February 9, 2017

|

Governor Walker

announces 2017-2019 fiscal year budget |

|

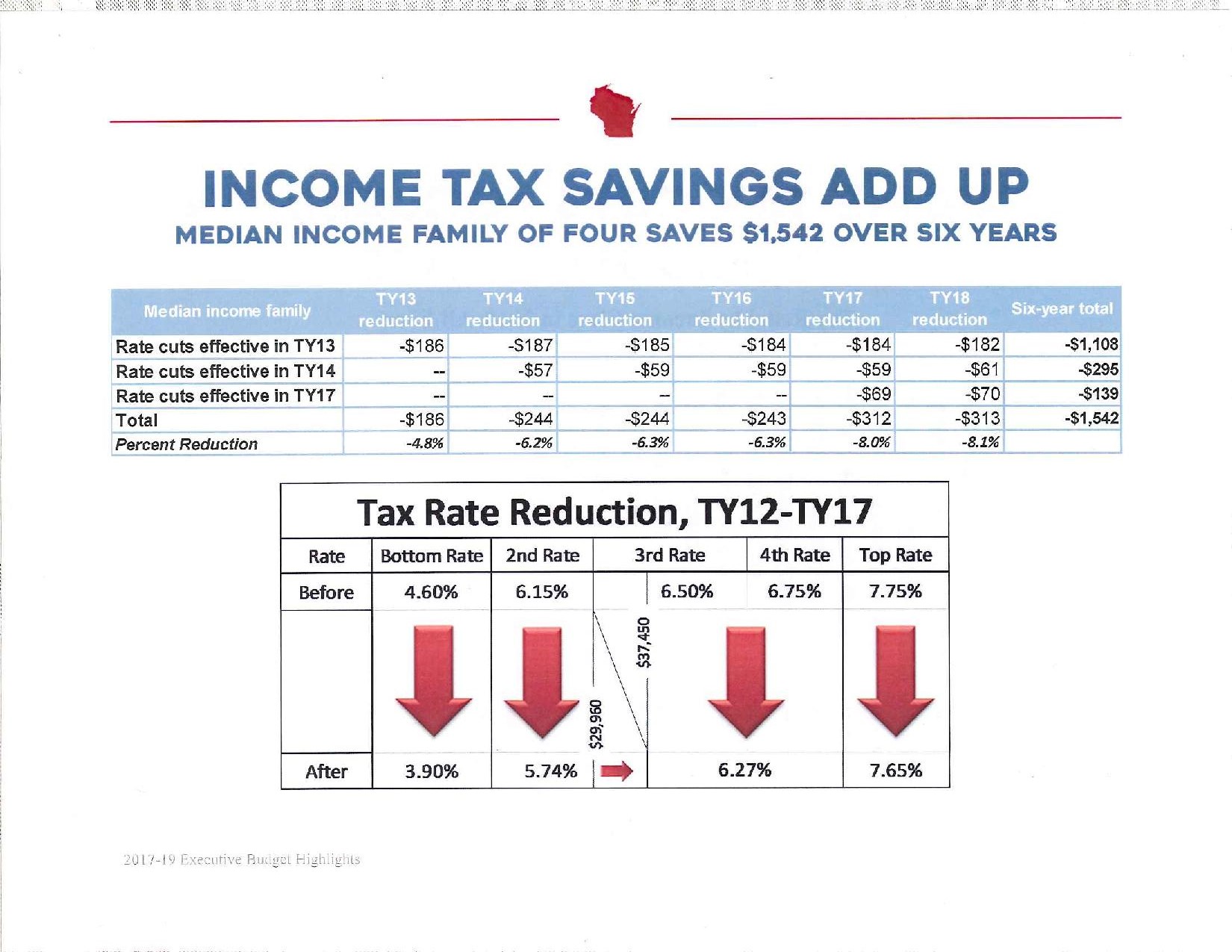

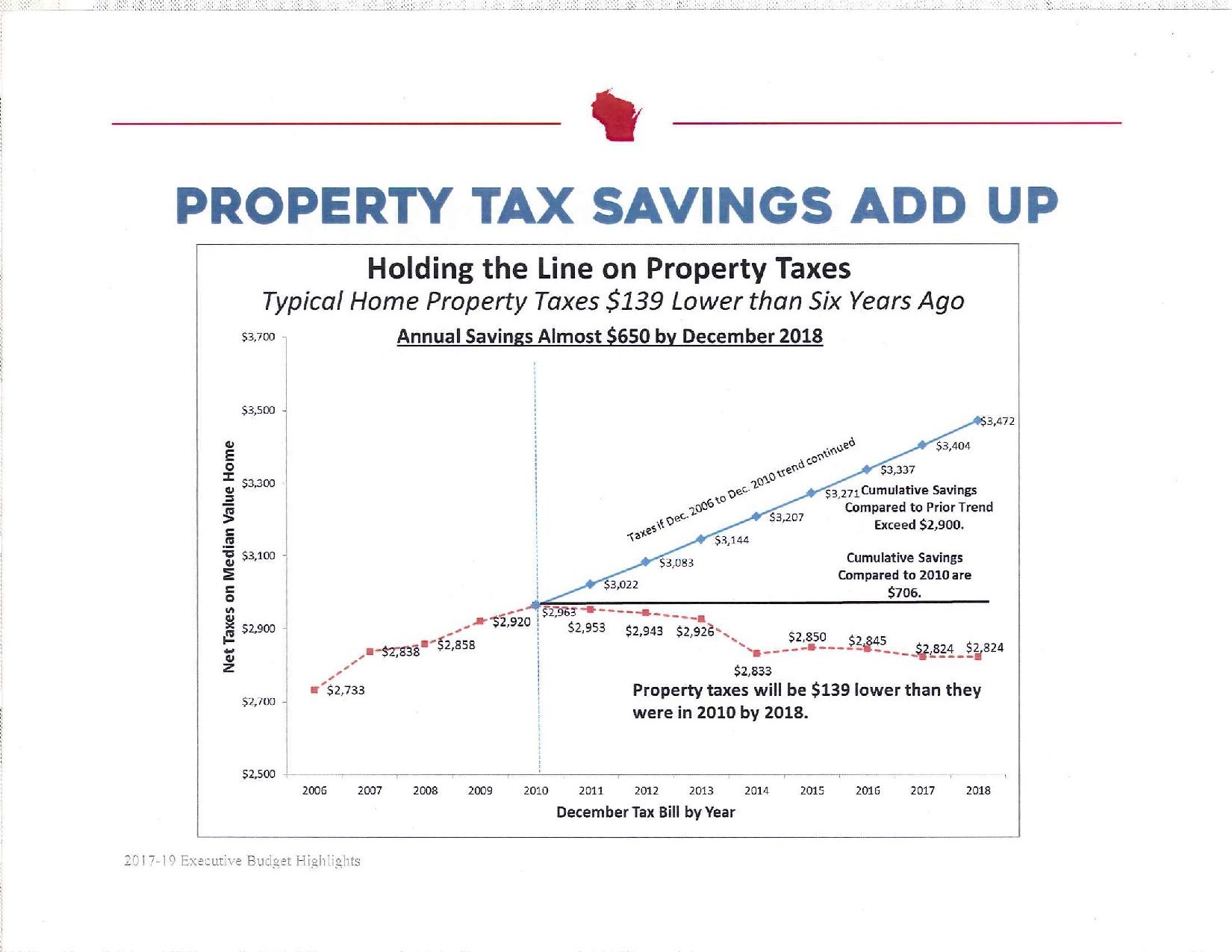

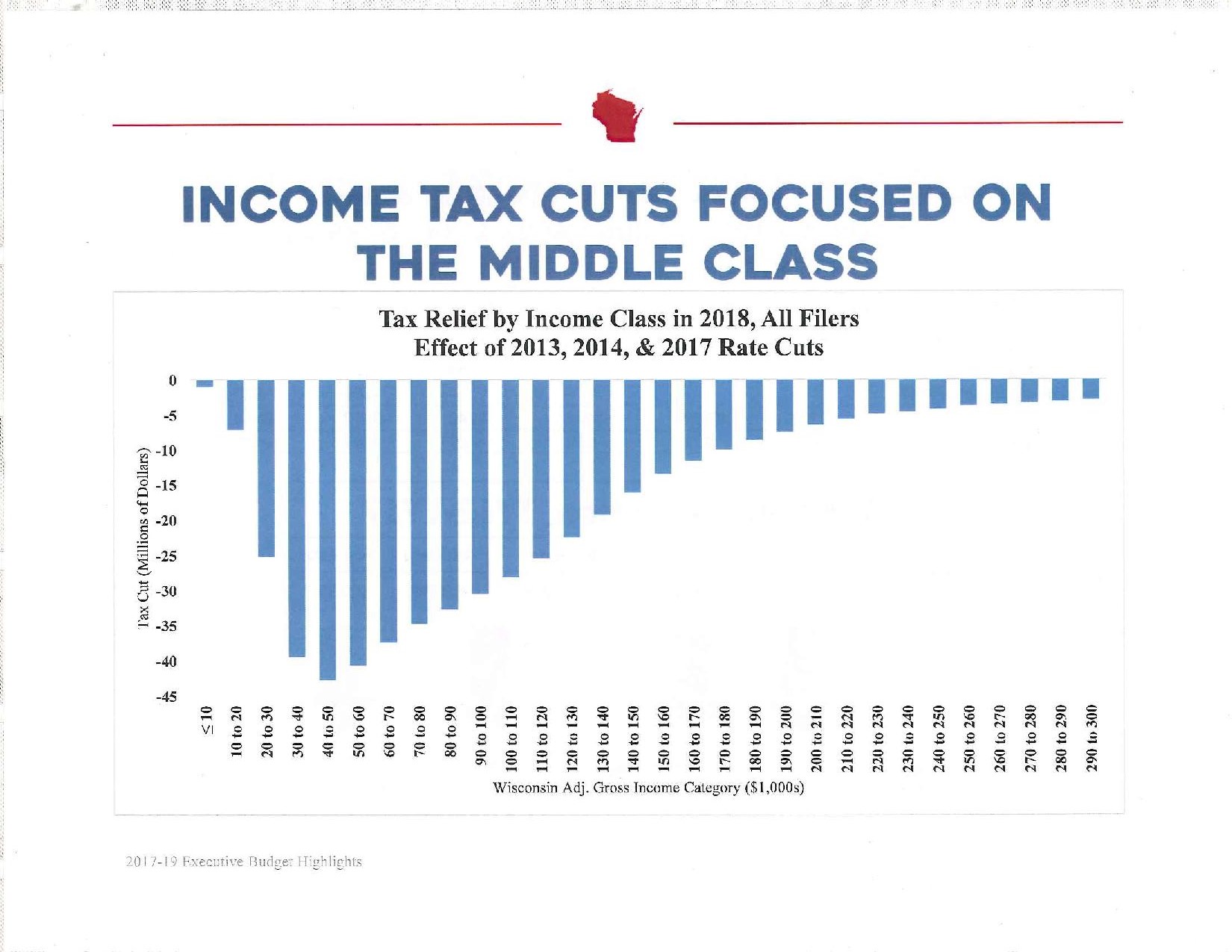

Last evening, Governor Scott Walker unveiled his fiscal year 2017-2019 budget, before a joint session of the legislature. The budget: invests more money in public education than at any time in state history; increases spending for the University of Wisconsin System by $100 million; builds a stronger infrastructure by spending more money on state highway rehabilitation than any previous budget; and reduces taxes to their lowest levels in more than four decades. I applaud Governor Walker for investing in Wisconsin's priorities, chiefly, education and