July 11, 2017

|

2017-19 Spring Survey

Results |

|

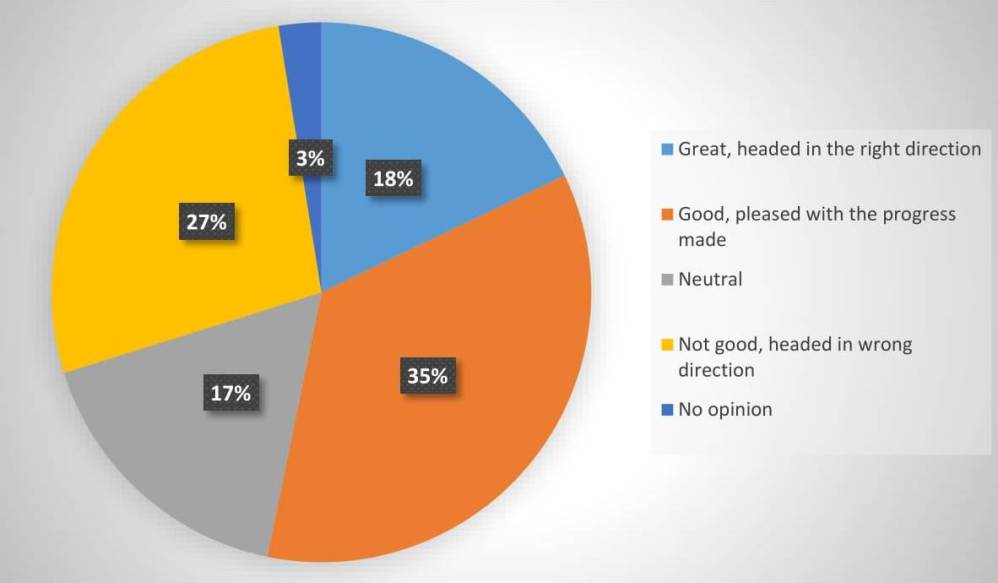

Thank you to everyone who responded to my 2017-19 Spring Survey. My office received 632 survey responses, and a few more still trickle in every week. It was a pleasure to hear from you; I very much appreciate and value your input. Constituent feedback is the essence of representative government. Furthermore, transparency with my constituency is a foremost priority and my spring survey affords me with the opportunity to better represent you, the residents of Wisconsin's Sixtieth Assembly District. For those yet to take the survey, you can do so by visiting my website; I value your input and look forward to reading your responses. This survey was an informal mechanism for ascertaining feedback from you, the residents of Wisconsin's Sixtieth Assembly District, on a wide range of consequential issues. Please recognize that this was not a scientific, or randomly conducted survey. As such, the data contained in the following graphs are a close approximation based on the surveys received by my office. Some individuals chose to answer only a few questions, whereas others completed the entire survey, and others penned comments, especially if the options provided did not represent their views. Question One: How do you think Wisconsin is doing as a state?

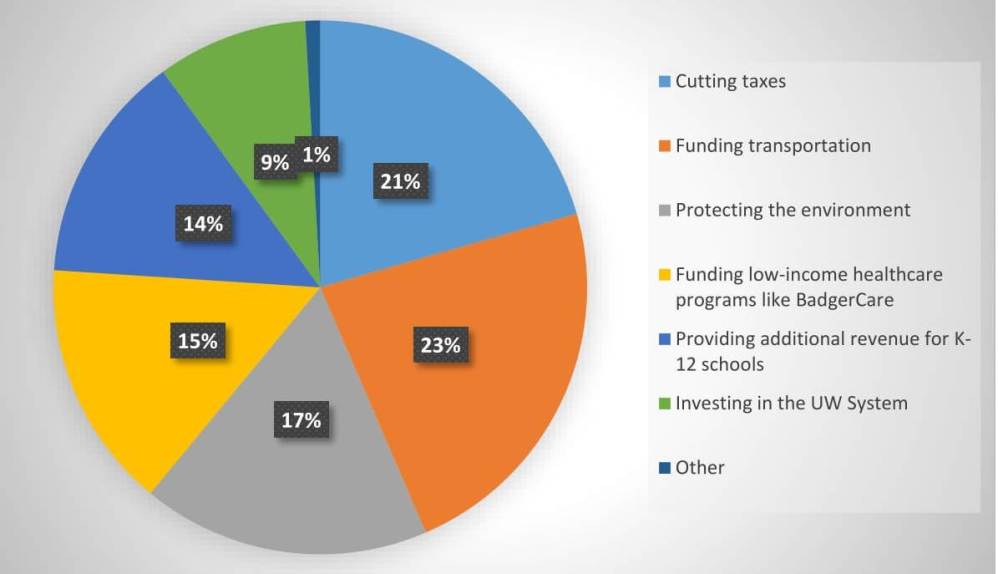

Question Two: As legislators work on the 2017-2019 state budget, what should their top priorities be in the spending plan?

