April 11, 2018

|

Job Creation and

Economic Development This will be the final e-update of the 2017-19 legislative session. This week's e-update, the tenth and last in series of articles focusing on legislative and budgetary accomplishments from the current session, centers on job creation, economic development, and tax reform. The legislature passed several bills designed to grow Wisconsin's economy, reduce the tax and regulatory burden on businesses and hard-working families, and create jobs. Wisconsin's economy is robust thanks to the pro-growth policies enacted by the legislature. The following represents some of the Assembly's legislative accomplishments as it related to job creation and economic development:

|

|

Tax Reform Reducing the tax burden on hard-working Wisconsin families, businesses, and property owners, is a foremost priority of the legislature. I had the opportunity to work with Representative John Macco on a series of initiatives designed to study sales and income taxes. Next session, Representative Macco plans to unveil a comprehensive tax reform package aimed at streamlining the state's outmoded and confounding sales tax code and reducing income tax rates. This following represent some of the Assembly's accomplishments as it relates to tax reform:

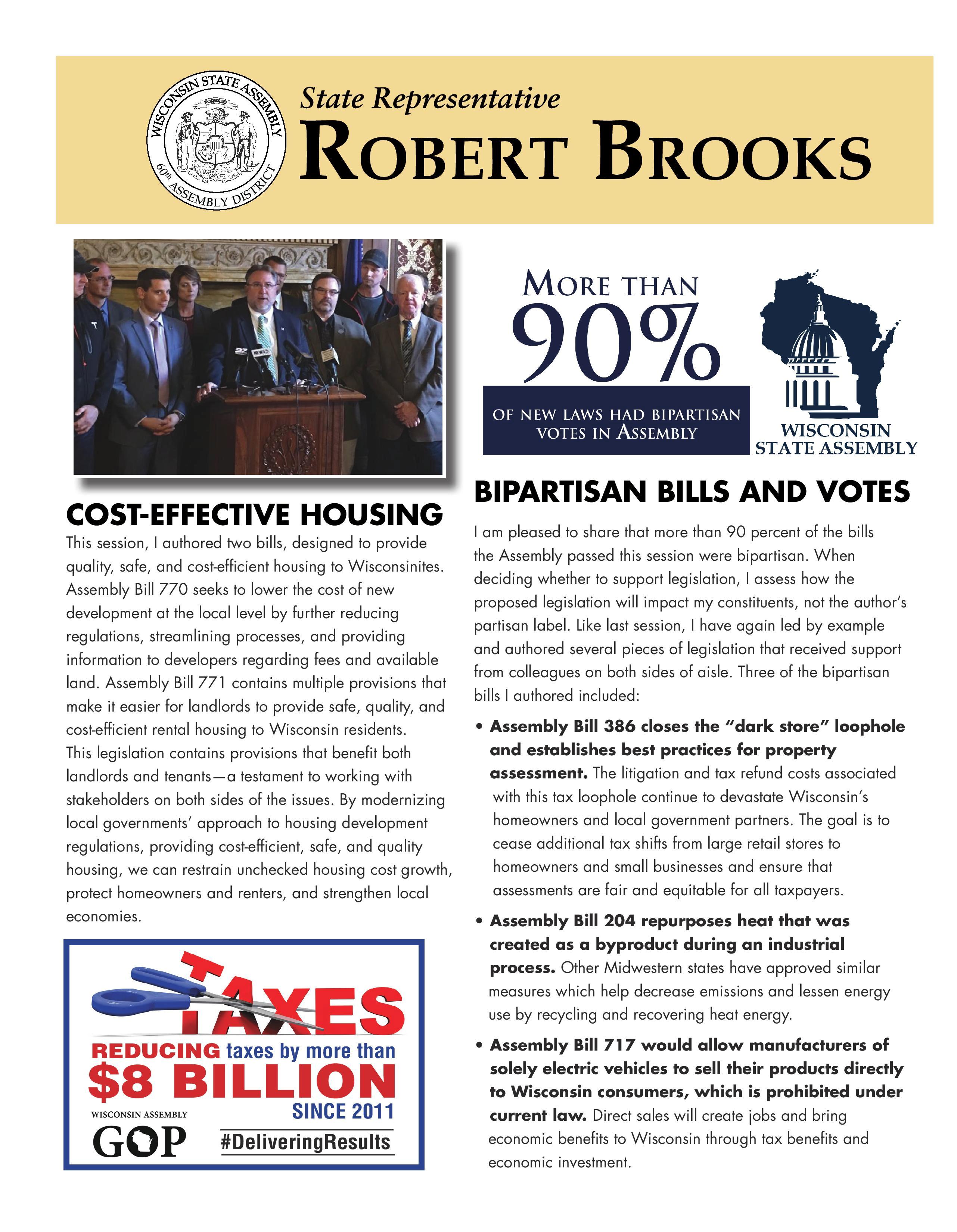

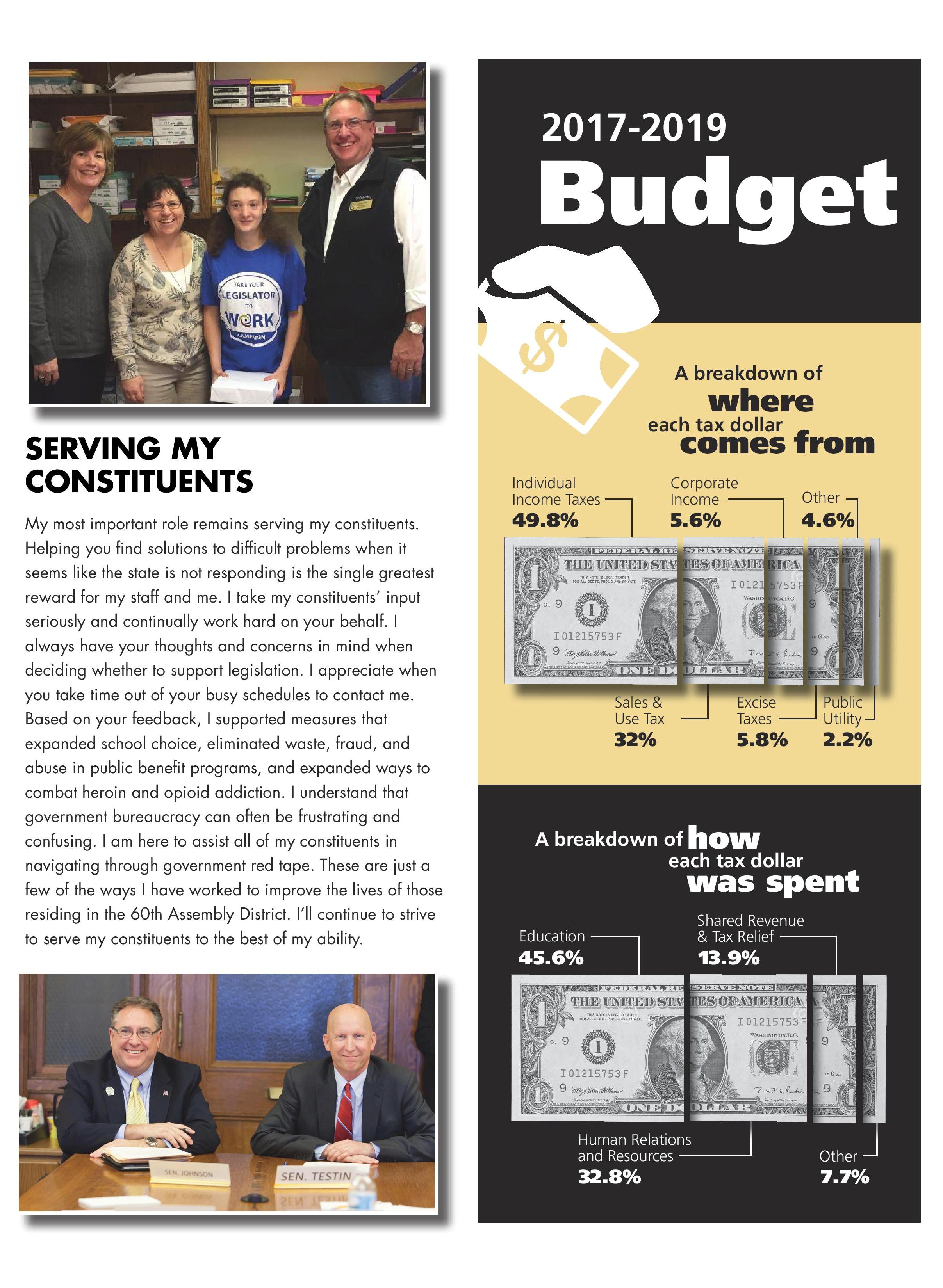

Medicaid update This week, the Wisconsin Department of Health Services notified my office that the Sheboygan Comprehensive Treatment Center, owned by Acadia Healthcare, intended to terminate participation in Medicaid on April 8, 2018. According to the Wisconsin Department of Health Services, "Medicaid continues to cover treatment for individuals with opioid use disorders through the use of medications such as methadone, substance abuse counseling, and other treatment services, delivered to Medicaid members. Although the Department of Health Services is actively working with Acadia Healthcare to maintain Sheboygan CTC's participation in Medicaid, the clinic still intends to terminate its participation and begin to directly charge Medicaid members cash payments for services." The Department of Health Services is working closely with BadgerCare Plus and Medicaid SSI HMOs to ensure impacted members are informed that their treatment services are covered by Medicaid at other clinics, without members needing to pay for treatment out of pocket. Additionally, Medicaid is able to provide transportation for any member that needs assistance traveling to a different provider through its non-emergency medical transportation benefit. At this writing, the Wisconsin Medicaid Program is collaborating with its partners in the Division of Quality Assurance and State Opioid Treatment Authority to ensure the Sheboygan CTC meets its obligation to maintain continuity of care and successfully transition treatment for individuals as they move to another Medicaid-enrolled provider. More information regarding these changes can be obtained by contacting the Department of Health Services: (608) 266-8922. Spring Newsletter The following spring newsletter highlights my personal accomplishments and those of Assembly Republicans. If you are interested in interested in a hard copy of the newsletter, please contact my office.