transportation. In the next several months, my staff and I will be analyzing the intricacies of this proposal, so as to ensure that it reduces the size and influence of government; adequately funds our priorities; defends the individual and civil liberties of Wisconsinites; and is fiscally responsible. Tax relief Governor Walker's budget contains the largest tax cuts--property, income, and corporate--in Wisconsin history. Property taxes on a median-valued home will be lower in 2018 than it was in 2010. Moreover, as a percentage of personal income, property taxes are at their lowest levels since Harry Truman occupied the White House. In an effort to reduce the property tax burden on hard-working Wisconsin families, Governor Walker proposed eliminating the state tax collected on the property tax bill paid by Wisconsin homeowners. While the property tax reductions were significant, they pale in comparison to Governor Walker's proposed reductions in Wisconsin income taxes. Upon being sworn in to office as Wisconsin's forty-fifth governor in 2011, Scott Walker promised that income tax rates would be lower in 2018 than 2010. Overall, income taxes on a typical Wisconsin family will decline by more than $130 in the 2017-2019 biennial budget. Cumulatively from 2010 to 2018, that represents a savings of $1,542. Governor Walker's budget proposal contains nearly six-hundred million in new tax relief--the largest tax reduction in Wisconsin history. The following charts provide visual representations of tax relief over the last decade.

