Report 22-5 | May 2022

As a condition of receiving federal funds, state agencies must meet the audit requirements of the federal Office of Management and Budget Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (Uniform Guidance), and the Single Audit Act of 1984, as amended. The Single Audit Act requires there to be one comprehensive audit of federal programs. This single audit also incorporates our annual audit of the State’s financial statements. These financial statements were included in the Annual Comprehensive Financial Report (ACFR) issued in December 2021 by the Department of Administration (DOA).

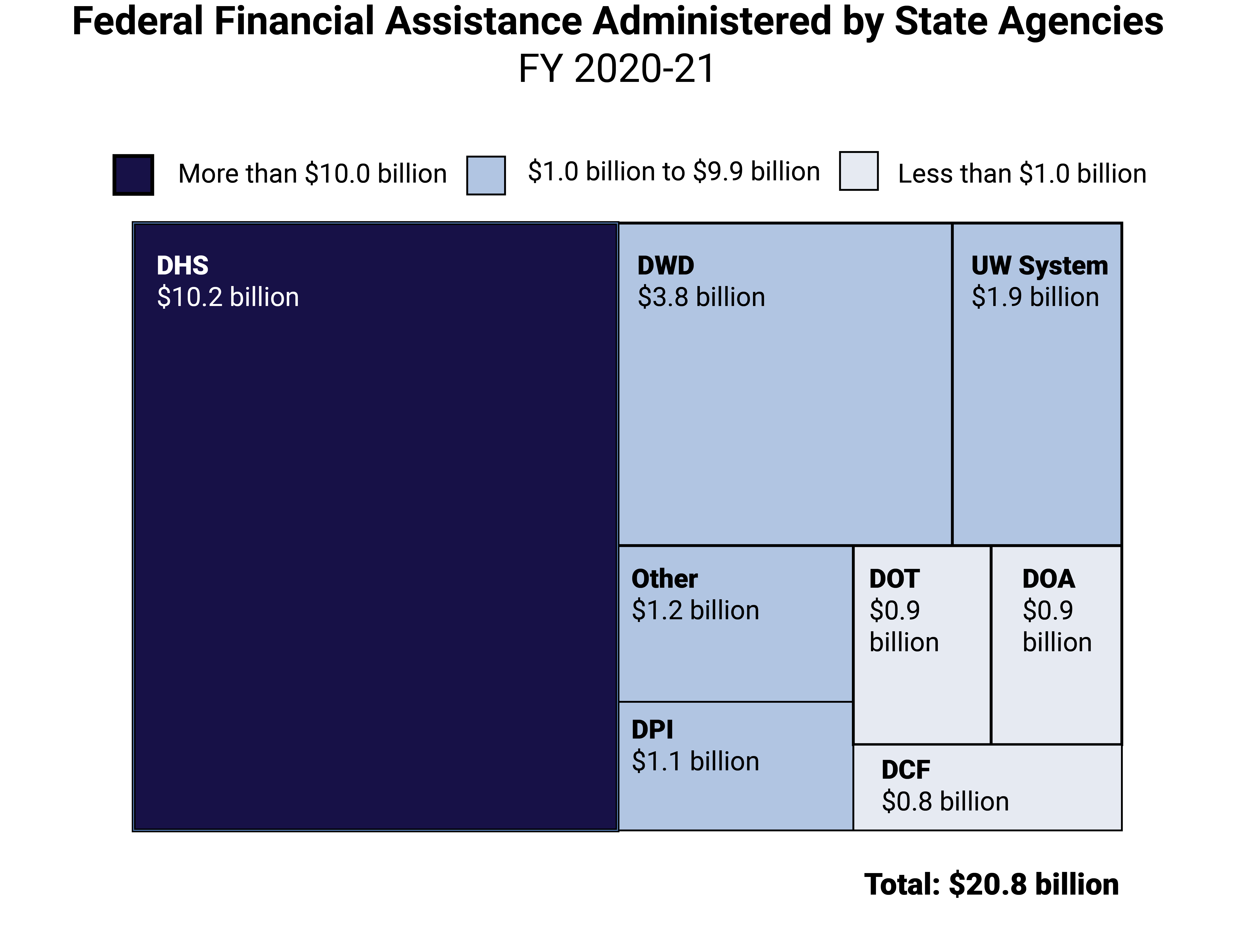

In fiscal year (FY) 2020-21, state agencies administered $20.8 billion in federal financial assistance, including $6.6 billion that was related to the public health emergency and that was separately identified in the State’s Schedule of Expenditures of Federal Awards (SEFA). Our audit focused on 24 federal programs that accounted for 82.3 percent of the federal financial assistance administered by state agencies in FY 2020-21. We found that state agencies generally complied with federal requirements, and we provided an unmodified opinion on federal compliance for 22 of the programs we reviewed. We qualified our opinion on compliance for certain requirements related to the Emergency Rental Assistance Program and the Unemployment Insurance program. We made 25 recommendations to improve the administration of federal programs and to address the internal control deficiencies we identified related to financial reporting. We also identified $314,531 of questioned costs that state agencies charged inappropriately to federal funds. The federal government will work with state agencies to resolve the concerns we identified.