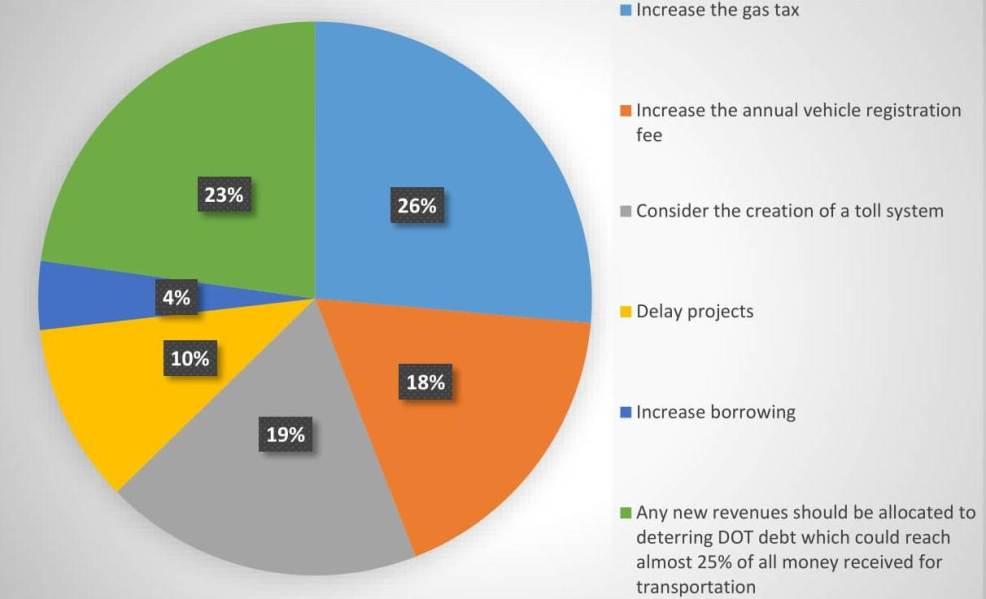

Question Three: Assembly Republicans are proposing new tax reforms and relief in the state budget. Assuming we reduce income taxes by $300 million and propose raising revenues for transportation by the same amount, what would you support?

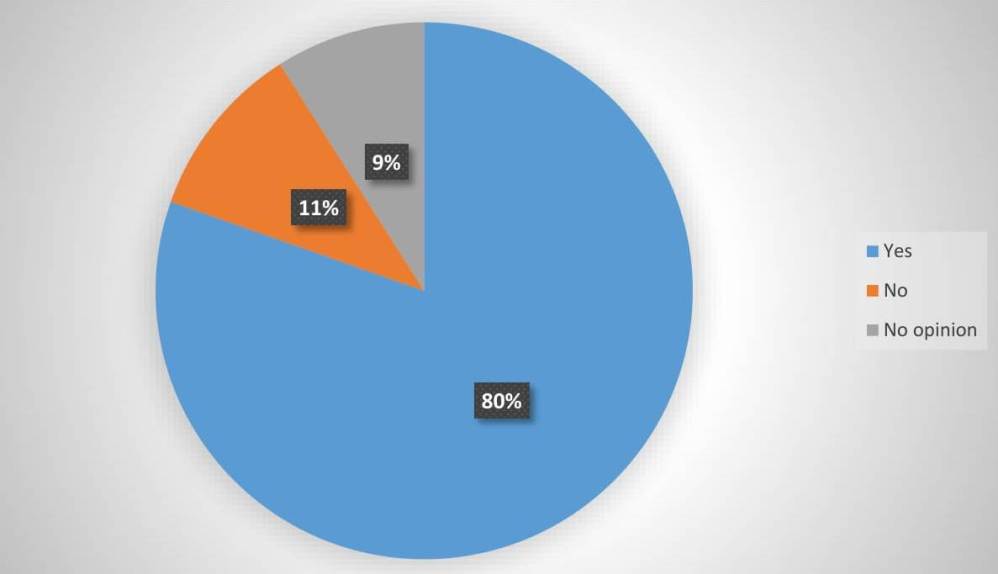

Question Four: Knowing the economy goes through ups and downs, should Wisconsin save a portion of its budget surplus to prepare for the future?