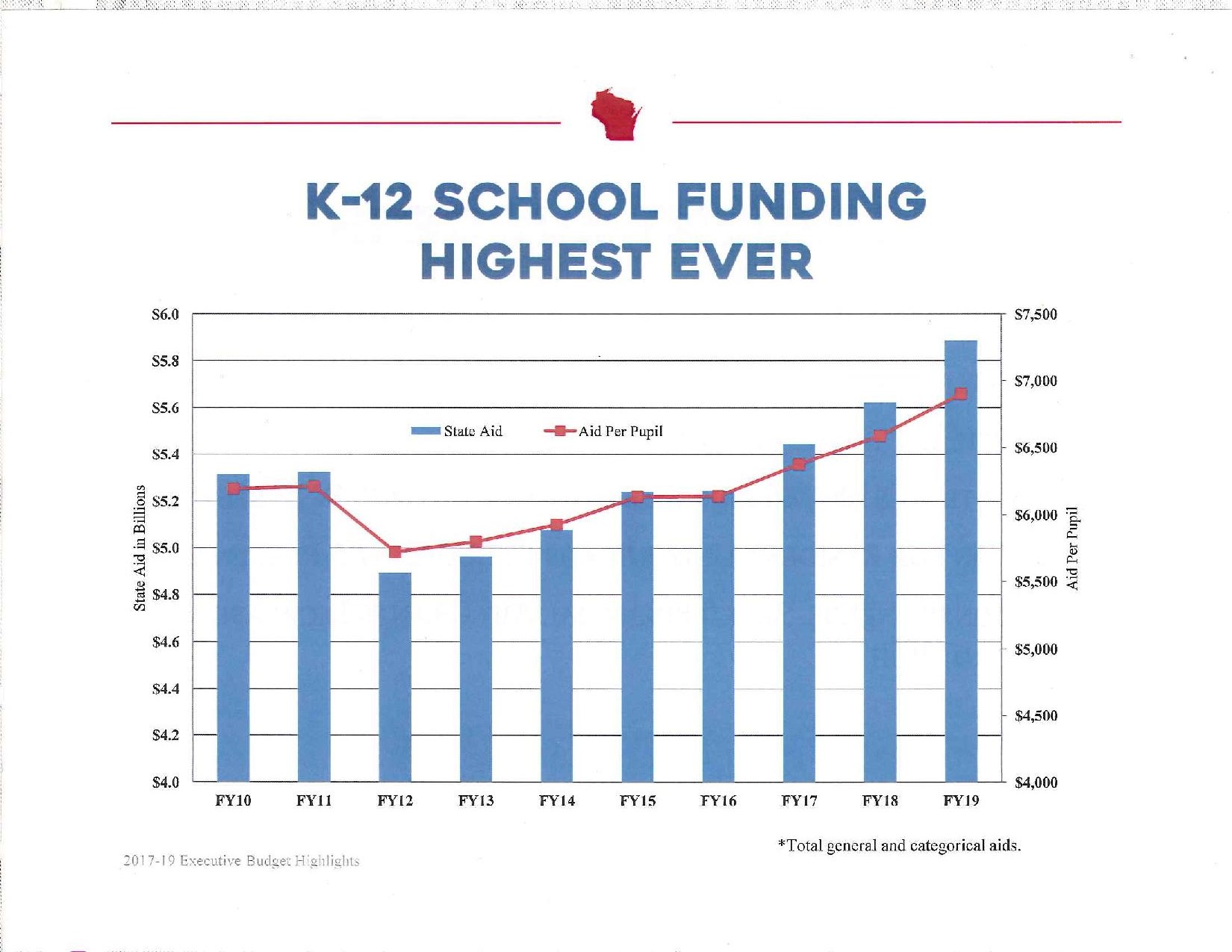

Public education funding As denoted at the outset, Governor Walker's budget proposal included historic increases in funding for Wisconsin public schools. This proposal advocates for the investment of more than $11.5 billion in public education. Specifically, Governor Walker's proposal includes a more than half-a-billion dollar increase in per pupil aid for public education. According to Governor Walker, "Last November, the state Department of Public Instruction requested an increase of $200 per student in the first year of [of the biennium] and a $204 increase per student in the second year...At the time, some suggested that we could not get close to that request. Well, this budget provides a $200 per student increase in the first year and a $204 increase per student in the second year. The following chart depicts education funding levels over the past decade. As readers will discern, state aid per pupil and general and categorical aids increased exponentially in the last decade. Additionally, Governor Walker's budget contains $3.6 million for the Better Bottom Line Initiative, a "pay-for-performance" incentive program, I authored last session, for school districts whose students with disabilities find employment or post-secondary education one-year following commencement from high school. My Better Bottom Line Initiative generated overwhelming bipartisan support the last two legislative sessions.

University of Wisconsin System funding In addition to public education, Governor Walker announced an ambitious plan for increasing higher education funding, while simultaneously cutting tuition for University of Wisconsin System students. The University of Wisconsin System will receive a $100 million funding increase. Furthermore, the budget includes the largest investment for need-based financial assistance, in state history. Lastly, Governor Walker's budget proposal reduces tuition for undergraduates by five percent at all thirteen of the state's research and comprehensive