Happy New Year! If you get nothing else out of this message, know two things upfront. (1) It's going to snow. If you already knew that, you maybe didn't know that you can usually sign up to receive notices to your phone, email, etc. from your local government alerting you to snow emergencies and special parking rules during snow emergencies. Sign up here to receive City of Sheboygan notices! At the time of this writing, no snow emergency has been declared yet, but I'm thinking that may change soon. And (2) the Brewers are hiring! I'm just saying, if you're looking for a job that might require temporary travel to someplace warm like Arizona in February... the Brewers might be able to help.

This week, the nonpartisan Wisconsin Policy Forum reported that, for the eighth year in a row, the overall tax burden decreased for Wisconsin residents. In fact, the proportion of your income that you had to pay in state and local taxes was the lowest in 2019 that it's been in 50 years! Once again, Republicans' pro-growth policies are bearing fruit in our state over the long term: the report confirms that, overall, personal income is up (5.1 percent in 2018!), enabling your government to cut your taxes (by $400 million last year, and $13 billion over the past decade) while still funding our priorities with more total dollars than ever before.

As always, I encourage you to follow my updates on social media or contact my office directly with your questions. Best wishes on your weekend... and be careful in the winter weather over the next few days!

Stuff Worth Knowin'

- In just a few weeks, taxpayers may begin filing federal and state income tax returns for 2019. Unfortunately, it seems every barrel has a few bad apples; just this week, a Wisconsin accountant was sentenced to prison on dozens of counts of falsifying his clients' tax returns and directing portions of their refunds into his own bank account. Don't be a victim: use this online tool to verify that your tax preparer is actually credentialed by the federal IRS to handle your needs. Ask the Better Business Bureau about your tax preparer and check for any disciplinary actions. Ask your tax preparer upfront about what fees you will be charged. And before you sign your tax return, review it; ask questions if something is unclear to you; and make certain that your refund goes directly to you.

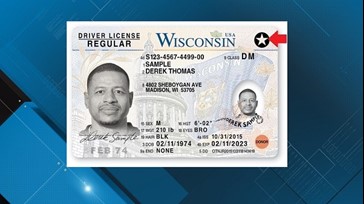

- Act early to prevent a major hassle! Beginning October 1, 2020, the federal Department of Homeland Security will not let you board an airplane if your driver's license is not a "REAL ID." That means that you may wish to renew your Wisconsin driver's license and upgrade it to a REAL ID this year even if your license does not expire in 2020. A REAL ID is identifiable by having a star printed in the corner (like the sample shown below); alternately, you may use this online tool to quickly verify whether your Wisconsin driver's license is a REAL ID. If you need to upgrade, use this website to learn what you will need to bring to the DMV.

- The federal government awards money to the states each year to award to nonprofit organizations, producer organizations and others to encourage specialty crop industries such as fruits, vegetables, nuts and herbs. Think you might know of a project that could qualify to receive a grant? Read more here!

- The search is on for the next Alice in Dairyland! Applications will be accepted through February 3rd for a young communications professional who will be the ambassador for our state's $105 billion agriculture industry. The most recent "Alice" to have come from Sheboygan County was Ashley (Huibregtse) Andre, from Plymouth, in 2008. Could this be our year again? Learn more here.

- An old scam is a new problem again in 2020. Security experts are urging folks to consider spelling out dates rather than abbreviating them. For example, consider today's date, which could be abbreviated "1/10/20." A clever crook could add digits to either end of this abbreviation, changing its meaning to a different date either in the past or in the future. (So, a person could change "1/10/20" to "1/10/2021" or "1/10/2019" or "11/10/20.") That could be a big deal, especially if the date appears on a check or a contract. The solution to this one is easy: protect yourself by writing "January 10, 2020."

Office of Representative Terry Katsma

State Capitol, Room 306 East

P.O. Box 8952

Madison, WI 53708

(608) 266-0656

Rep.Katsma@legis.wisconsin.gov| |

|

|

|

|