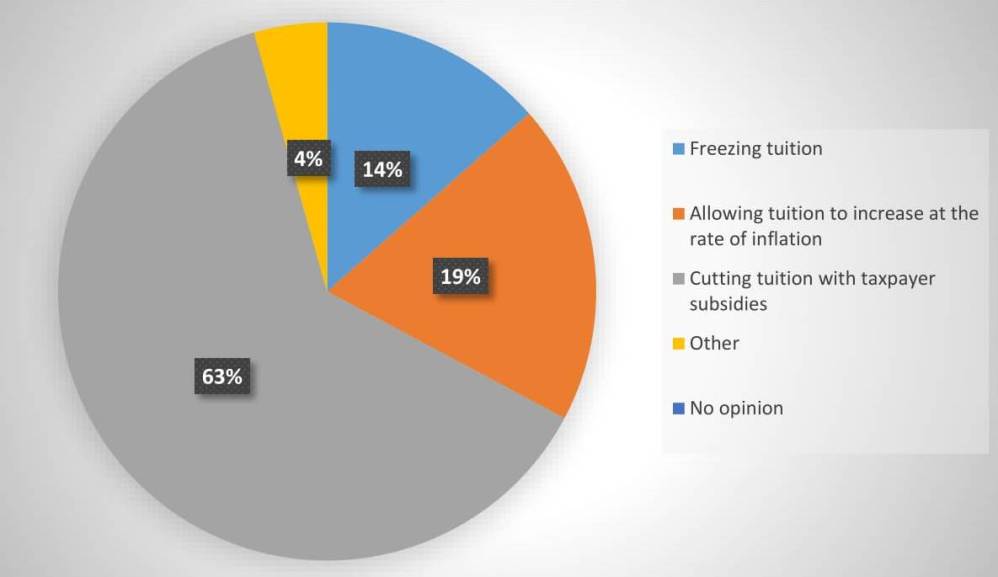

Question Five: UW-Madison is ranked seventh in the Big Ten for tuition and fees, but some say it is still too high. Others say students should continue to pay for a portion of their education and not increase the subsidies for taxpayers. When it comes to setting tuition for undergraduates at the UW system, what do you support?

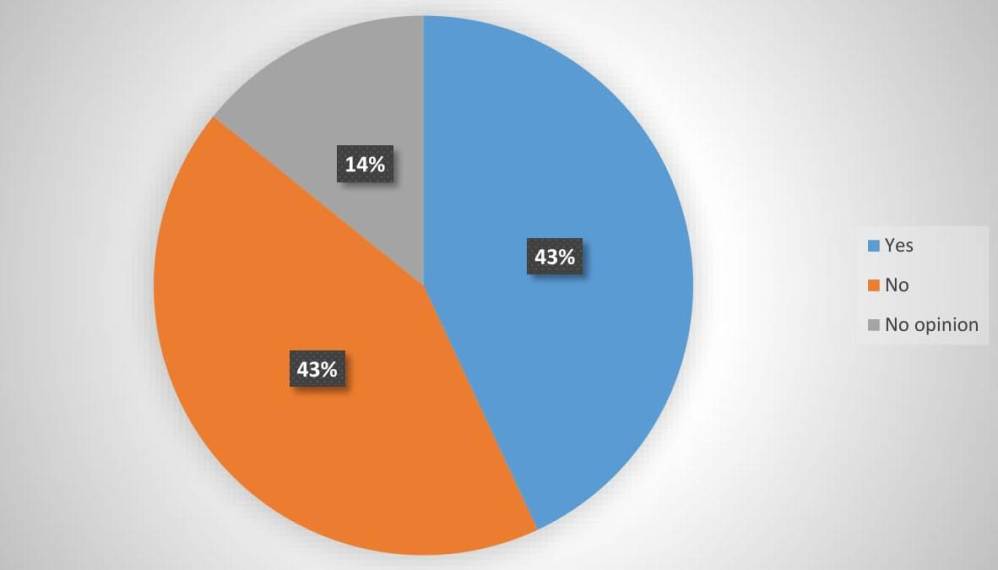

Question Six: Should the state invest more money to provide Broadband internet services to underserved areas of Wisconsin?