universities. Governor Walker, in describing the maladies that plagued Wisconsin institutions of higher education prior to his inauguration, wrote, "During the decade before our freeze, tuition increased by one-hundred-eighteen percent. Had that trend continued, a typical University of Wisconsin System student would be paying $6,300 more over the past four years. We froze tuition four years in a row and that helped turn the trend around, but students, parents and others are telling me that they are concerned about the high cost of university tuition. The governor's reduction in tuition will save an average student $360 per year, and that is in addition to the tuition freeze." I look forward, in the months ahead, to your input on Governor Walker's biennial budget proposal. To better obtain your feedback, I will be hosting a series of in-district listening sessions and will be sending out a spring survey, focused primarily on budgetary issues. As always, if you have any questions or concerns, do not hesitate to contact my office. |

State Income Tax Return With tax season in full swing, I thought it was imperative to provide constituents with information from the Wisconsin Department of Revenue (DOR) relating to protecting citizens from fraud and identity theft. As reports of cyber crimes and identity theft become more common, the Wisconsin Department of Revenue prevents fraudulent activity by diligently reviewing filed tax returns. Our systems are secure. Despite that, when cyber criminals steal one's identity from other mediums, they frequently attempt to file fraudulent tax returns. The Wisconsin Department of Revenue uses

analytics to identify returns that indicate possible identity

theft. When that occurs, DOR sends a letter to the tax filer asking them to complete a quiz,

enter a Personal Identification Number (PIN), or submit

documentation to confirm their identity. The unique PINs

are a tool DOR began using last year to help safeguard tax

filers who have been identified as possible identity theft

victims.