Wisconsin state agencies administered $20.8 billion in federal financial assistance during FY 2020-21, including $18.6 billion in cash assistance, $2.0 billion in noncash assistance, and $127.8 million in outstanding loan balances. Seven agencies administered 94.3 percent of the federal expenditures during FY 2020-21: DOA, Department of Children and Families (DCF), Department of Health Services (DHS), Department of Public Instruction (DPI), Department of Transportation (DOT), Department of Workforce Development (DWD), and the University of Wisconsin (UW) System.

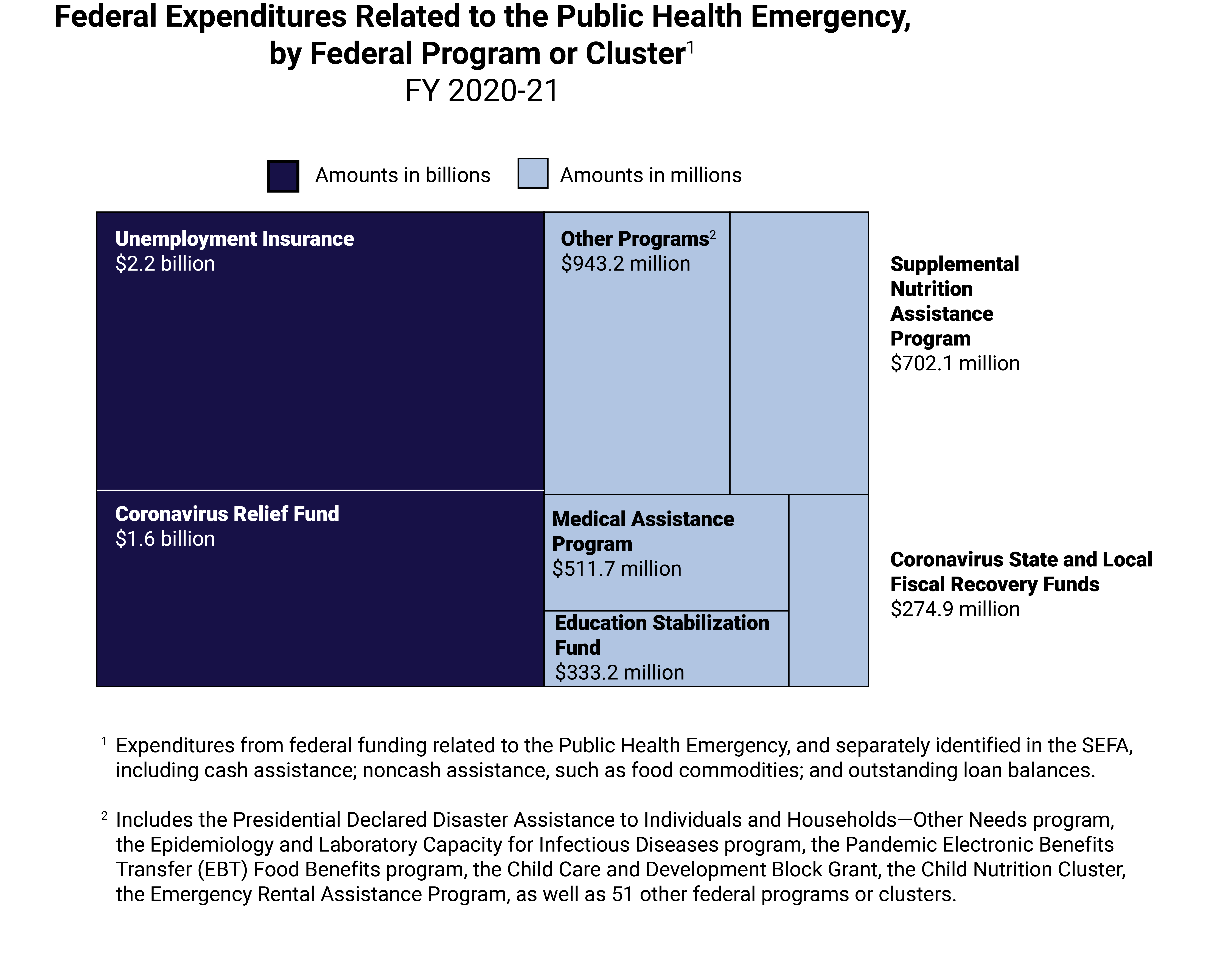

The State was required to separately identify the federal funding it expended related to the public health emergency, including funding provided under the Coronavirus Aid, Relief, and Economic Security (CARES) Act and the American Recovery Plan Act (ARPA). In its SEFA, the State reported that it spent $5.6 billion largely through six programs or clusters. The largest portion of these expenditures was $2.2 billion for the Unemployment Insurance program. These federal expenditures also included spending through the Coronavirus Relief Fund (CRF), the Supplemental Nutrition Assistance Program, the Medical Assistance Program, the Education Stabilization Fund, and the Coronavirus State and Local Fiscal Recovery Funds.

An auditor provides a qualified opinion on compliance when the compliance concerns are material in relation to a specific compliance area tested for a federal program or cluster.

We qualified our opinion on compliance related to eligibility requirements for the Emergency Rental Assistance Program at DOA. Specifically, we found DOA cannot be assured that only those eligible for emergency rental assistance received program benefits. We made recommendations to improve DOA’s administration of the program both in this report and in report 22-3.

We also qualified our opinion on compliance related to reporting requirements for the Unemployment Insurance program at DWD. Specifically, we found DWD cannot be assured that it reported complete and accurate information to enable the U.S. Department of Labor to assess the outcomes of Wisconsin’s Unemployment Insurance program. We made recommendations to improve DWD’s administration of the program.

We made 25 recommendations to improve the administration of federal programs and internal control over financial reporting. The recommendations pertained to 25 findings, and we consider 2 of the findings to be material weaknesses and 19 to be significant deficiencies. The remaining 4 findings were related to other matters that did not rise to the level of a significant deficiency.