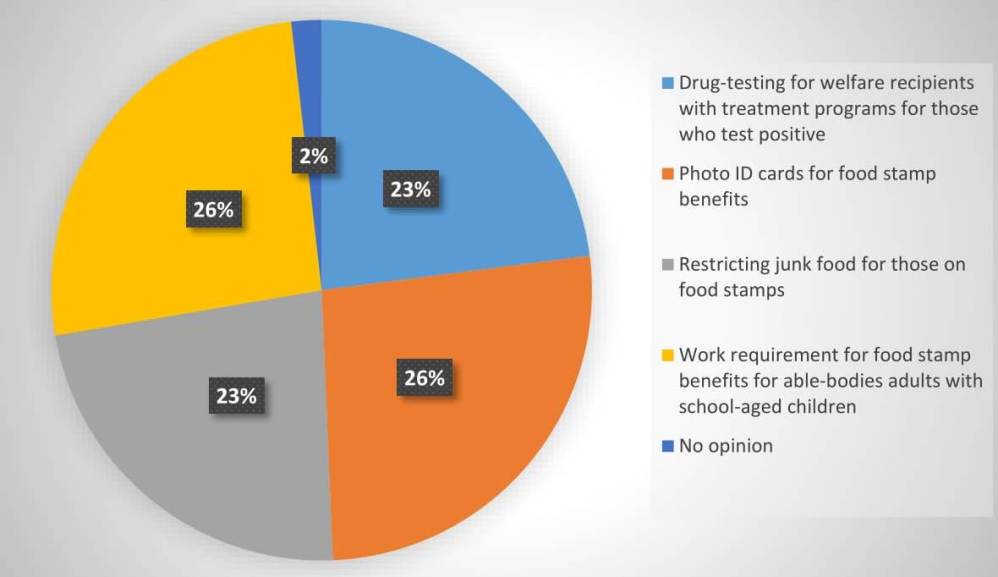

Question Seven: Which of the following do you support in order to reduce the fraud, waste and abuse in taxpayer-funded public benefit programs?

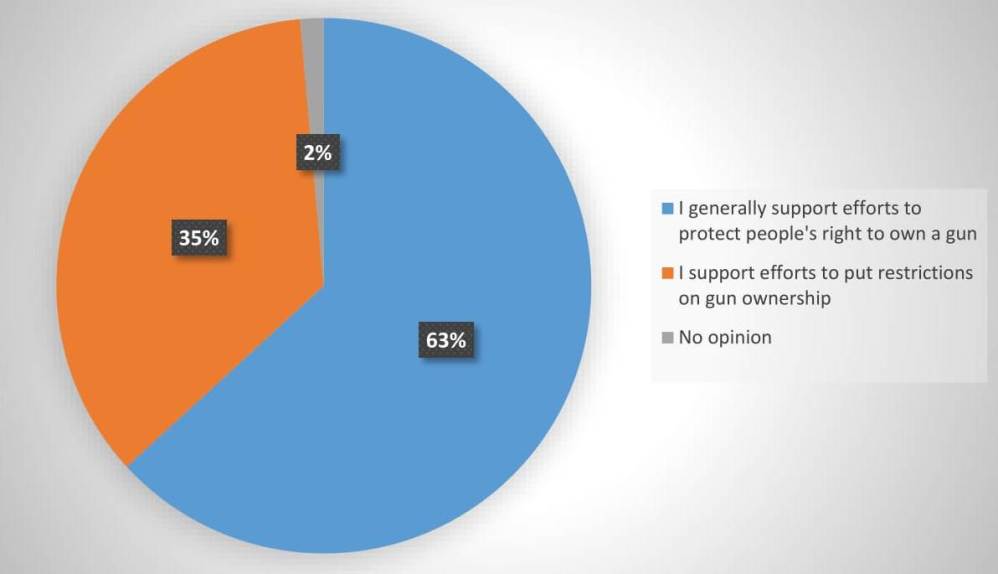

Question Eight: What is the closest to your views on gun ownership?

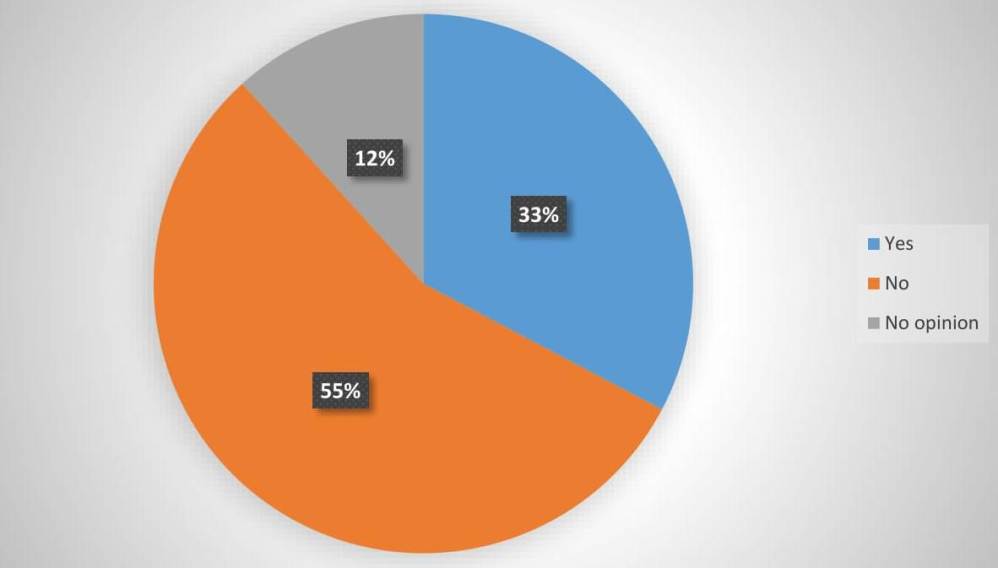

Question Nine: Wisconsin is considering a self-insurance model and would assume risk for the healthcare coverage of state employees, which could save up to $60 million. However, by removing the pool of workers from the private marketplace, it may mean increased rates for everyone else. Do you support the proposed move to the self-insurance model?

