August 14, 2017

|

Income tax reciprocity

|

|

Everyone who works in Wisconsin and earns income, owes Wisconsin income tax on those earnings. In most cases, nonresident workers file Wisconsin nonresident income tax returns and pay the taxes they owe directly to Wisconsin and file returns in their home states. In some cases, however, Wisconsin possesses an income tax reciprocity agreement with other states so that residents of both states who cross the border for employment, only have to file tax returns in their respective states. The Wisconsin Department of Revenue then, calculates the amount each of the aforementioned individuals paid in taxes to the states in which they work. Subsequently, that amount is paid to the state in which they work by their home state. Wisconsin's most recent reciprocity agreement is with Illinois. Because of this agreement, Illinois residents who work in Wisconsin, only file tax returns in Illinois. These individuals, however, indirectly pay Wisconsin taxes because of the reciprocity agreement. Similarly, Wisconsin residents who work in Illinois are only required to file return in Wisconsin. Reciprocity is intended to simplify the filing process for those residents who cross state borders for employment. It does not change the amount of taxes each state ultimately receives from nonresidents who work there. There are approximately fifty-six-thousand Wisconsin residents who work in Illinois and have a simpler tax filing process because of reciprocity. A common question posed by Wisconsinites to the Wisconsin Department of Revenue, as it relates to this issue: "Why does Wisconsin make a reciprocity payment to Illinois every year?" The answer is that more Wisconsin residents work in Illinois than vice-a-versa, so the amount we owe to Illinois on behalf of the Wisconsin residents who work there is greater than the amount Illinois owes our state on behalf of the Illinois residents who work here. Therefore, Wisconsin makes a new payment to Illinois, annually. The Wisconsin Department of Revenue calculates the reciprocity payments based on a study of how many people cross the border for work--this total is adjusted each year based on population changes. |

|

Governor Walker Announces $840,000 Coastal Resilience Grant for Lake Michigan Communities Governor Scott Walker announced, this week, that the National Oceanic and Atmospheric Administration (NOAA) has awarded Wisconsin a three-year $840,000 Coastal Resilience Grant to assist Lake Michigan communities and property owners in Southeastern Wisconsin to reduce damages from coastal hazards and sustain the operation of the coastal economic assets. The grant entitled, "Improving Economic Security in Coastal Wisconsin," will be awarded to the Wisconsin Department of Administration's Wisconsin Coastal Management Program. Governor Walker, in a press release, stated, "This grant is crucial to Wisconsin's coastal communities...We are grateful the National Oceanic and Atmospheric Administration recognizes the challenges our Lake Michigan communities are facing and this is an excellent step as we work towards repairing damage and preserving our coasts for years to come." Southeastern Wisconsin's Lake Michigan bluffs, beaches, and harbor infrastructure are currently being impacted by a combination of high water levels, erosion, and coastal storms. These coastal hazards threaten coastal properties and can impair tourism and commerce in the region. The new project will support efforts to map shoreline recession to improve hazard planning and provide guidance on options to protect coastal property. The project team will work collaboratively with the counties and municipalities of southeastern Wisconsin to plan and implement actions to reduce the impacts of coastal hazards. The Wisconsin Coastal Management Program balances natural resource protection and sustainable economic development along Wisconsin's Great Lakes coasts. The program awards federal funds from the Office for Coastal Management in the United States Department of Commerce and National Oceanic and Atmospheric Administration, to local governments and other entities for innovative coastal initiatives. County Deer Advisory Council Meetings Beginning August 21, 2017, County Deer Advisory Councils (CDAC) will review deer population data and other key information necessary for developing preliminary three-year population objectives within their respective counties. August CDAC meetings will develop preliminary recommendations, and a public feedback period in mid-September will include an online survey. Each CDAC meeting is open to the public. Councils will reconvene in October to determine the final population objective and boundaries that will be in place through the 2020 deer seasons. Final population objectives and Deer Management Units (DMU) boundaries will be determined at the December 2017 Natural Resources Board meeting based on the information received through the public involvement process. The Ozaukee County meeting will be held on Tuesday, August 29, 2017 from 7:00-9:00 p.m. at Riveredge Nature Center, 4458 County Highway Y, Saukville. The Washington County meeting will be held on Wednesday, August 30, 2017 from 6:30-8:30 p.m., at Cabela's, 1 Cabela Way, Richfield.

Antlerless Deer Tags The 2017 Bonus Antlerless Tag sale is one of the busiest license sales events for DNR--depending on the number of customers attempting to use the website at the sale's outset; customers may experience a waiting period before they can proceed. To prepare for the high-volume of sales, an online queuing system will be put in place, daily, to manage the volume in the Wisconsin Department of Natural Resources' "Go Wild" system. After 10:00 a.m., all online users will be randomly assigned into a "virtual line," regardless of the actual time they enter into the system. There is no advantage for customers to enter the site early. Tags will go on sale beginning on the following dates:

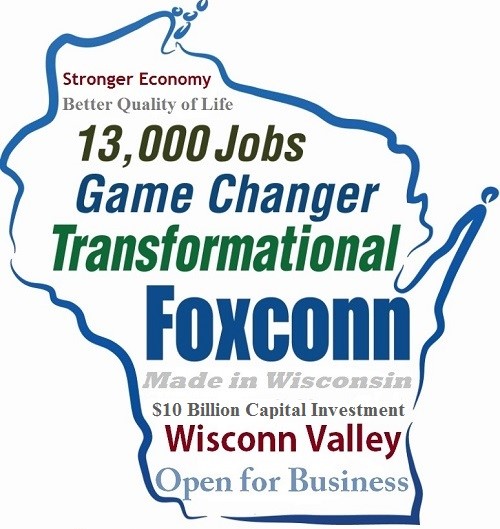

More information regarding antlerless deer tags can be found by visiting the "Go Wild" system. Foxconn update It is imperative that the legislature does it correctly when it votes on legislation expected to generate $10 billion in capital investment to southeast Wisconsin. On Friday, the Assembly released the substitute amendment being proposed to Assembly Special Session Bill 1. The substitute amendment protects taxpayers and natural resources, while simultaneously preparing Wisconsin for the largest economic development project in history. My colleagues and I have been thorough and deliberate in our analysis of the public testimony and the legislation that has been introduced. Assembly Substitute Amendment 1 addresses the needs of local units of government, increases worker training opportunities, and tightens the language to ensure Wisconsin receives the best deal that will bring the most return on its investment. Members of the Assembly Committee on Jobs and the Economy will vote on the bill, Monday afternoon. It is our goal to have the full Assembly pass this legislation during a floor session on Thursday, August 17, 2017.

Have a great week,

Stay up to date One of the best ways to stay up to date with what is happening in Madison is to sign up for the legislature's notification tracking service. This service affords you with the opportunity to track legislative activities in Madison. Upon creation of a free account, you can sign up to receive notifications about specific bills or committees as well as legislative activity pertaining to a subject area (i.e. real estate, education, health). You can sign up for this service at any time. You can also follow me on Facebook to see what

I have been doing in Madison and around the 60th Assembly

District.

Please recommend the page to your friends and family members.

|

If you would like to be removed from future mailings, email me to unsubscribe.

State Capitol Room 309 North-PO Box 8952, Madison, WI 53708

(608) 267-2369

Email: Rep.Rob.Brooks@legis.Wisconsin.gov