We also identified $314,531 of questioned costs that state agencies charged inappropriately to federal funds. These questioned costs relate to the Medical Assistance Program, the CRF, the Emergency Rental Assistance Program, and the HIV Care Formula Grants program.

Finally, we followed up on the progress of state agencies to address 22 recommendations we made in our FY 2019-20 single audit report (report 21-6). The federal government will work with state agencies to resolve the new and continuing concerns we identified.

| Findings by Type | ||||

| Agency | Material Weakness1 | Significant Deficiency2 | Other3 | Total |

| DHS | 5 | 4 | 9 | |

| DOA | 1 | 6 | 7 | |

| DWD | 1 | 4 | 5 | |

| DPI | 2 | 2 | ||

| OCI | 1 | 1 | ||

| UW System | 1 | 1 | ||

| Total | 2 | 19 | 4 | 25 |

| Federal Program | Questioned Costs | |||

| Medical Assistance Program | $ 215,480 | |||

| Coronavirus Relief Fund | 72,523 | |||

| Emergency Rental Assistance Program | 22,800 | |||

| HIV Care Formula Grants | 3,728 | |||

| Total | $314,531 | |||

1 A material weakness is a deficiency, or a combination of deficiencies, in internal control over compliance or financial reporting, such that there is a reasonable possibility that a material misstatement or material noncompliance will not be prevented, or detected and corrected, on a timely basis.

2 A significant deficiency is a deficiency, or a combination of deficiencies, in internal control over compliance or financial reporting that is less severe than a material weakness in internal control, yet important enough to merit attention by those charged with governance.

3 A noncompliance finding that does not have a related material weakness or significant deficiency.

| Findings by Type | ||||

| Agency | Material Weakness1 | Significant Deficiency2 | Other3 | Total |

| DHS | 5 | 4 | 9 | |

| DOA | 1 | 6 | 7 | |

| DWD | 1 | 4 | 5 | |

| DPI | 2 | 2 | ||

| OCI | 1 | 1 | ||

| UW System | 1 | 1 | ||

| Total | 2 | 19 | 4 | 25 |

1 A material weakness is a deficiency, or a combination of deficiencies, in internal control over compliance or financial reporting, such that there is a reasonable possibility that a material misstatement or material noncompliance will not be prevented, or detected and corrected, on a timely basis.

2 A significant deficiency is a deficiency, or a combination of deficiencies, in internal control over compliance or financial reporting that is less severe than a material weakness in internal control, yet important enough to merit attention by those charged with governance.

3 A noncompliance finding that does not have a related material weakness or significant deficiency.

| Federal Program | Questioned Costs | |||

| Medical Assistance Program | $ 215,480 | |||

| Coronavirus Relief Fund | 72,523 | |||

| Emergency Rental Assistance Program | 22,800 | |||

| HIV Care Formula Grants | 3,728 | |||

| Total | $314,531 | |||