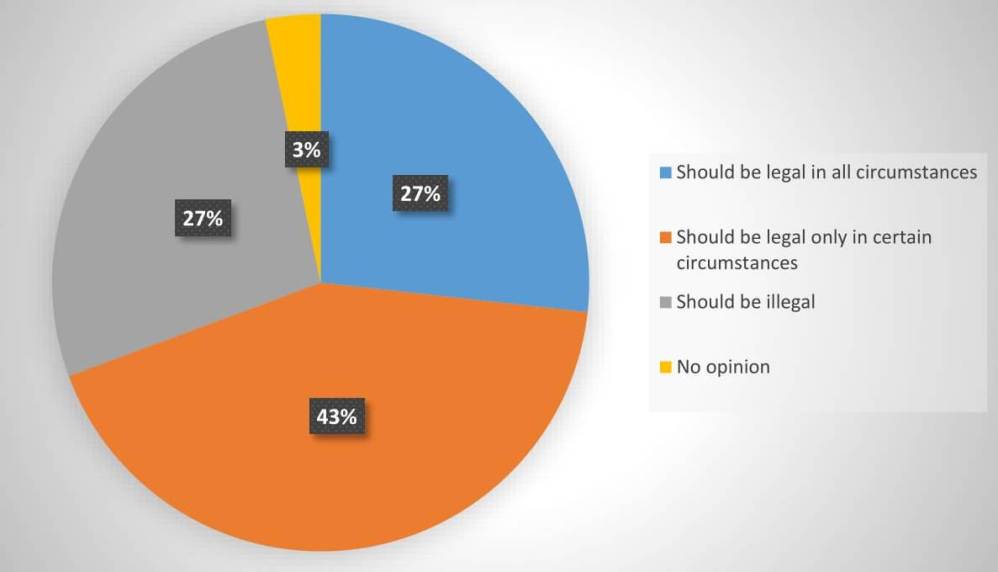

Question Ten: Please choose what best represents your position on abortion.

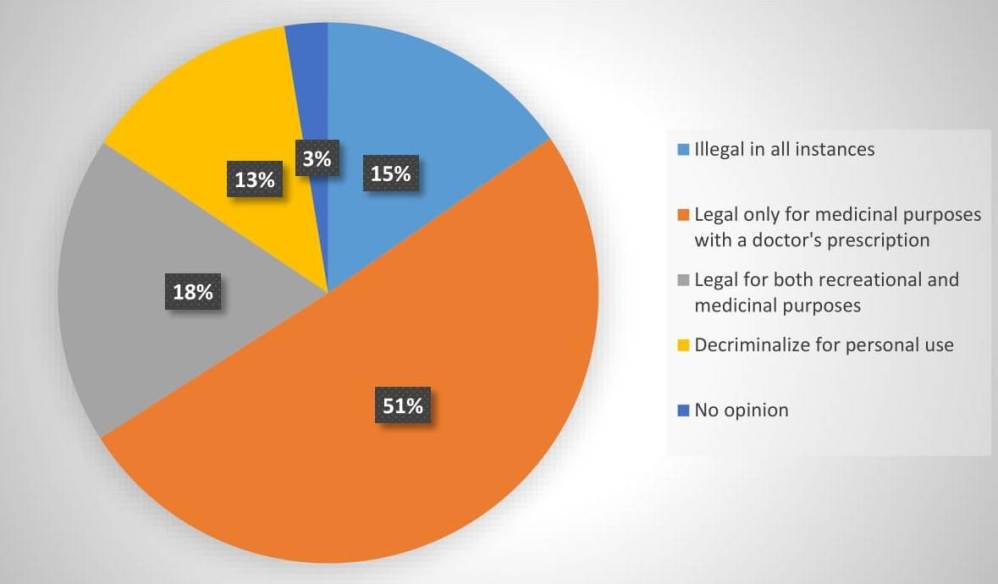

Question Eleven: What is your position on the legalization of marijuana?

