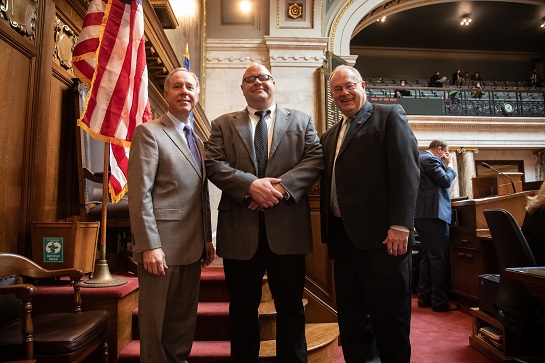

The State Assembly convened for business twice this week. And look who joined us! Pastor Drew Zylstra from our very own First Christian Reformed Church of Oostburg delivered the opening prayer during Tuesday's session.

And what a session it was! With broad bipartisan support, the Assembly voted to advance a package of bills that will reduce the cost of prescription drugs; ensure that pre-existing health conditions won't cost you your coverage; and add dentists to the list of professionals who may administer COVID-19 and flu vaccines.

Assembly Bill 7/Senate Bill 3 sets standards for pharmacy benefit managers (people who negotiate drug prices and handle claims payments). Among other provisions, the bill prohibits them from penalizing a pharmacist or an insurer who tells patients that a generic or other lower-cost alternative drug might be available.

Regardless of what may or may not change someday at the federal level, Assembly Bill 34 ensures that insurance companies won't deny health coverage due to pre-existing conditions. I coauthored this same language a session ago; this time the vote was unanimous.

Yes, you read that correctly: Democrats joined Republicans in a 92-0 vote to make sure that, in our state, you'll never lose your health insurance due to a pre-existing condition. It was Republicans' highest priority two years ago (it was 2019 Assembly Bill 1; it passed our house on the first legislative session day) and now we've passed it again.

A third item of business was also particularly timely. Assembly Bill 124/Senate Bill 13 gives dentists (with some additional special training) the ability to administer vaccinations against the flu and COVID-19. At long last, COVID-19 vaccine doses are arriving in large quantities; it will continue to be critical that we have enough ready workers to deliver them.

I'm very pleased that these priorities advanced in our chamber with overwhelming bipartisan support. And I hope this encouraging trend continues when we return for another day of debate and voting next week.

Best wishes on your weekend!

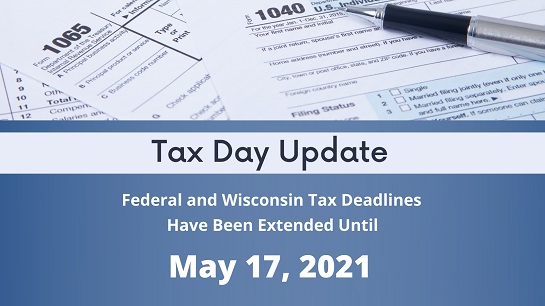

Tax Day Postponed -- But Beware

The federal Treasury Department and federal Internal Revenue Service (IRS) have announced that the due date for individuals to file 2020 federal income taxes has been postponed by a few weeks from April 15 (the regular date that we're all used to) to May 17. You don't need to take any action to qualify for this extension; you don't need to fill out any forms or make any calls; and you won't owe any extra interest or penalties for using the extra time.

In Wisconsin, our Department of Revenue (DOR) has announced that our state's rules will be exactly the same. In fact, I'm a coauthor of a bill to clarify that Wisconsin's due dates will always automatically conform with federal dates without delay in the future. (There was some confusion on this point in spring 2020 in particular; I, for one, am always looking to make tax matters clearer and easier!)

HOWEVER: unlike what happened in 2020, the extension DOES NOT apply to situations where taxpayers are required to make estimated tax payments for Tax Year 2021. Employers still have to withhold taxes from your wages and pay these to the government quarterly. And if you have income that isn't subject to tax withholding (such as self-employment income, rental income, alimony, and others), you still have to make those quarterly payments of estimated tax according to the "regular" quarterly deadlines. April 15 is one of these regular quarterly deadlines and this due date is not postponed.

This news article published by the IRS and this statement from the Wisconsin DOR comprise the latest agency information "in writing" on this subject. The IRS says formal guidance will be published in coming days.

We're Eager to See You!

Community listening sessions are coming back soon after a long break. Area legislators will host a series of meet-and-greet events across Sheboygan County and beyond throughout the day of Monday, March 29. We'd love to see you there and learn what's on your mind! I'll be at two locations on that date:

- Sheboygan listening session (with Sen. Devin LeMahieu and Rep. Tyler Vorpagel) from 1:30 to 2:15 PM. UW-Green Bay, Sheboygan Campus, Fine Arts and University Theater, 1 University Drive, Sheboygan; and

- Rural listening session (with Sen. Devin LeMahieu) from 2:45 to 3:15 PM. Hingham Hall, N2744 N. Main Street, Waldo.

We hope you can join us that day, but remember: we're always just a call or email away. Don't be afraid to simply reply to this email to share your ideas or ask questions any time you like!

Office of Representative Terry Katsma

State Capitol, Room 306 East

P.O. Box 8952

Madison, WI 53708

(608) 266-0656

Rep.Katsma@legis.wisconsin.gov| |

|