma@legis.wisconsin.gov| |

|