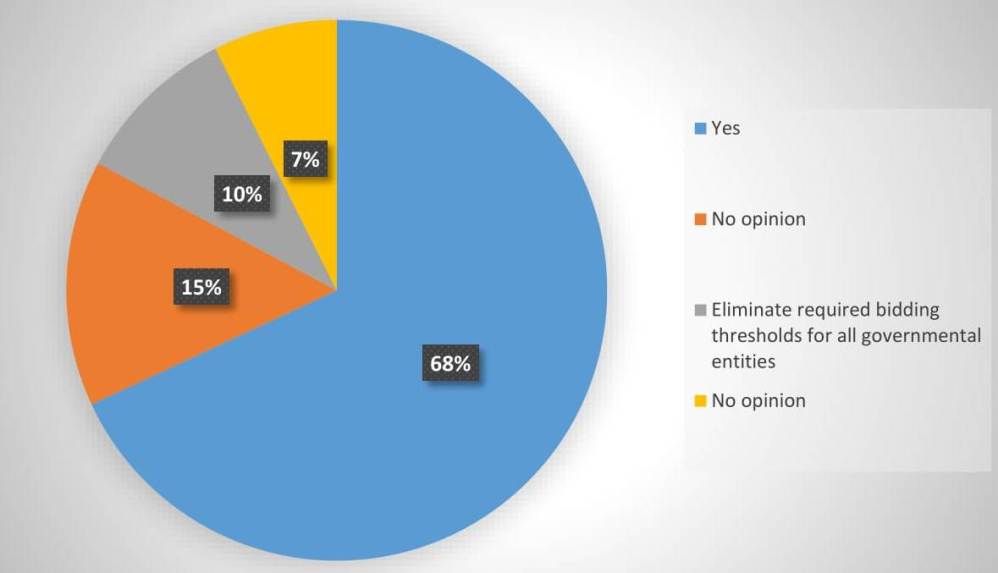

Question Twelve: Do you think that school districts should be required to submit to the same bidding requirements as towns, villages. counties and municipalities? Currently, any town, village, municipality, or county public construction project exceeding $25,000 must be awarded to the lowest responsible bidder.

If you are interested in receiving paper copies of the survey results, feel free to contact my office. Again, thank you for taking time out of your busy schedules to complete these surveys and provide your feedback on what you consider to be the most salient public policy issues. |

|

Pending legislation Assembly Bills 386 and 387 Late last month, the Assembly Committee on Ways and Means held a public hearing on Assembly Bills 386 and 387 relating to property tax assessments and closing the "Dark Store" loophole, that I coauthored with Senators Roger Roth (R-Appleton) and Duey Stroebel (R-Cedarburg). More than fifty-five individuals, representing cities, towns, counties, villages, and school districts, testified in favor of these proposals. Assembly Bills 386 and 387 have wide bipartisan support--fifty percent of legislators in both houses have cosponsored these proposals--and were introduced at the behest of local units of government, school districts, and other political subdivisions that want to stop additional tax shifts from large retail stores to homeowners and small businesses. The litigation and tax refund costs associated with what is commonly referred to as the "Dark Store Theory," have devastated our local units of government and as such, it is imperative that a workable solution is formulated. These proposals, quite simply, clarify the best practices as proscribed by the Wisconsin Property Tax Assessment Manual. Moreover, they seek to provide clarity and direction to the Board of Review and courts when determining the value of property. The intent of these bills is to prevent further potential tax shifts from big box stores to small businesses and homeowners by ensuring assessments are fair and equitable for all taxpayers. It is imperative to denote that neither of these bills will result in an overall property tax increase. Local governments work under strict levy limit caps and these bills do not change the amount a community can tax, they only ensure that the process is fair and equitable to everyone. Assembly Bills 386 and 387 assess properties at their highest and best use. Highest and best use is defined as, "the specific current use of the property of a higher use to which the property can be expected to be put in the immediate future, if the use is legally permissible, physically possible, financially feasible, and provides the highest net return." Assembly Bill 386, provides that, for property tax assessment purposes, to determine the value of a property using generally accepted appraisal methods, an assessor must consider all of the following as comparable to the property being assessed: 1. Sales or rentals of properties exhibiting the same or similar highest and best use with placement in the same real estate market segment. 2. Sales or rentals of properties that are similar to the property being assessed with regard to age, condition, use, type of construction, location, design, physical features, and economic characteristics. Additionally, this bill provides that a property is not comparable to the property being assessed if the seller has placed significant restrictions on the highest and best use of the property or if the property is "dark" property and the property being assessed is occupied. Assembly Bill 386 defines "dark" property as property that is vacant or unoccupied beyond the normal time period for a property in the same real estate market segment. The second proposal, Assembly Bill 387, provides that, for property tax purposes, real property includes any leases, rights, and privileges pertaining to the property that transfer with the property shall be used in determining the value of that property. Ordinarily, the best information for assessing a property's fair-market value for property tax purposes is a recent arm's-length sale of the property. This is true in Wisconsin for all properties except single-tenant retail facilities, which have relied on the Wisconsin Supreme Court's 2008 ruling in Walgreen Company v. City of Madison, to convince courts that their assessed values should be less than half of the actual sale price of the property. A recent example of this occurred when the Wisconsin Court of Appeals relied on the aforementioned case to affirm that a single-tenant retail facility in Appleton should be valued at $1.8 million, significantly lower than the city's $4.4 million assessment, which was based on an actual sale of the property. Appleton, a result, must now issue a $350,000 tax refund to the single-tenant retail facility.

Senator Duey Stroebel and I testifying before the Assembly Ways and Means Committee.