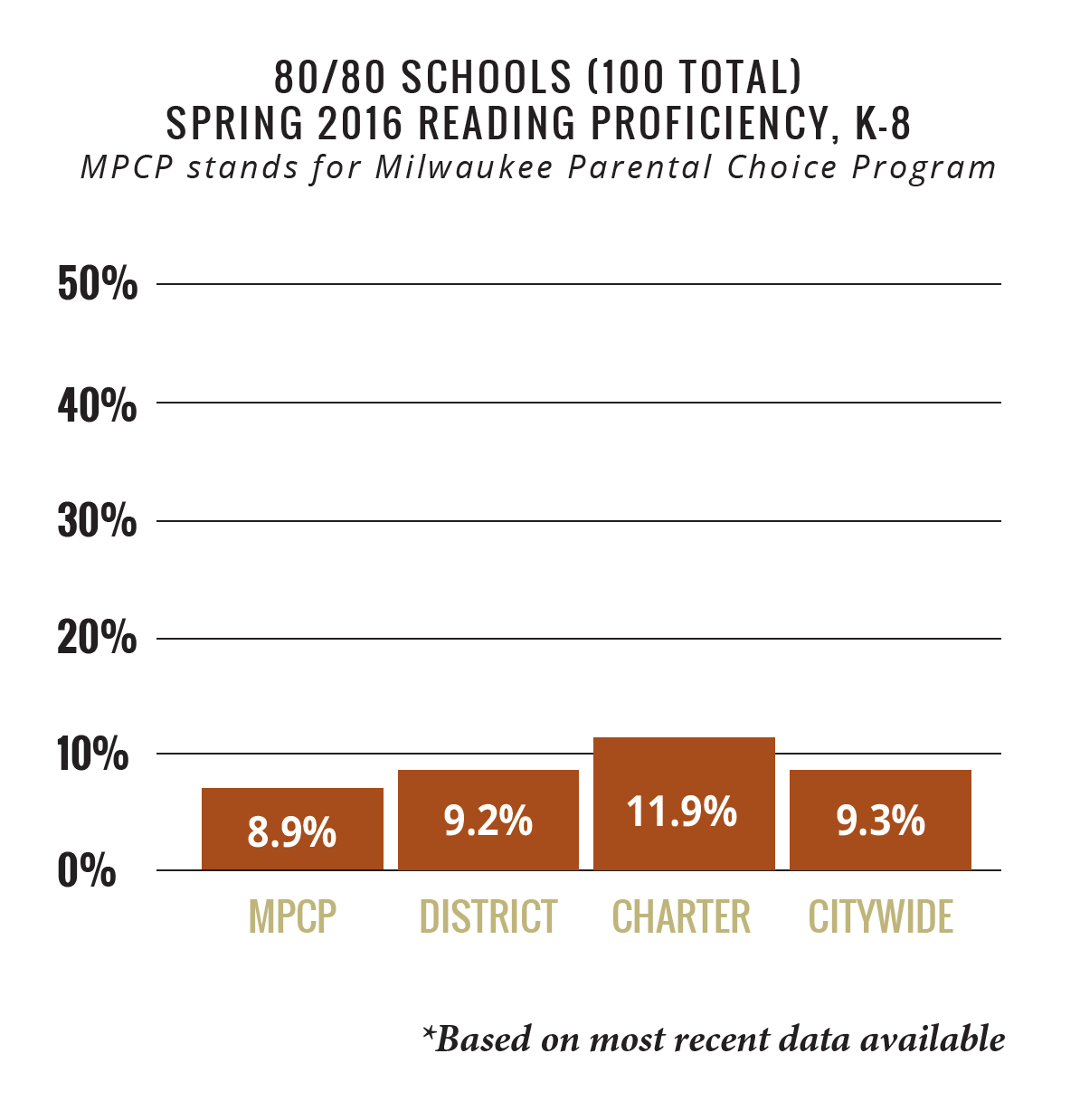

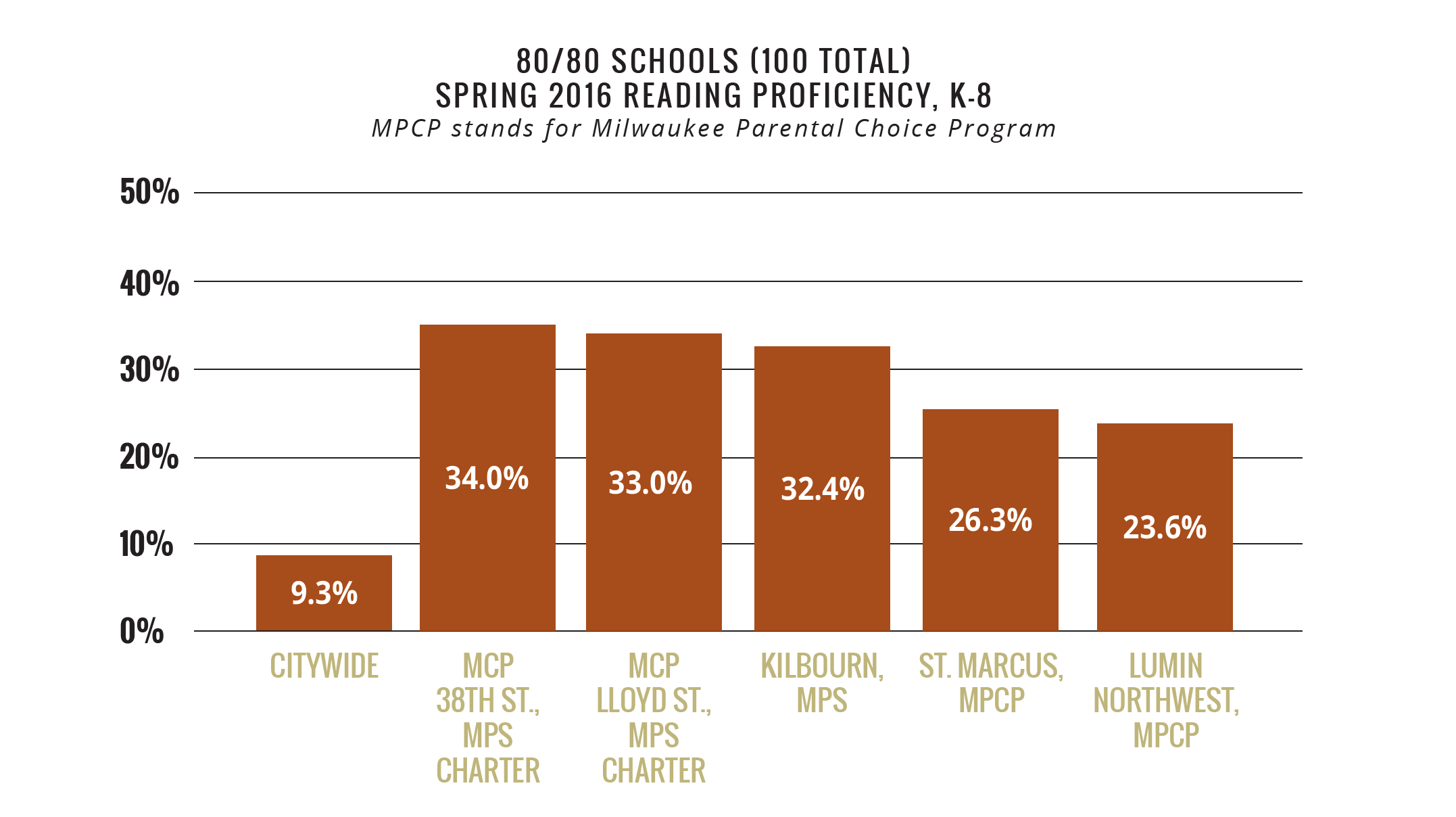

This week in the district Last week, my staff and I had the opportunity to participate in a life-changing tour of Saint Marcus Lutheran, a voucher school located on North Avenue in Milwaukee. Henry Tyson, the impassioned superintendent of this venerable institution, afforded us with the opportunity to converse with students and parents who benefited from Wisconsin's voucher program. Eighty percent of the Saint Marcus' students come from low-income, minority families. One-hundred schools in Milwaukee have an enrollment of at least eighty percent African American students and least eighty percent low-income students. These schools serve approximately thirty-six thousand students. Saint Marcus is one of them. The average reading proficiency rate in these one-hundred eighty-eighty schools is 9.3 percent, about half the district wide proficiency rate of 19.7 percent. Saint Marcus ranks fourth after more than ten years of expansion and the addition of nearly eight-hundred students from private, public, and charter schools.

The most enriching aspects of this visit was meeting with students and listening to their stories and educational goals. One student I conversed with, through her hard-work, dedication, and commitment to excellence, earned a scholarship to Brookfield Academy--a goal of this student's from a young age. Success stories such as the aforementioned, are commonplace at Saint Marcus. Saint Marcus not only knows what it takes to open doors of lifelong success, their record of success is well-documented:

Participating in this tour was undoubtedly a life-changing experience and one that opened up my eyes to the impact that a quality education can have on students. If you ever have the opportunity, I strongly suggest that you visit Saint Marcus Lutheran School. Have a great week,

|

If you would like to be removed from future mailings, email me and ask to unsubscribe.

State Capitol Room 309 North-PO Box 8952, Madison, WI 53708

(608) 267-2369

Email: Rep. Rob.Brooks@legis.Wisconsin.gov