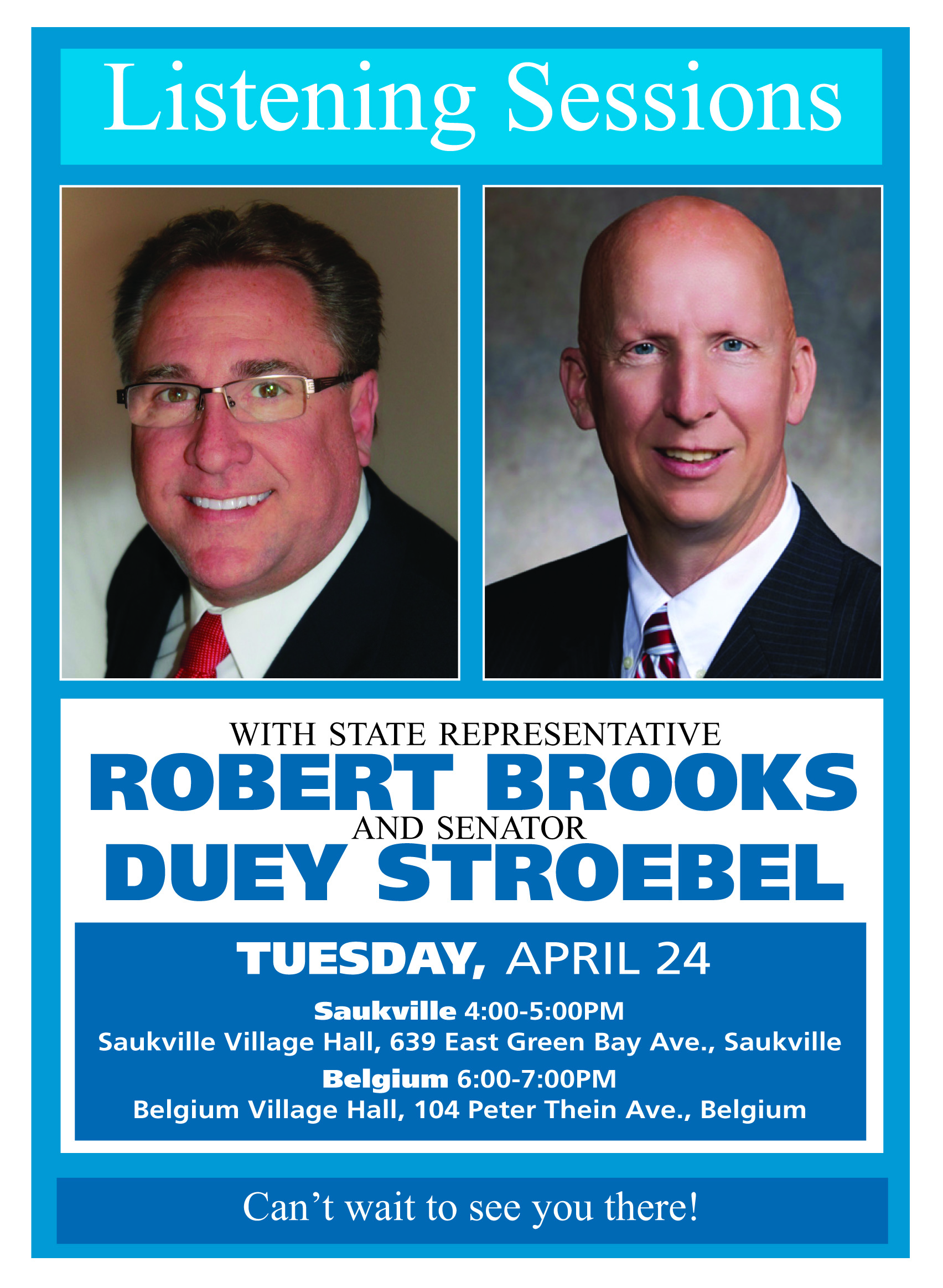

Listening sessions Senator Duey Stroebel (R-Cedarburg) and I will be hosting a series of in-district listening sessions on Tuesday, April 24. I very much look forward to your attendance, input, and participation. Listening sessions serve as a valuable opportunity for me to better understand the viewpoints of Sixtieth District residents. Senator Stroebel and I will visit the following locations on April 24: 4:00-5:00 p.m.: Saukville Village Hall--639 East Green Bay Avenue, Saukville, WI 53080 6:00-7:00 p.m.: Belgium Village Hall--104 Peter Thein Avenue, Belgium, WI 53004

|

|

Have a great week,

Stay up to date One of the best ways to stay up to date with what is happening in Madison is to sign up for the legislature's notification tracking service. This service affords you with the opportunity to track legislative activities in Madison. Upon creation of a free account, you can sign up to receive notifications about specific bills or committees as well as legislative activity pertaining to a subject area (i.e. real estate, education, health). You can sign up for this service at any time. You can also follow me on

Facebook and

Twitter to see what

I have been doing in Madison and around the 60th Assembly

District.

Please recommend the page to your friends and family members.

|

If you would like to be removed from future mailings, email me to unsubscribe.

State Capitol Room 309 North-PO Box 8952, Madison, WI 53708

(608) 267-2369

Email: Rep.Rob.Brooks@legis.Wisconsin.gov