Officials from local units of government throughout the state came to Madison to testify in favor of Assembly Bills 386 and 387. Public Bidding threshold This week, the Assembly Local Government Committee will be holding a public hearing on Assembly Bill 307, the "Threshold Modernization Initiative," that I coauthored with Senators Duey Stroebel (R-Cedarburg) and Devin LeMahieu (R-Oostburg). Assembly Bill 307 increases the competitive bidding threshold for local governments from $25,000 to $75,00. For local units of government, costs of public works projects have increased--precipitated in part by inflation--while the threshold for triggering competitive bidding has remained stagnant since 2005. As a result, local governments have been required to competitively bid for small-dollar projects that, in the past, would have fallen under the cap levels. For instance, in 2015, the City of Mequon was required to bid a $39,000 project to remove ash trees. Subsequently, the City of Fond du Lac had to bid a $35,000 project for park shelter renovations. Providing more flexibility while continuing to require Class one notices for public works projects, will benefit local local communities across the state. Additionally, Assembly Bill 307 requires that school districts employ competitive bidding on public works projects exceeding $75,000. Currently, school districts are exempt from having to abide by competitive bidding regulations. This bill requires school districts to competitively bid for large expenditures, chiefly capital improvement projects akin to their local counterparts. According to the Wisconsin Department of Public Instruction, Wisconsin taxpayers, in 2016, approved, via the referendum process, $1.34 billion in debt issuance for capital improvement projects. Moreover, in 2017 alone, Wisconsin taxpayers approved more than $700 million via the referendum process; none of which were required to competitively bid their projects. By ensuring that, in the future, these projects are subject to competitive bidding requirements taxpayers will potentially save millions of dollars annually and school districts will be encouraged to award projects to the lowest responsible bidder--a practice currently employed by other local units of government. It is imperative to denote that Assembly Bill 307 will codify best practices employed by many school districts that currently utilize self-imposed bidding requirements. Wisconsin Private Colleges Week In addition to world-class public universities, Wisconsin is fortunate to have two dozen private, non-profit institutions of higher learning. July 10-15 is Private Colleges Week, with events scheduled in every corner of the state. To learn more and plan a trip to one or more campuses, please visit: http://www.wisconsinprivatecolleges.org/visit/register-private-college-week-visit.

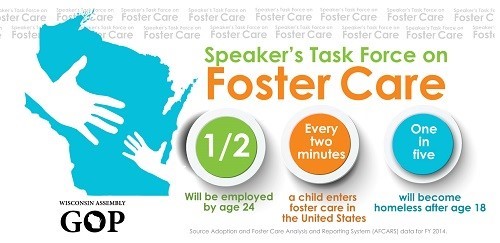

Speaker's Task Force on Foster Care Assembly Speaker Robin Vos announced last week, the formation of the Speaker's Task Force on Foster Care.

The Wisconsin Department of Children and Families reports 7,168 children resided in out-of-home care (OHC) in December 2015, which is an increase from the previous year. The group of lawmakers assigned to this task force will focus on ways to improve the child welfare system that provides out-of-home care for more than 7,000 Wisconsin children. The goal is to help end the multi-generational cycle of government dependence by strengthening community partnerships, and updating programs to meet the changing needs of parents, children, and communities. Consumer Protection Did you receive an order cancellation email from Amazon for a product you do not remember ordering? It might be a scam. Do not click on any links contained in the email. The Wisconsin Department of Agriculture, Trade, and Consumer Protection is aware of phishing scam involving fake Amazon order cancellation emails and asks consumers to be suspicious of any analogous emails they receive. If you click any links in the email, you could unintentionally download malicious software onto your device or be driven to a site that attempts to collect your Amazon account username and password or other personal information. If you receive a cancellation email and you wish to inquire further, do NOT click the links in the email. Instead, go directly to http://www.amazon.com or use the company's smart phone application to check your account. If you share access to an Amazon account with a family member, check with that person to see if he or she cancelled the supposed order before you take any additional action. In many fraudulent emails, you can check the sender's email address for an easy tipoff--the web address (URL) referenced the sender's email address does not match the actual URL for the business in question. For example, a fake email that claims to come from Amazon may have a sender address of "JoeSchmo@somefakecompany.com instead of "___@ amazon.com." But some of these phony Amazon cancellation emails have had "spoofed" sender addresses that actually appear to come directly from "__@amazon.com. Consumers should be aware that spoofing of email addresses is possible and that that the displayed sender address may not be legitimate. With this in mind, the best way to avoid being scammed is to delete similar emails and go directly to Amazon.com or the company's smart phone application to check your account. Follow these additional tips to spot and avoid spam emails:

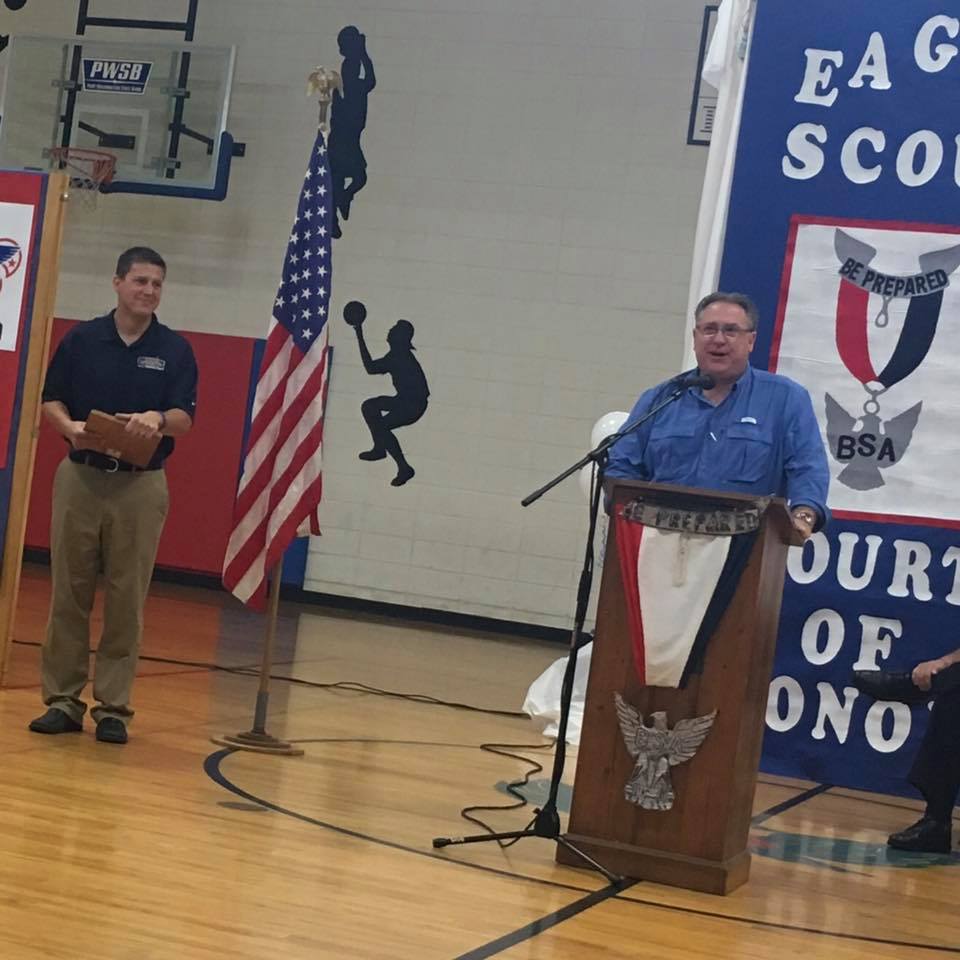

For additional information, visit the Consumer Protection Bureau or send an e-mail to datcphotline@wisconsin.gov or call the Consumer Protection Hotline at 1-800-422-7128. This week in the district I had the opportunity, this week, to attend the Eagle Scout Court of Honor Ceremony for six members of Boy Scout Troop 875, Port Washington, WI: Brandon Baumann; Jonathan Bischoff; Samuel Heinecke; Noah Irish; Erik Moe; and Hans Pfrang. Congratulations to these young men on their accomplishments and hard work.

Presenting Eagle Scout plaques to six members of Boy Scout Troop 875, Port Washington.

Eagle Scouts from Boy Scout Troop 875, Port Washington. In-district legislative video My staff and I, earlier this month, toured Advent Lutheran Church's recently constructed columbarium, a first-class facility with an area for the public to gather by the river. A few of my constituents who are members of this congregation contacted me seeking clarification for the definition of columbarium under state statute. Advent Lutheran was unable to place a columbarium on their church premises, as statute considered columbarium to be a mausoleum, which would have violated local zoning ordinances. Together, members of the congregation, local leaders, and I were able to navigate through the legislative process to update the statute. As a result of our efforts, deceased congregants are able to have their final resting place in their desired location. A video that my office produced pertaining to Advent Lutheran's Columbarium, can be viewed below by clicking on the photograph. Have a great week,

Stay up to date One of the best ways to stay up to date with what is happening in Madison is to sign up for the legislature's notification tracking service. This service affords you with the opportunity to track legislative activities in Madison. Upon creation of a free account, you can sign up to receive notifications about specific bills or committees as well as legislative activity pertaining to a subject area (i.e. real estate, education, health). You can sign up for this service at any time. You can also follow me on Facebook to see what

I have been doing in Madison and around the 60th Assembly

District.

Please recommend the page to your friends and family members.

|

If you would like to be removed from future mailings, email me to unsubscribe.

State Capitol Room 309 North-PO Box 8952, Madison, WI 53708

(608) 267-2369

Email: Rep.Rob.Brooks@legis.Wisconsin.gov