New information is emerging almost constantly about the coronavirus pandemic and the federal and state governments' responses. I won't attempt to compile it all, but I'll try to highlight a few items in this special bulletin that hopefully expand upon what you're hearing elsewhere.

Before you read on, a few particularly useful and comprehensive resources that I've found so far include:

My Capitol office continues to be open for business as usual; please feel welcome, as always, to contact me with your questions!

Stuff You Might Want to Know, Like, Now

- Act quickly: at 2:00 pm today, the general public (especially members of the business community) are welcome to participate in a live webinar arranged by Wisconsin Manufacturers and Commerce that will feature Governor Tony Evers and several cabinet secretaries. Their goal is to update Wisconsin's business world on the pandemic's impact on them and how state agencies are responding. Register here to watch live; the conversation will also be recorded for viewing later.

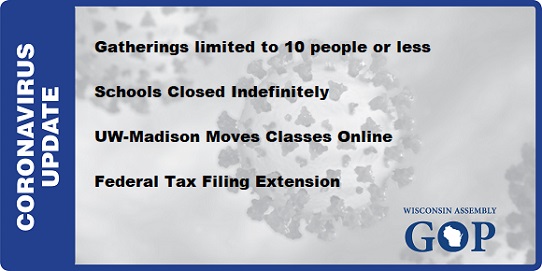

- Yesterday afternoon (3/17), the U.S. Treasury Secretary announced that, for now, people should still file their 2019 federal income taxes by April 15, but if it turns out that you have to pay in, you will have an additional 90 days penalty- and interest-free beyond April 15 to pay your bill. So far, although I think there will be further clarification coming soon, you should still assume that you are required (like usual) by April 15 to either file your 2019 federal income tax return or request an extension. (I checked the IRS coronavirus webpage this morning; there is nothing in writing yet that says it's officially OK to file later than usual. But stay tuned.) Also, so far, the State of Wisconsin has not announced any changes from normal tax filing requirements; probably we will try at the state level to match as best we can whatever the federal government decides to allow during the emergency, but there has been no news yet on any state-level changes to normal procedures. As you can probably tell, the federal and state plans for changing the normal rules about filing taxes are changing rapidly; I'll keep you updated as things firm up. (Finally: the American Institute of CPAs is keeping a list of state and federal tax filing guidance during the health emergency. Note that Wisconsin doesn't have any information listed yet.)

- So far, the upcoming April 7 statewide spring elections are still on as scheduled. Click here for voting-related deadlines. Today is the deadline for registering online or by mail to vote on April 7. If you miss this deadline, you may still register in person with your municipal clerk's office prior to April 3, or you may register in person at your polling place on Election Day. Also, this same website provides instructions for requesting an absentee ballot if you prefer not to visit your polling place; any Wisconsin voter may use this service for any reason, but you must act absolutely no later than April 2.

Office of Representative Terry Katsma

State Capitol, Room 306 East

P.O. Box 8952

Madison, WI 53708

(608) 266-0656

Rep.Katsma@legis.wisconsin.gov| |

|

|

|

|